Mass timber construction promises faster build times for greener construction, creating living spaces that will make their residents feel more connected to nature. However, for condo buyers, there’s a catch: while mass timber buildings are environmentally friendly and architecturally impressive, they’re also relatively new to the market. This article delves into the nuances of living in a mass timber building and how this may impact your condo insurance rates.

What Is Mass Timber?

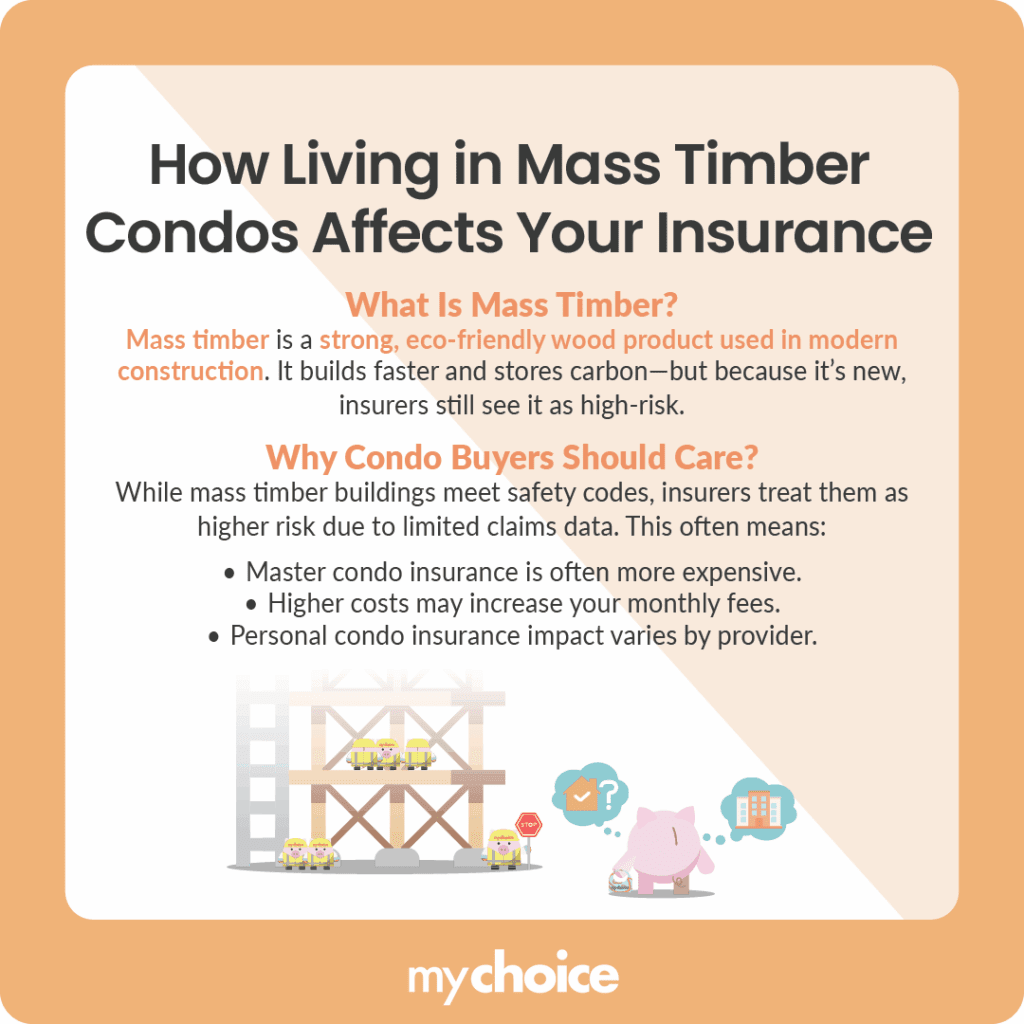

Mass timber is a category of engineered wood products created by bonding solid wood layers together to form large structural components like columns, panels, and beams for construction.

This material has become popular because it’s renewable and stores carbon, helping offset emissions from other materials in a building, such as steel and concrete. Prefabricated mass timber components also allow faster, quieter onsite construction, and their relatively high strength compared to weight allows them to be used even for high-rise buildings.

However, mass timber buildings are susceptible to moisture damage and pest damage from wood-boring insects. The supply chain and industry standards for mass timber are also still fairly new, affecting pricing, design consistency, and availability.

Why This Matters to Condo Buyers

While mass timber buildings meet the same fire and structural safety standards as traditional concrete and steel buildings, insurance companies see them very differently. The reason is simple: because it’s a relatively new material, there’s almost no historical claims data related to mass timber to work with.

For condo buyers, this uncertainty creates two main concerns. First, your condo corporation’s master insurance policy (covering the building structure and common areas) will likely cost significantly more than in a traditional concrete building. Second, your personal condo insurance might also be affected, though the impact here is less predictable.

How This Affects Your Premiums and Deductibles

When it comes to the master policy, your condominium corporation’s insurance costs are likely to be higher for a mass timber building because of hesitation from insurers to cover this riskier construction type. These increased costs get passed down to unit owners through higher monthly maintenance fees.

While some insurers may charge higher premiums on your personal condo insurance if they find out your unit is in a mass timber building, others might not. This is largely because personal condo insurance primarily covers interior improvements and your belongings instead of the building’s structure itself.

What to Ask Before Buying a Mass Timber Condo

Thinking of getting a condo in a mass timber building? Before you make this crucial decision, ask your insurer and condo corporation these questions:

Key Advice from MyChoice

- If you’re facing higher premiums due to the building’s construction type, a higher deductible can help offset some of the increased costs.

- Consider saving money by bundling your condo insurance with other policies, such as auto insurance. This strategy will be especially valuable if your mass timber condo pushes your insurance costs higher than expected.

- Before purchasing a unit, ask for documentation about the building’s insurance arrangements. Understanding these costs upfront helps you budget accurately and avoid surprises down the road.