If you’re renting your home out to somebody else, you’ll need insurance protection to ensure you’ll be covered if unwanted incidents happen. For rental properties, you generally need landlord insurance. However, in some cases, home insurance is still a good idea to have. What are the differences between these two policies, and which one should you get? Read on to learn more.

Landlord Insurance vs Home Insurance: Key Differences

While there’s some overlap, landlord insurance and home insurance are fundamentally two distinct policies with different coverage, rate-determining factors, and rules. Check the table comparing these two policies side-by-side to learn their differences:

| Insurance type | Occupancy rules | Coverage differences | Personal property coverage | Liability coverage | Cost |

|---|---|---|---|---|---|

| Landlord insurance | Can be used in conjunction with a home insurance policy if you still live on the rental property | Protects your income and property in case of tenant-related damages | Covers damage to your rental property and its contents that belong to you | Provides general liability coverage | Generally depends on the location, expected revenue, and type of your rental property |

| Home insurance | Your policy may be voided if the insurer finds out you have a tenant on the property without their knowledge | Protects your home and possessions in case of unexpected incidents | Covers damage to your home and its contents | Provides personal liability coverage | Depends on your home’s maintenance status, replacement cost, and location |

Which One Do You Need?

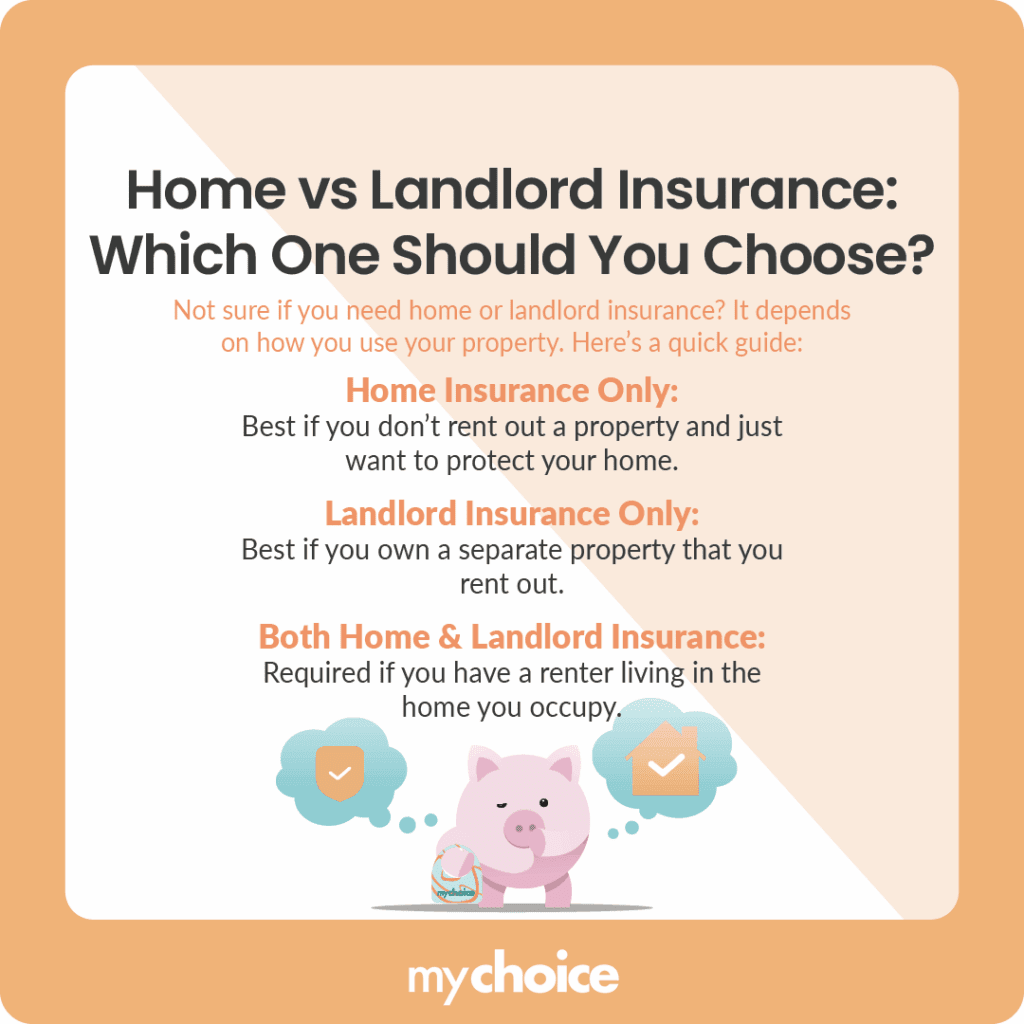

Between landlord and home insurance, you might only need one of them, or you might need both, depending on the situation. Here’s a quick breakdown:

- Get just home insurance if you don’t own a rental property or are planning to rent out your house, and simply want to insure your home.

- Get landlord insurance if you have a separate property you rent out.

- Get both home and landlord insurance if you have a renter living on the property you live in.

If your situation changes, the IBC recommends telling your insurance representative before your living arrangement changes to ensure no issues from the insurance company.

Special Situations Canadians Often Overlook

In addition to long-term rental arrangements, there are two special situations that some people might not consider. Let’s take a look at these situations and how you can best address your insurance needs if they happen:

Tax & Mortgage Considerations

Landlord insurance isn’t a requirement for renting out properties. However, mortgage lenders generally require you to get landlord insurance before you can qualify for a loan.

In terms of taxes, you can claim landlord insurance premiums as a tax deduction since it’s included as a business expense, alongside management fees, utilities, and other costs.

Tenant Insurance: Filling the Gap

Home and landlord insurance protects your property and belongings contained within. However, there’s no protection for the tenants’ belongings. As a landlord, you can require or recommend that renters get tenant insurance to protect their belongings from damage.

You may be wondering, why should you care about your renters’ things? By requiring renters to take tenant insurance, you can reduce the occurrences of disputes and protect yourself from personal liability. Renters who have tenant insurance are also generally more responsible and trustworthy, which acts as an indirect tenant screening process.

Key Advice from MyChoice

- It’s a good idea to get landlord insurance when applying for a rental property mortgage, because most lenders require it.

- If you’re a one-time or occasional renter, consider talking to your insurer about your insurance protection options so you don’t overpay on landlord insurance.

- Require your tenants to have tenant insurance to reduce disputes and personal liability cases.