Knowing how your condo insurance protects you from risks like fires is crucial. Many condo owners assume the building’s policy covers everything, but that’s rarely the case. This guide breaks down how condo fire insurance really works.

What Exactly Does Your Condo Insurance Cover in a Fire?

When you own or rent a condo, you will usually have a policy that covers the “unit owner’s interest”, meaning your personal contents, upgrades you’ve done inside the unit, personal liability, and so on.

To help you understand clearly, here’s a table that breaks down some common coverage types, what they protect, and an example of each.

| Coverage Type | What it Protects | Example |

|---|---|---|

| Unit Upgrades & Improvements | The built-in components of your unit that you have upgraded or that may not be covered by the condo building’s base insurance (e.g., flooring or finishings you added) | If a fire breaks out in your unit and the built-in hardwood flooring you installed is destroyed, your policy covers the cost to replace it. |

| Contents (Personal Belongings) | Your personal property, like furniture, electronics, or clothing | If a fire causes smoke damage to your couches and clothes, your fire insurance covers those items (up to your limit). |

| Loss of Use (Additional Living Expenses) | Extra costs you incur while your unit is uninhabitable | You cannot live in the unit for several weeks; you have to stay in a hotel and eat out more often. This covers those extra expenses. |

| Personal Liability | If you are held legally responsible for damage or injury occurring in your unit or to others | A fire you accidentally started spreads to your neighbour’s unit, causing damage. If you are found liable, your liability coverage handles the financial side. |

| Loss Assessment | If your condo corporation’s master policy triggers a special assessment (or you’re required to pay part of a deductible) because of a fire, this helps you pay your share | A fire in the building leads to a large deductible under the condo corporation’s policy, and you are assessed a share. Your loss assessment coverage helps you cover that cost. |

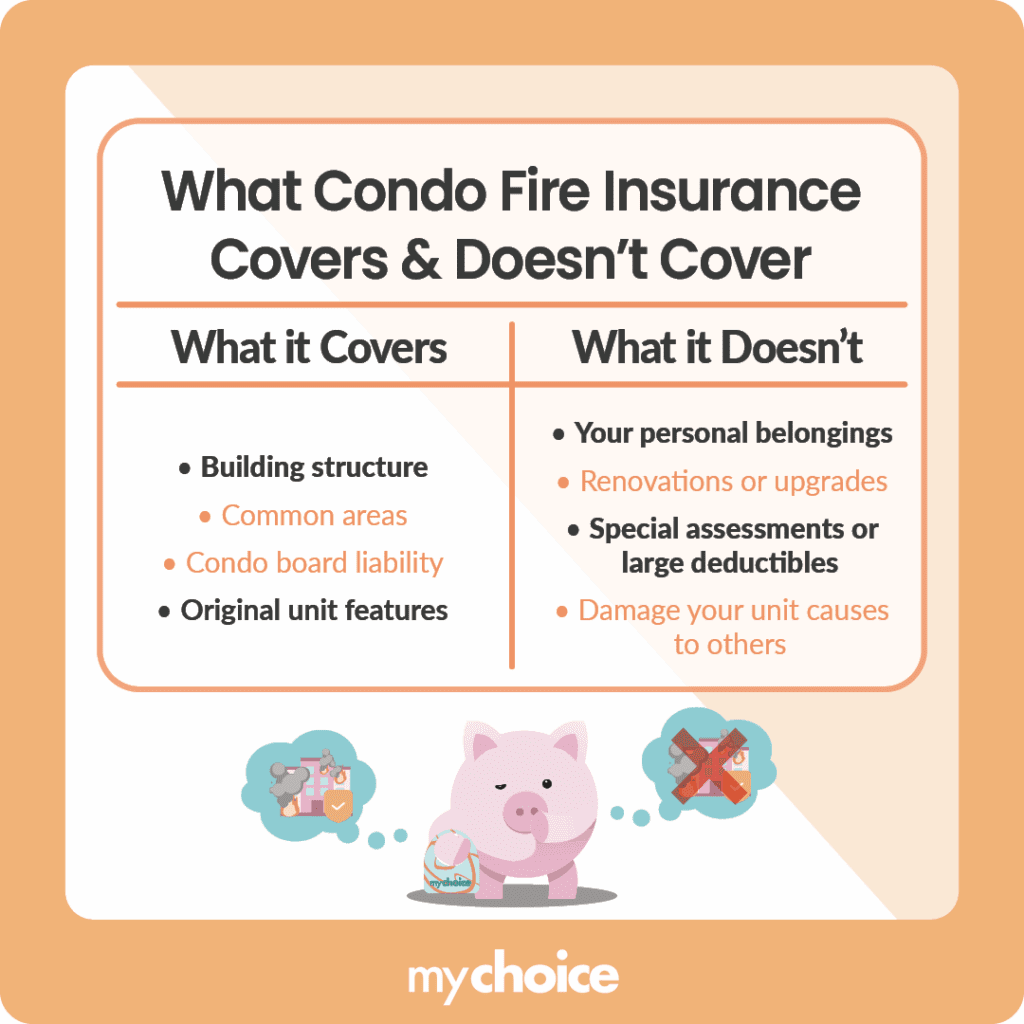

What the Condo Corporation’s Policy Covers (and What It Doesn’t)

As a condo owner or tenant, you are part of a larger building or development managed by a condo corporation/association. The condo corporation holds a “master policy” which typically covers:

- The building’s physical structure, such as the exterior, roof, and partitions that are defined as common elements.

- Common areas like lobbies, elevators, etc.

- Liability of the corporation or the board for injuries or damage in common areas.

- The basic original unit-owner’s portion of the unit (depending on condo by-laws or declaration).

Meanwhile, some things aren’t, or are only partially covered, such as:

- Your personal contents inside the unit

- Upgrades or renovations above the standard version the developer built

- Special assessments or high deductibles passed on to unit owners if the master policy’s deductible is large.

- Liability for damage your unit caused to others

Sometimes the master policy’s limits or deductible may be insufficient relative to costs, and unit owners may be required to pay more. Check your condo corporation’s insurance policy to understand what the building covers and what your responsibility is.

What Happens When Fires Spread Between Units?

A condo fire can spread to other parts quickly. This raises questions about whose insurance pays and how liability is determined. Here are a few scenarios and how they generally work:

Common Condo Fire Triggers and How to Reduce Your Risk

Having condo fire insurance is essential, but it’s better to simply reduce your risk in the first place. Here are common fire triggers and how to reduce your risk:

What to Do After a Condo Fire

If a fire happens in your unit or building, there are several steps you should take to help protect your interests. Here are immediate and follow-up ones to do:

Immediately after a fire:

- Ensure safety and evacuate: Get out, follow the building’s evacuation procedures, and call 911 if needed.

- Notify the condo board/property manager: They need to be aware of the fire so the master policy can be triggered, building safety procedures initiated, and emergency support may be arranged.

- Contact your insurer: Even if you’re unsure whether the damage affects your personal contents or upgrades, let them know ASAP.

- Document damage: Once safe and permitted, photograph the damage, note the location, the cause if known, and collect receipts where applicable.

- Secure your unit: If the fire leaves your unit open or at risk of further damag, take steps to secure it. Board up windows and doors if necessary, but consult your insurer and condo board first so you don’t invalidate coverage.

The next few days after a fire:

- Work with the association to understand structural and common area damage: The building may need to coordinate repairs, inspections, and your stay may be affected.

- Check your “loss of use” coverage: If you can’t live in your unit, you may be eligible for temporary accommodation, extra food costs, and storage and moving costs.

- Keep receipts: For any temporary housing, meals above usual, travel/moving/storage, keep records.

- Understand your liability and assessment exposure: If the fire started in your unit or you are assessed for part of the building’s deductible, know how your policy handles loss assessment.

- Review your policy: After a fire, you may want to reassess your coverage and check if any exclusions or changes are needed.

Long-term checks after a fire:

- Check for upgrades or changes after the fire: When rebuilding or repairing, you may choose better materials, fire-resistant finishes, or other improvements. Make sure your policy reflects that.

- Fire prevention review: Map out what preventive steps you’ll take going forward.

- Consider increases in premiums: After a fire in your building, premiums for personal condo-owners may rise; you might want to shop around or negotiate with your insurer.

Key Advice from MyChoice

- To get the most value out of your insurance policy in Atlantic Canada, learn what risks are common in your area and get the proper insurance coverage options to counter them.

- Protect your home from extensive damage by implementing weather-resistant measures and materials.

- Keep a close eye on local news and alerts so you’re not caught off guard when an extreme weather incident is about to occur.