As a student in Canada, you may be living in rented residences, such as on-campus dorms or off-campus apartments. Living near the campus offers ease of access and, for most of you, the first experience of living on your own outside of your family’s residence.

While the experience may be great, there are some steps you can take to ensure your stay throughout your studies is safe and pleasant, and one of them is getting rental insurance. Student rental insurance can protect you and your property if unwanted incidents happen in your rented home.

Why Do Students Need Tenant Insurance?

While not explicitly mandated by law, it’s a great idea for students to have tenant insurance to protect their property from theft, vandalism, and other perils, such as water damage. Additionally, tenant insurance also covers injuries suffered by other people while in their rented home.

Per the Financial Services Regulatory Authority (FSRA), tenant insurance covers unforeseen losses in the property. This coverage usually includes the following:

- Third-party liability: Covers medical and legal fees if somebody gets injured or damages property within your rented property.

- Contents insurance: Protects your valuables in case of damage or theft.

- Additional living expenses: Covers your accommodation elsewhere if your rented property is rendered uninhabitable due to covered perils.

Am I Still Covered By My Parents’ Home Insurance Policy?

You may still be covered by your parents’ home insurance policy as long as your home is still considered your primary residence. Staying in on-campus dormitories or off-campus apartments is usually considered a temporary situation, so you should still be considered a primary resident at your parents’ house. However, this may differ depending on the insurance company, so it’s best to ask and confirm.

That said, it’s still a good idea for you to get tenant insurance because if something happens to your rented room without tenant insurance, your claim will be charged to your parents’ home insurance and raise its rates.

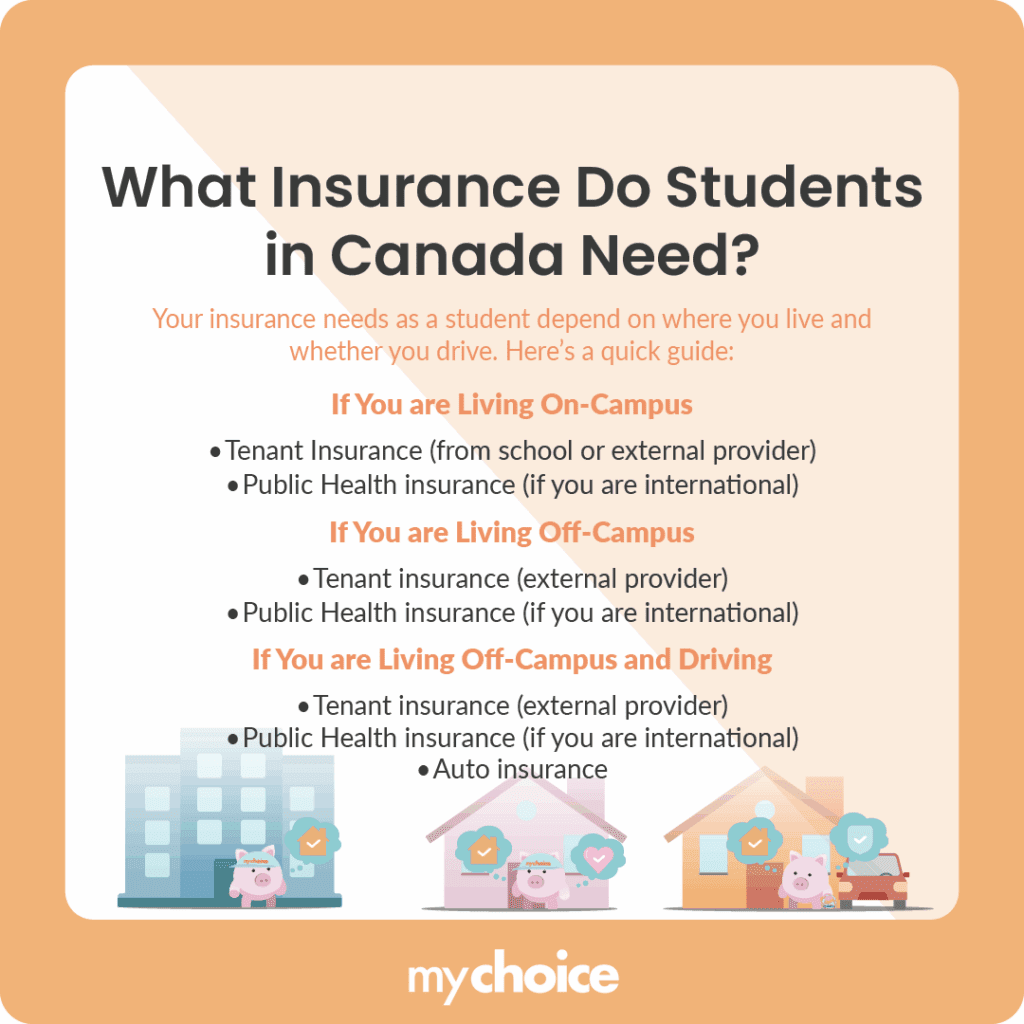

What Coverage Should I Get as a Student in Canada?

The insurance coverage you should get as a student in Canada depends on your lifestyle and personal circumstances. You can refer to the table below to see which types of coverage are recommended for students in Canada.

| Lifestyle | Insurance Recommendation |

|---|---|

| Stay in on-campus residences | Tenant insurance provided by the campus housing department or external insurance provider, public health insurance if an international student (which may need a residency period). You may need to get private health insurance if the province doesn’t offer public coverage. |

| Stay in rented off-campus residences | Tenant insurance provided by an external insurance provider, public health insurance if an international student. |

| Stay in rented off-campus residences + drive a car | Tenant insurance provided by an external insurance provider, public health insurance if an international student, and auto insurance. |

Note that the above table only contains recommendations of what insurance coverage you should get. Examine your circumstances and learn which types of insurance coverage are required and which ones aren’t mandatory, but recommended.

Can You Share Your Policy With Roommates?

Yes, you can share your student tenant insurance policy with a roommate. However, the specifics of sharing your policy may differ between insurers. They may limit the number of people who can share a tenant insurance policy and usually only allow two people per policy. Some insurers may also charge you for adding another person to your policy.

Sharing a tenant insurance policy can potentially lower your insurance costs, but you’ll share your claims history with your roommates. So, claims on incidents that may not necessarily be your fault can show up on your record and impact your credit score. Moreover, you also need to split costs with your roommates, which may lead to difficulties coming up with a fair premium split.

While you can share your tenant policy with roommates, it’s not necessarily the best idea. Consider your circumstances and decide whether or not sharing your policy is appropriate for your situation.

Can You Get Tenant Insurance Discounts as a Student?

Whether you can obtain tenant insurance discounts as a student depends on the insurance company. However, student rental insurance policies are often lower than rental insurance policies for non-students. Insurers charge less for student tenant insurance because students typically have fewer expensive items, allowing them to provide lower amounts of coverage at more affordable rates.

That said, the location of the rental property, the student’s personal claims history, and other factors can still raise or lower your rates as with regular tenant insurance. The riskier you are to insure, the higher your rates are likely to be.

What Happens If You Sublet Your Room?

If you sublet your room, you’re changing your insurance risk profile because someone else is living there. Since tenant insurance is tied to you, the policyholder, and not the space, you may encounter issues if you sublet without notifying your insurance company. Your insurer may deny tenant insurance claims made if something goes wrong while you’re subletting your room.

However, if you inform the insurance provider when you take on a subtenant, you may still qualify for protection under certain conditions. Your insurer may ask you to add terms in the sublease agreement to hold the subtenant responsible for any damages or accidents that happen on their watch, for example.

Key Advice from MyChoice

- Rental or tenant insurance isn’t a mandatory requirement for students staying in apartments or campus dormitories, but it’s highly recommended because it protects from theft, damage, and other incidents.

- You may still be covered under your parents’ home insurance if you still primarily reside there, but it’s still better to get your own tenant policy.

- What coverage you should get as a student varies depending on your needs, but tenant insurance and health insurance (if you’re an international student) are generally recommended. If you drive a car, auto insurance is mandatory.