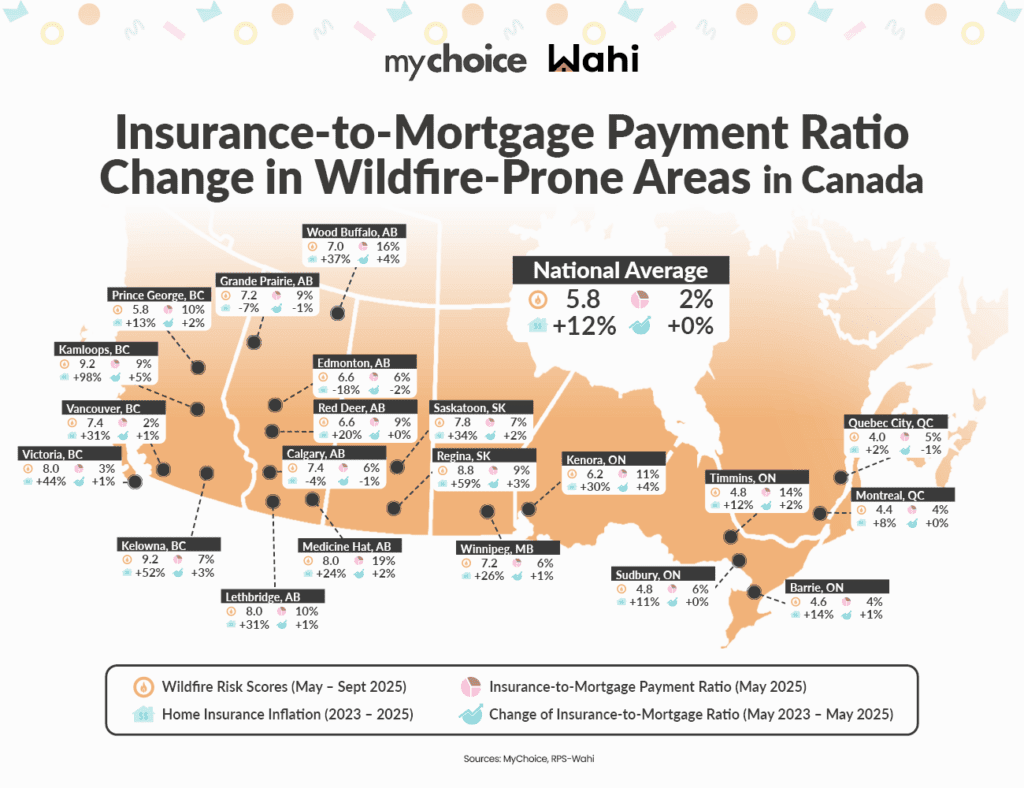

Home Insurance Now Accounts for Up to 19% of Mortgage Payments in Canada’s Wildfire Zones

The wildfires in Canada continue to be a devastating problem for many communities. This summer, Alberta, Saskatchewan, Ontario, and Manitoba have all experienced fires larger than their five-year averages, highlighting the growing impact of climate-related events on Canadian homeowners.

Earlier this year, our team at MyChoice conducted a study to assess wildfire risk scores across Canada, using data from the Canadian Wildland Fire Information System. Building on that research, we sought to investigate how home insurance premiums have evolved in recent years in these high-risk areas and whether rising costs are impacting housing affordability. To make this analysis more comprehensive and data-rich, we partnered with Wahi, one of Canada’s leading real estate agencies, to leverage their housing price data and provide a more holistic view of the Canadian homeowner experience.

Our Methodology

The report examined thousands of real homeowner quotes generated through MyChoice between January and June 2025 and compared them with the same period in 2023. For consistency, we focused on quotes reflecting a standardized homeowner profile: a 35-year-old male or female with a clean claim history, currently insured, non-smoker, living in a semi-detached or detached 3–4 bedroom home (2,000–2,500 sq. ft.). Each property was assumed to have monitored fire and burglar alarms, at least one fire extinguisher, a $1,000 deductible, $1,000,000 liability coverage, and an Enhanced Water Protection package. By combining the MyChoice dataset with the RPS-Wahi Home Value Estimates, the report was able to quantify how wildfire risk translates into insurance cost changes and overall housing affordability pressures across Canadian cities. To illustrate this, the monthly insurance-to-mortgage payment ratio for each city was calculated, factoring in local home value estimates, standard mortgage assumptions (five-year fixed term, 20% downpayment and the prevailing interest rates for 2023 and 2025), and the average home insurance premiums — providing a clear picture of how rising insurance costs affect homeowners’ monthly budgets.

Key Findings from the Study

- Medicine Hat, AB, stands out as the least affordable market for insurance, with annual premiums rising 24% to $3,875. Insurance payments now equal 19% of a typical mortgage — the highest ratio among all cities analyzed.

- Kamloops, BC, saw home insurance premiums nearly double in two years, from $1,893 to $3,743. The monthly insurance payment now represents 9% of a typical mortgage, up from 5% in 2023.

- Wood Buffalo, AB (including Fort McMurray) follows closely, with premiums surging 37% to $3,367. Insurance costs now make up 16% of the average mortgage payment, underscoring the region’s long history of wildfire risk.

- Kelowna, BC, experienced a 52% increase, with premiums rising from $2,250 to $3,424, and the insurance-to-mortgage ratio increasing from 4% to 7%.

- Regina, SK, saw premiums jump 59%, from $1,231 to $1,957, moving insurance payments from 6% to 9% of the mortgage.

- Victoria, BC, had a 44% premium rise, from $1,456 to $2,102, but high home values keep the insurance-to-mortgage ratio low at 3%, up from 2%.

- Both Alberta and British Columbia are seeing the sharpest pressures on affordability. In B.C., rising wildfire risk has driven premiums up significantly, though high property values in cities like Vancouver and Victoria keep the insurance-to-mortgage ratio relatively modest. Alberta, meanwhile, faces a more volatile picture. Some areas are experiencing severe affordability strain, with insurance consuming a large share of mortgage payments, while others saw rare relief in premiums.

- Ontario shows a wide spread in insurance-to-mortgage ratios. In Kenora, premiums now make up 11% of mortgage payments, up from 7%, despite home prices actually falling by 11%. Timmins rose from 11% to 14%, one of the sharpest jumps in the country. Sudbury held steady at 6%, while Barrie increased slightly from 3% to 4%.

- At the national level, average home insurance premiums rose 12% over two years, from $933 to $1,043 annually. While the typical Canadian homeowner spends only about 2% of their mortgage payment on home insurance, the averages mask the severe affordability challenges in wildfire-exposed regions.

- If insurance ratios continue rising, it could start influencing where Canadians choose to buy homes. In markets where insurance is 15–20% of mortgage payments, younger buyers may be priced out not by the house itself, but by the ongoing cost of protecting it.

If insurance ratios continue rising, it could start influencing where Canadians choose to buy homes. In markets where insurance is 15–20% of mortgage payments, younger buyers may be priced out not by the house itself, but by the ongoing cost of protecting it.

“Homeownership costs are no longer just about mortgage payments — climate risk is rapidly becoming a key financial factor,” says Aren Mirzaian, CEO of MyChoice. “Our joint study with Wahi shows that in Canada’s wildfire-prone cities, insurance premiums are rising faster than home values, directly impacting housing affordability.”

Wildfire Challenges: A Comparison with the U.S.

Canada is not alone in grappling with the insurance fallout from wildfires. To get a sense of where things could be headed if climate risks continue to intensify, one can look at the experience in the United States – particularly in California, which has been at the epicentre of wildfire-driven insurance turmoil. In recent years, several major U.S. insurers have effectively declared parts of California too risky and unprofitable to insure. In 2023, for instance, State Farm – California’s largest homeowners’ insurer – announced it would stop selling new home insurance policies in the state due to “historic increases in construction costs outpacing inflation, rapidly growing catastrophe exposure, and a challenging reinsurance market”. Allstate and other household-name insurers also pulled back from offering coverage in California’s high-risk areas. The result has been a scrambling of the market: many homeowners can only find fire insurance through California’s FAIR Plan (a state-mandated high-risk insurance pool) at much higher rates and with bare-bones coverage.

The U.S. comparisons are a cautionary tale for Canada. So far, Canadian insurers have generally remained willing to insure homes even in wildfire-prone areas, and the market, while hardening, is still competitive. However, the same pressures that drove U.S. insurers out of places like California are now building up in Canada: higher catastrophe losses are making reinsurance more expensive and underwriting more difficult, and insurers have to raise premiums to stay in risky markets.

Affordability vs. Availability: An Insurance Dilemma

The interplay between rising insurance costs and insurance availability presents a double-edged sword for policymakers and consumers. On one edge, surging premiums undeniably hurt housing affordability – pricing some people out of insurance or forcing difficult choices about coverage levels. On the other hand, if insurers are not allowed to charge premiums commensurate with risk (or if the risk simply becomes too high to insure at a price people can pay), the alternative is even more dire: lack of coverage.

For instance, Aviva Canada withdrew its direct-to-consumer home & auto insurance business from Alberta in early 2025 — a move that echoes the early stages of insurer retreat seen in wildfire-prone California. While Alberta’s auto insurance rate caps largely influenced the decision, rising climate risks also contributed to the exit.

The contrast between home and auto insurance in Alberta underscores a dilemma: insurance prices are rising rapidly due to higher risks and claims, but attempts to suppress these price increases (at least in auto) have resulted in reduced coverage availability. In the home insurance space, Alberta has so far avoided direct rate caps, and insurers have largely remained willing to write policies – albeit at higher premiums. For consumers, neither scenario is pleasant: either pay more for insurance or face potential difficulty finding an insurer at all.

In short, there is no easy escape from this climate-induced insurance trap. Higher costs strain household budgets, but they also signal the true underlying risk. If we suppress those costs artificially or ignore them, we may find ourselves with insurance deserts where homes are uninsurable at any cost.

What Can be Done?

Investing in community resilience (better forest management, firebreaks, improved building codes in fire zones) and encouraging homeowners to harden their homes against wildfires are some of the initiatives that can be taken today. Governments also have a role to play. As the National Flood Insurance Program (NFIP) is developed to handle uninsurable flood risk, authorities may need to consider backstop solutions for wildfire risk if private insurance starts to falter. This could take the form of a high-risk insurance pool or federal disaster insurance program to ensure coverage remains available for all, even as the private insurers recalibrate their models.

Ultimately, the story emerging from our research is that climate change has injected a new financial reality into homeownership. Insurance, once a relatively static line item, is becoming a dynamic and significant factor in the cost of owning a home. Wildfire-prone communities in Canada are feeling it first – in places like Kamloops or Fort McMurray, insurance premiums are climbing at a rate that outstrips property values and incomes. But even outside those hotspots, Canadians are seeing their insurance bills trend upward year after year. While rising premiums are hard to swallow, they are also a signal calling for action. As climate risks mount, all stakeholders – insurers, governments, and homeowners – will need to collaborate on solutions that keep insurance both affordable and available. The balance is delicate, but it’s one we must strive to achieve to protect the dream of homeownership in an era of increasing wildfire threats.

Full Dataset:

| City | Wildfire Risk Score (May – Sept 2025) | Average Annual Home Insurance Premium (2025) | Home Insurance Inflation (2023 – 2025) | Monthly Insurance Payment as a % of Mortgage (May 2025) | RPS-Wahi Home Value Estimate (May 2025) |

|---|---|---|---|---|---|

| National | 5.8 | $1,043 | 12% | 2% | $816,652 |

| Kamloops, BC | 9.2 | $3,743 | 98% | 9% | $733,948 |

| Kelowna, BC | 9.2 | $3,424 | 52% | 7% | $912,680 |

| Regina, SK | 8.8 | $1,957 | 59% | 9% | $384,272 |

| Victoria, BC | 8 | $2,102 | 44% | 3% | $1,215,919 |

| Lethbridge, AB | 8 | $2,333 | 31% | 10% | $442,593 |

| Medicine Hat, AB | 8 | $3,875 | 24% | 19% | $388,198 |

| Saskatoon, SK | 7.8 | $1,653 | 34% | 7% | $447,526 |

| Vancouver, BC | 7.4 | $1,924 | 31% | 2% | $1,447,290 |

| Calgary, AB | 7.4 | $2,345 | -4% | 6% | $713,644 |

| Winnipeg, MB | 7.2 | $1,413 | 26% | 6% | $432,331 |

| Grande Prairie, AB | 7.2 | $1,740 | -7% | 9% | $365,950 |

| Wood Buffalo (including Fort McMurray), AB | 7 | $3,367 | 37% | 16% | $397,550 |

| Red Deer, AB | 6.6 | $1,909 | 20% | 9% | $412,990 |

| Edmonton, AB | 6.6 | $1,725 | -18% | 6% | $505,829 |

| Kenora, ON | 6.2 | $2,017 | 30% | 11% | $352,350 |

| Prince George, BC | 5.8 | $2,788 | 13% | 10% | $502,972 |

| Timmins, ON | 4.8 | $2,051 | 12% | 14% | $276,050 |

| Sudbury, ON | 4.8 | $1,750 | 11% | 6% | $506,178 |

| Barrie, ON | 4.6 | $1,700 | 14% | 4% | $823,183 |

| Montreal, QC | 4.4 | $1,543 | 8% | 4% | $708,363 |

| Quebec City, QC | 4 | $1,378 | 2% | 5% | $476,331 |