The concept of a vacant home tax has been gaining traction in Ontario, especially in cities like Toronto, Vaughan, Markham, York Region, Mississauga, and Hamilton. As housing prices continue to soar, the government is taking steps to ensure that homes are not left empty, thereby exacerbating the housing crisis. In this article, we’ll delve into what a vacant home tax is, how it works, and what you need to know to navigate this new landscape.

What is a Vacant Home Tax?

A vacant home tax is a levy imposed on residential properties that are not occupied for a certain period, typically six months in a calendar year. The tax aims to discourage homeowners from leaving properties empty, thereby increasing the housing supply and potentially lowering housing costs.

How Does Vacant Home Tax Work?

The tax is generally self-declared, meaning homeowners are responsible for informing the government if their property is vacant. Failure to do so can result in hefty fines. In Toronto, for example, the tax rate is set at 1% of the property’s current value assessment. In Peel Region, a proposed tax could range from 1-3%.

Toronto Vacant Home Tax

In Toronto, property owners must declare the occupancy status of their properties annually. The tax is 1% of the Current Value Assessment (CVA) and applies to homes vacant for over six months in the previous year. Declarations can be made online or via a paper form, and failure to declare or making a false declaration may result in a fine of $250 to $10,000.

Vacant Home Tax in Other Regions

- Vaughan, Markham, and York Region: While these areas are still in the consultation phase, they are closely watching the implementation in Toronto and may soon follow suit.

- Mississauga and Hamilton: Mississauga is in the early stages of considering a vacant home tax, while Hamilton is set to implement one beginning in 2024.

Exemptions and Special Cases

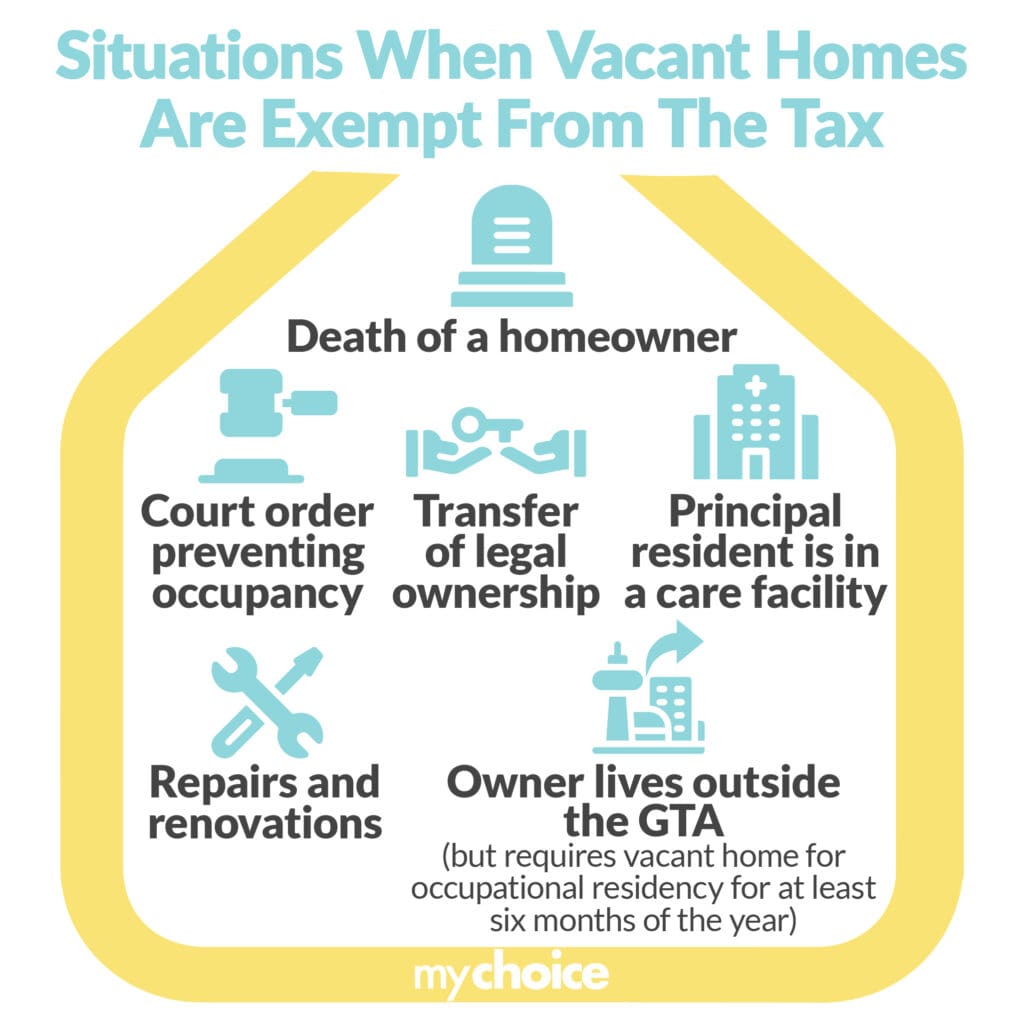

There are some exemptions to the vacant home tax, such as:

- Death of a registered owner

- Repairs or renovations

- Principal resident is in care

- Transfer of legal ownership

- Occupancy for full-time employment

- Court order prohibiting occupancy

Underused Housing Tax (UHT)

The Canadian government and the Department of Finance have also introduced an Underused Housing Tax (UHT), effective from January 1, 2022. This tax aims to control housing supply and demand.

Tax Credits

Some provinces may offer tax credits for homeowners who declare a second property or home that is not being used as the principal address. Council-approved empty homes and homeowners could be eligible for a tax credit of roughly CAD 2,000 on a secondary home or property.

Assessment for The Speculation and Vacancy Tax

Secondary homeowners need to declare their property individually, even if the property has more than one owner. The tax would then apply depending on the owner’s residency status, how the property is used, and how or where owners declare their income.

Change of Homeownership

Owners that are currently selling their property will be held responsible for all ongoing property taxes. Any person who sells their property between January 1, and February 2, will need to complete a property status declaration.

Lessons from British Columbia

BC’s vacant home tax, known as the “Speculation and Vacancy Tax,” varies depending on one’s citizenship. For Canadian citizens and permanent residents, the tax rate is 0.5%, while for foreign homeowners or satellite families, it’s 2%. The tax has been somewhat effective in increasing rental units but has not significantly impacted housing prices.

Effectiveness of the Tax

In BC, the tax raised $81 million for affordable housing programs in 2020. However, housing prices remain high, indicating that the tax alone may not be sufficient to cool the market.

By understanding these nuances, homeowners can better navigate the complex landscape of vacant home taxes in Ontario.

Bottom Line

The vacant home tax is a tool aimed at alleviating the housing crisis by encouraging homeowners to either occupy or rent out their properties. While it’s not a silver bullet, it’s a step in the right direction. If you own property in Ontario, it’s crucial to understand how this tax works to avoid any penalties.