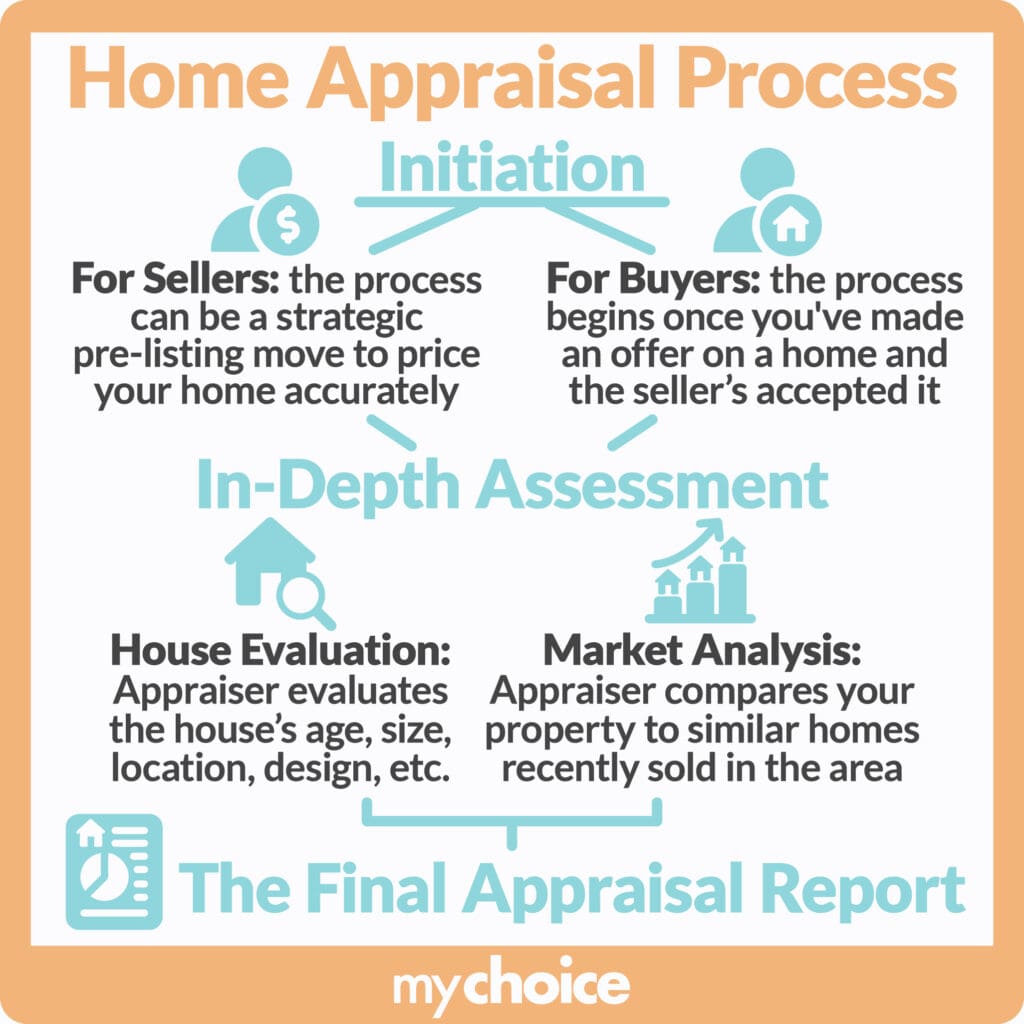

Home appraisal is typically a required process for buying a property. Because it tells buyers and sellers the unbiased, estimated value of a property, it determines how much it should sell for. It’s also part of a bank or other lender’s due diligence when reviewing a mortgage application, as it helps them assess the amount to lend a home buyer.

Home Appraisal in Ontario at a Glance

- A home appraisal is the unbiased assessment of a home’s value, usually required before selling a home to know its market value or by banks when you apply for a mortgage.

- Typically, a lender will call for an appraisal and cover its costs. But in some cases, a buyer will have to find an appraiser. Check if your Ontario home appraiser is licensed and certified by the Canadian National Association of Real Estate Appraisers (CNAREA) and the Appraisal Institute of Canada (AIC).

- Small changes like repairing roofing, mowing your lawn, and improving landscaping can increase your home’s appeal. Don’t hesitate to do these little tasks to get the best appraisal value.

Wondering when and how to get a house appraisal in Ontario? Read on to find out these details, what an appraiser looks at when computing a home’s fair market value, and if appraisal affects your home insurance policy.

How Do Renovations Impact Home Appraisals?

Many homeowners think that renovating and adding improvements to their property will automatically increase its value. However, not all improvements and renovations will drive up your home’s appraisal value. For example, some unique features like a wine cellar are costly and only increase resale value if prospective buyers share your interests.

Appraisers will look at the overall functionality, aesthetic appeal, and marketability of any renovations and improvements you make. Low-quality work, exterior finishes that don’t match the rest of the neighbourhood homes, and improvements that cater to niche preferences won’t increase appraisal value. In some cases, it may even cause it to go down.

Here are some improvements and renovations that may positively impact your home appraisal:

- Smart home technology

- Replacing old systems and built-in appliances with energy-efficient solutions

- Replacing or repairing roofing

- Adding a deck

- Finishing a basement

When in doubt about the overall value improvements and renovations will add, a licensed appraiser can provide an unbiased viewpoint.

Who Are Home Appraisers?

Home appraisers are trained and certified professional assessors who combine research, property inspection, and market analysis to determine how much a property is worth. Assessing a home’s value can be complicated, so the profession is nationally regulated by the Canadian National Association of Real Estate Appraisers (CNAREA) and the Appraisal Institute of Canada (AIC). These two institutions ensure that both consumers and appraisers understand the responsibilities of appraisers and the appraisal process itself.

When looking for an appraiser, make sure they have the following:

- Professional designations: Check your appraiser’s certifications and make sure these come from strongly regulated, trusted institutions like CNAREA and AIC-ON (the Ontario association of AIC). These qualifications show they’ve passed training and taken the necessary courses to acquire skills in property valuation. It also gives you official channels to make complaints or hold them accountable for unprofessional conduct, if needed.

- Experience: Simply put, the more relevant experience that an appraiser has in valuing Ontario residences, the better. If they’ve dealt with similar houses or worked in your location for a long time, this will help them judge more accurately.

- References: Don’t be afraid to ask an appraiser for references. Seeing the number of clients they’ve worked with and their ties to local businesses also says a lot about how well they do their work.

What Influences a Home Appraisal?

When you hire a home appraiser, they will visit and assess your property and its neighbourhood. These are the usual factors that they take into consideration for their report and final valuation:

- Local market trends: Economic trends play a role in the estimated value of a home. For example, if it’s a buyer’s market with lots of sellers, home prices tend to go down while a seller’s market with fewer houses for sale will have buyers paying more.

- Amenities: Amenities are basically all the features that make up the house itself, such as the number and size of bedrooms, bathrooms, and living areas. It may also include appliances, utilities, and home fixtures made with premium materials, as these increase the value of a home. Other amenities considered include available parking areas, gutters, roofing, and general construction.

- Neighbourhood features: Different locations will be more desirable to different prospective buyers, so appraisers will take note of a house’s neighbourhood. For example, young professionals may be more attracted to homes closer to public transit, or families may be willing to pay more for homes near schools and recreation options.

- Comparable properties: Appraisers will also look at the value of similar properties in your area for comparison.

What If I Disagree With My Home Appraiser’s Valuation?

Appraisers will lean on their training, experience, and knowledge to provide as precise a valuation as possible. However, they’re only human too and if you’re worried that their valuation is well below your asking price, you can ask them about the report or hire a different appraiser.

See if there are key features they may have missed in their appraisal. Mistakes happen and it’s worth seeing if something can be reevaluated to adjust the value. However, be prepared for your home appraiser to stand by their estimate. On the other hand, you always have the option to hire another appraiser – but note that you risk having the second appraiser make an even lower valuation.

Is a Home Appraisal The Same Thing as an Inspection?

Home appraisals and home inspections are not the same thing. They’re both key processes for buying a home, but they have these major differences:

- Home appraisals are focused on determining the value of a property for resale and mortgaging. They’re only concerned with repair or maintenance issues because they lower a property’s value.

- Home inspections can be organized by a buyer on their own to examine a property’s condition thoroughly. This includes looking closer at utility lines, systems, structural integrity, and other issues that may need repairs or maintenance.

How Does Home Appraisal Affect Your Insurance?

Home appraisal reveals the value of your home in its current market, location, and condition. But does your appraisal value result in higher or lower insurance premiums? Here’s how an appraiser’s valuation may affect your home insurance policy in Ontario:

It Doesn’t Directly Affect Your Premiums

Your home’s appraised value doesn’t directly impact your home insurance premiums. Home insurance is primarily meant to cover the cost of repairing or rebuilding your home due to certain risks or events, not to cover its market value.

It Can Reveal Risks

Home appraisals may reveal issues that could make you or your Ontario home insurance provider review your policy and coverage. During appraisal, risks like outdated wiring or old roofing affect your home’s market value and may lead your insurer to require repairs or updates for continued coverage.

There May Be Potential for Coverage Adjustment

Your home appraisal may result in a higher or lower valuation for your home. If the appraiser gives a higher value than expected because you’ve made improvements or there are market changes, you may want to increase your home insurance coverage. This ensures your policy can cover your home’s new value and any necessary future rebuilding or repairs.

How to Prepare for a Home Appraisal

If you have an upcoming house appraisal in Ontario, here are some ways you can get your home ready and potentially get a higher valuation:

- List recent renovations and key features: The house appraiser will note key features on their own, but it doesn’t hurt to make their job easier and have a list ready just in case they miss something. Include when these renovations were made, who did them, and how much they cost.

- Make small, cost-efficient renovations to increase appraisal value: Some renovations are pricey and often not worth the potential added value. Others, however, are fairly low-cost changes that boost your

- Thoroughly clean your property: Apart from basic cleaning, you need to deep clean areas of your home where dirt and clutter easily accumulate so it is more presentable to the appraiser. Counters should be polished, carpets deep cleaned, and garages made clean.

- Keep your home free of people and pets during appraisal: It’s best not to have a social gathering at your house during an appraisal as it makes it difficult for an appraiser to evaluate your home. If necessary and possible, you should also keep your pets away during this process.

Key Advice from MyChoice

- Home appraisals don’t directly affect your insurance premiums, but they can reveal risks that may influence your rates.

- If your home appraisal shows that your home’s value is higher than you thought, you may want to increase your home insurance coverage so it’s sufficient for the newly appraised value.

- Make sure a home appraiser is properly licensed. Because their work affects how much home insurance you want and how much a mortgagor may offer, it’s important to check they have the necessary credentials and knowledge.

- If your Ontario home appraisal is lower than expected, talk to your appraiser. They may have found problems that affect the price, such as utility issues or missing permits. They can explain their appraisal report and how they arrived at the final figure.

- Not all improvements will improve your home’s resale value. Some unique features like a wine cellar are costly and only increase resale value if prospective buyers share your interests. When in doubt about the overall value improvements will add, a licensed appraiser can provide an unbiased viewpoint.