Canada Records Over 300 Significant Earthquakes Since 1986 — Yet Millions of Homes Remain Uninsured

On August 19, 2025, a magnitude 3.6 earthquake struck west of Victoria on Vancouver Island, shaking parts of southern B.C. While lightly felt, it was the latest in a string of seismic events that included a 5.4 quake near Sechelt in February and a 5.0 off Port Alice days later. Scientists are also warning of something much larger. A new study of the Tintina Fault in the Yukon, once thought dormant, suggests that enough pressure has built up to trigger a magnitude 7.5+ earthquake. This poses a major but often overlooked risk to communities in the northern and western parts of the country.

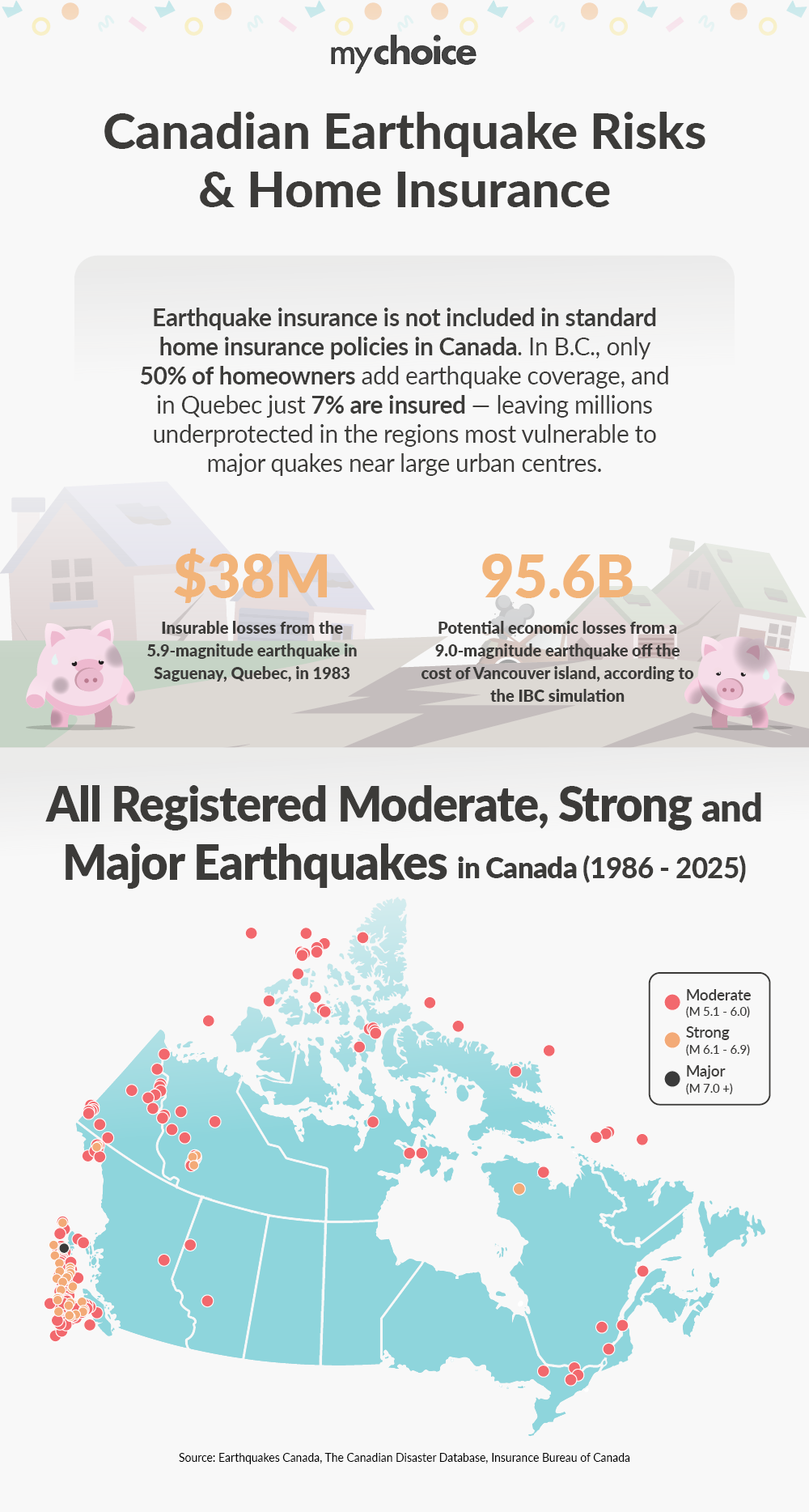

To understand how seismic risks are distributed, our team at MyChoice, a leading Canadian Insurtech company, analyzed Earthquakes Canada’s historical data on moderate (M 5.1–6.0), strong (M 6.1–6.9), and major (M 7.0+) earthquakes over the last 40 years.

Key Findings from the Study:

- Earthquake insurance is not included in standard home insurance policies in Canada. It’s an optional endorsement that homeowners in high-risk areas often overlook.

- British Columbia remains Canada’s seismic epicentre. Since 1986, the province has recorded more than 200 moderate-to-major earthquakes, the majority concentrated around Vancouver Island & Offshore (over 160 events) and Haida Gwaii. The 2016–2025 period still shows dozens of moderate events, but fewer than in the 1996–2015 peak, suggesting continued seismic activity, but slightly lower frequency compared to earlier decades.

- Quebec is Canada’s second most earthquake-prone province. Most activity centres in the Western Quebec Seismic Zone (Ottawa Valley), which has seen multiple moderate quakes since the 1980s. Though the number of events has declined in recent decades (only one moderate quake between 2016 and 2025), the risk of a strong tremor persists — past magnitude-6+ events in the Ottawa Valley show its destructive potential.

- Atlantic Canada’s offshore regions show steady activity. Over 25 moderate earthquakes have occurred since 1986 along the continental shelf, particularly off Newfoundland and Nova Scotia. The 2016–2025 decade has seen the highest count yet (11 events), highlighting an upward trend.

- Yukon continues to show risk, especially in the southwest. While the territory records modest numbers overall, the Southwestern Yukon region has seen consistent clusters of quakes each decade, including two strong events between 2016 and 2025.

- Northwest Territories and Nunavut record recurring seismic activity. Nunavut’s Arctic Archipelago has experienced nearly 40 moderate quakes since 1986, showing a clear rising trend (from 3 events in the late 1980s to 10 between 2016 and 2025). In the Mackenzie & Nahanni regions, activity has tapered off, with only one moderate quake in the last decade.

- Alberta records virtually no historical earthquake risk. Only a single moderate event was detected between 2016 and 2025, showing the province is largely stable compared to its western neighbour.

The financial stakes of earthquakes in Canada are enormous. A study commissioned by the Insurance Bureau of Canada (IBC) modelled a hypothetical magnitude 9.0 earthquake near Vancouver, estimating about $95.6 billion in total economic losses, with $26.1 billion in insured losses.

Lessons Drawn from Across The Border

While Canada hasn’t seen a major devastating earthquake in modern history, if we look south of the border, we can see what the consequences may be. In 1994, the Northridge earthquake (magnitude 6.7) struck the Los Angeles area, causing widespread destruction. The event resulted in $15.3 billion USD in insured losses and more than $40 billion USD in total economic damage. Like in Canada, earthquake coverage in the U.S. is not included in a standard home insurance package—it must be purchased separately. After Northridge, the financial shock nearly drove insurers out of the California market, forcing the creation of the California Earthquake Authority to keep coverage available. The lessons from Northridge highlight what could happen in Canada’s high-risk zones if a similar event strikes without sufficient insurance uptake.

Earthquake Insurance in Canada: Coverage Gaps Persist

Unlike wildfires or floods, earthquake damage is not automatically included in standard home insurance. It requires an endorsement – yet adoption remains worryingly low.

- British Columbia: Around 50% of homeowners purchase earthquake coverage, despite being Canada’s most seismically active province. High premiums (sometimes one-third of a policy) deter many.

- Quebec: Only 7% of homeowners have earthquake coverage, even though 38% wrongly believe they’re already protected. A major quake could cause $61 billion in losses, with only $12 billion insured.

- Rest of Canada: Awareness and uptake are minimal, even in areas with proven seismic activity like the Yukon and Atlantic provinces.

Canada has so far avoided the catastrophic earthquake losses seen in places like the US, Japan or Chile, but the risk is no longer hypothetical.

As Matthew Roberts, COO of MyChoice, notes: “Earthquake risk in Canada is often underestimated because events are sporadic. But history shows us these quakes will happen again, it’s just a matter of when. For homeowners, the best defence is preparation: both structurally and financially, through proper insurance coverage. If you live in an at-risk region, earthquake insurance should not be optional. With provincial data showing clusters of seismic activity in B.C., Quebec, the Yukon, and Atlantic offshore zones, protecting your home and family today could make the difference between recovery and financial ruin when the ground starts to shake.”

What You Can Do to Stay Protected

If you live in or near one of Canada’s seismic hotspots – Vancouver Island, Haida Gwaii, the Ottawa Valley, or Dawson City, you should:

- Review your home insurance policy and confirm if you have earthquake coverage.

- Consider adding an endorsement for earthquake protection, especially if your home’s foundation and structure could suffer major damage.

- Strengthen your home by securing heavy furniture, retrofitting older structures, and following preparedness steps like “Drop, Cover, Hold On.”

- Plan financially: ensure you have coverage for additional living expenses, which can support you if displacement occurs after a major event.

Earthquakes by Province (1986–2025)

| Province | 1986–1995 | 1996–2005 | 2006–2015 | 2016–2025 |

|---|---|---|---|---|

| Alberta | Mdrt: 0, Str: 0, Mjr: 0 | Mdrt: 0, Str: 0, Mjr: 0 | Mdrt: 0, Str: 0, Mjr: 0 | Mdrt: 1, Str: 0, Mjr: 0 |

| Atlantic Provinces | Mdrt: 5, Str: 0, Mjr: 0 | Mdrt: 2, Str: 1, Mjr: 0 | Mdrt: 8, Str: 0, Mjr: 0 | Mdrt: 11, Str: 0, Mjr: 0 |

| British Columbia | Mdrt: 29, Str: 1, Mjr: 0 | Mdrt: 59, Str: 7, Mjr: 0 | Mdrt: 65, Str: 9, Mjr: 1 | Mdrt: 34, Str: 8, Mjr: 0 |

| Northwest Territories | Mdrt: 5, Str: 0, Mjr: 0 | Mdrt: 3, Str: 0, Mjr: 0 | Mdrt: 4, Str: 0, Mjr: 0 | Mdrt: 1, Str: 0, Mjr: 0 |

| Nunavut | Mdrt: 3, Str: 0, Mjr: 0 | Mdrt: 9, Str: 0, Mjr: 0 | Mdrt: 19, Str: 0, Mjr: 0 | Mdrt: 10, Str: 0, Mjr: 0 |

| Quebec | Mdrt: 4, Str: 1, Mjr: 0 | Mdrt: 4, Str: 0, Mjr: 0 | Mdrt: 2, Str: 0, Mjr: 0 | Mdrt: 1, Str: 0, Mjr: 0 |

| Yukon | Mdrt: 5, Str: 0, Mjr: 0 | Mdrt: 8, Str: 0, Mjr: 0 | Mdrt: 5, Str: 0, Mjr: 0 | Mdrt: 4, Str: 2, Mjr: 0 |

Earthquakes by Region (1986–2025)

| Region | 1986–1995 | 1996–2005 | 2006–2015 | 2016–2025 |

|---|---|---|---|---|

| British Columbia | ||||

| Vancouver Island & Offshore (BC) | Mdrt: 21, Str: 1, Mjr: 0 | Mdrt: 53, Str: 5, Mjr: 0 | Mdrt: 36, Str: 5, Mjr: 0 | Mdrt: 32, Str: 8, Mjr: 0 |

| Offshore Haida Gwaii / Q.C. Islands | Mdrt: 7, Str: 0, Mjr: 0 | Mdrt: 5, Str: 2, Mjr: 0 | Mdrt: 29, Str: 4, Mjr: 1 | Mdrt: 2, Str: 0, Mjr: 0 |

| Northeastern BC | Mdrt: 1, Str: 0, Mjr: 0 | Mdrt: 1, Str: 0, Mjr: 0 | Mdrt: 0, Str: 0, Mjr: 0 | Mdrt: 0, Str: 0, Mjr: 0 |

| Yukon & NWT | ||||

| Southwestern Yukon | Mdrt: 5, Str: 0, Mjr: 0 | Mdrt: 8, Str: 0, Mjr: 0 | Mdrt: 5, Str: 0, Mjr: 0 | Mdrt: 4, Str: 2, Mjr: 0 |

| Mackenzie & Nahanni Regions (NWT) | Mdrt: 5, Str: 0, Mjr: 0 | Mdrt: 3, Str: 0, Mjr: 0 | Mdrt: 4, Str: 0, Mjr: 0 | Mdrt: 1, Str: 0, Mjr: 0 |

| Arctic Archipelago (Nunavut) | Mdrt: 3, Str: 0, Mjr: 0 | Mdrt: 9, Str: 0, Mjr: 0 | Mdrt: 19, Str: 0, Mjr: 0 | Mdrt: 10, Str: 0, Mjr: 0 |

| Quebec | ||||

| Western Quebec (Ottawa Valley) | Mdrt: 2, Str: 0, Mjr: 0 | Mdrt: 4, Str: 0, Mjr: 0 | Mdrt: 2, Str: 0, Mjr: 0 | Mdrt: 1, Str: 0, Mjr: 0 |

| Northern Quebec | Mdrt: 2, Str: 1, Mjr: 0 | Mdrt: 0, Str: 0, Mjr: 0 | Mdrt: 0, Str: 0, Mjr: 0 | Mdrt: 0, Str: 0, Mjr: 0 |

| Atlantic Canada | ||||

| Offshore Regions (Atlantic Provinces) | Mdrt: 5, Str: 0, Mjr: 0 | Mdrt: 2, Str: 1, Mjr: 0 | Mdrt: 8, Str: 0, Mjr: 0 | Mdrt: 11, Str: 0, Mjr: 0 |

| Alberta | ||||

| Prairies | Mdrt: 0, Str: 0, Mjr: 0 | Mdrt: 0, Str: 0, Mjr: 0 | Mdrt: 0, Str: 0, Mjr: 0 | Mdrt: 1, Str: 0, Mjr: 0 |