Return of premium life insurance is one of the few things you can buy and get 100% cashback if you don’t use it. However, its steep costs can offset your potential savings. Adding a return of premium to your policy could be the best decision under certain circumstances, but other insurance products could provide similar benefits with additional gains.

Some people hesitate to buy life insurance because they won’t see its benefits in their lifetime. However, not all insurance policies are made the same. With return of life insurance, you can get a partial (if not full) refund of the premiums you’ve paid.

Read on for a guide to return of premium life insurance, its pros and cons, and when it might be the right choice for you.

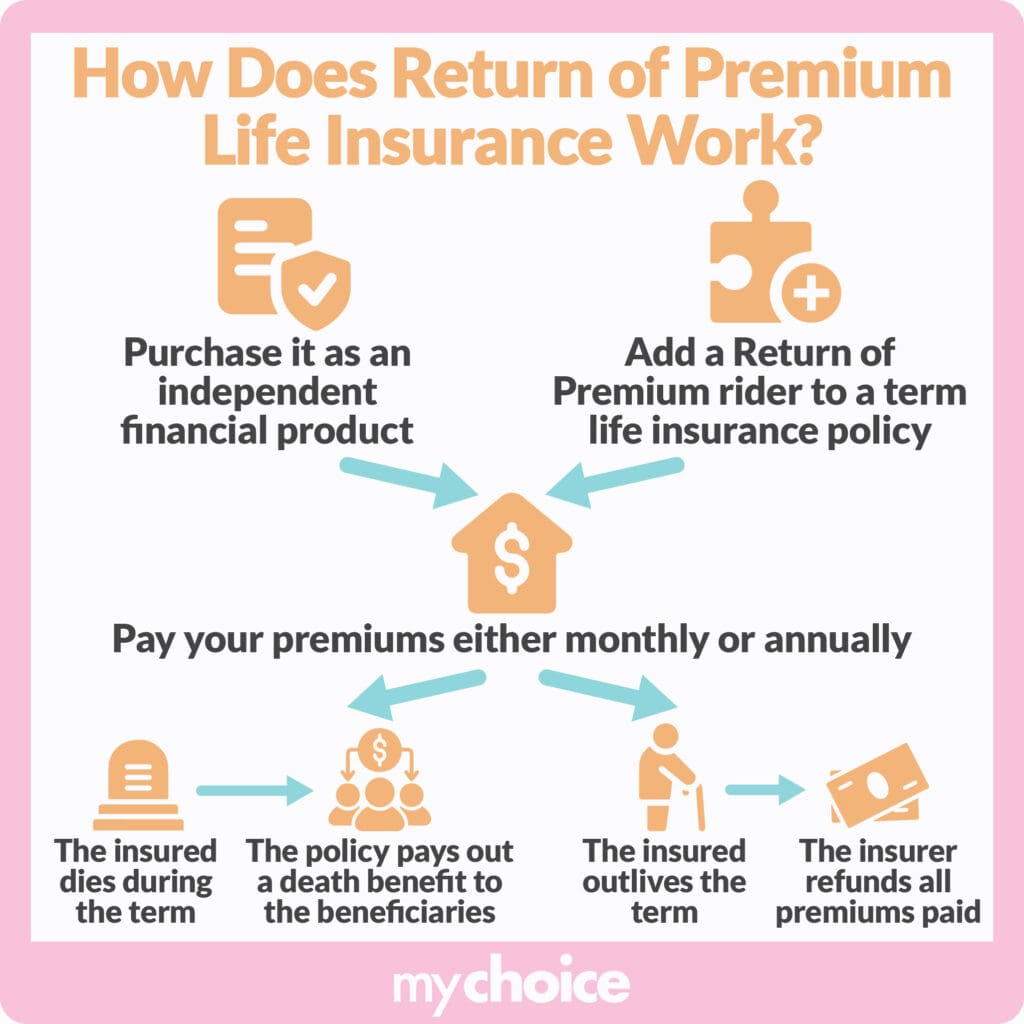

How Return of Premium Life Insurance Works

Most life insurance policies only pay out when the insured passes away. In contrast, return of premium insurance pays back all premiums if the policyholder survives the policy. Returned premiums are not subject to tax.

There are two main ways you can get a return of premium: through a standalone policy or as a policy rider. However, in Canada, you can only add it to a term life insurance policy or another rider, such as disability, critical illness, or accidental death.

When you receive the refund depends on the terms of your policy. Term life insurance typically provides coverage for 10-30 years.

When Do ROPs Pay Out?

Under a return of premium rider, insurers refund your premiums in the following scenarios:

- Return of Premium on Death (ROPD): If the policyholder dies while the policy is active, both the premiums paid and the death benefit to beneficiaries.

- Return of Premium on Expiry: If the policy ends without any claims, all premiums are refunded to the policyholder, free of tax.

- Return of premium on Surrender/Cancellation: Some insurers fully or partially refund premiums when the policyholder or policy reaches a certain age. For example, you could get back half of your premiums 20 years after getting the policy, with full refunds expected by age 65 or 75. This is in addition to any cash surrender value you’ve accumulated over the life of the policy.

How Much Do You Get Back With An ROP?

If you outlive a policy with a return of premium rider, you get back 100% of the premiums you’ve paid over the policy’s lifetime. For example, you get a 10-year return of premium critical illness insurance policy that costs $60/month. That translates to $7,200 returned to you at the end of 10 years.

Insurance companies do not pay interest on any premiums they return to you. Without accounting for inflation, the value of the returned premiums will be less than when you paid them.

Let’s take the example above. Assuming you got the policy in 2014, your $7,200 in refunded premiums will have a purchasing power of just over $5,600 in 2024.

How Much Do Return of Premium Riders Cost in Canada?

Because of the premium refund, ROPs tend to be more expensive than their term life counterparts by 2-3x. However, they’re usually more affordable than whole life insurance.

Keep in mind that premiums are paid monthly or annually and are calculated based on a variety of factors, such as coverage, term length, and the age, health, and medical history of the policyholder.

Is Return of Premium the Same as Return Premium?

No. “Return of premium” refers to insurance policies that pay back premiums at the end of their term. Meanwhile, “return premium” is the amount refunded to policyholders when they’re paying too much for coverage. This usually happens when a policyholder changes, cancels, or overpays their policy.

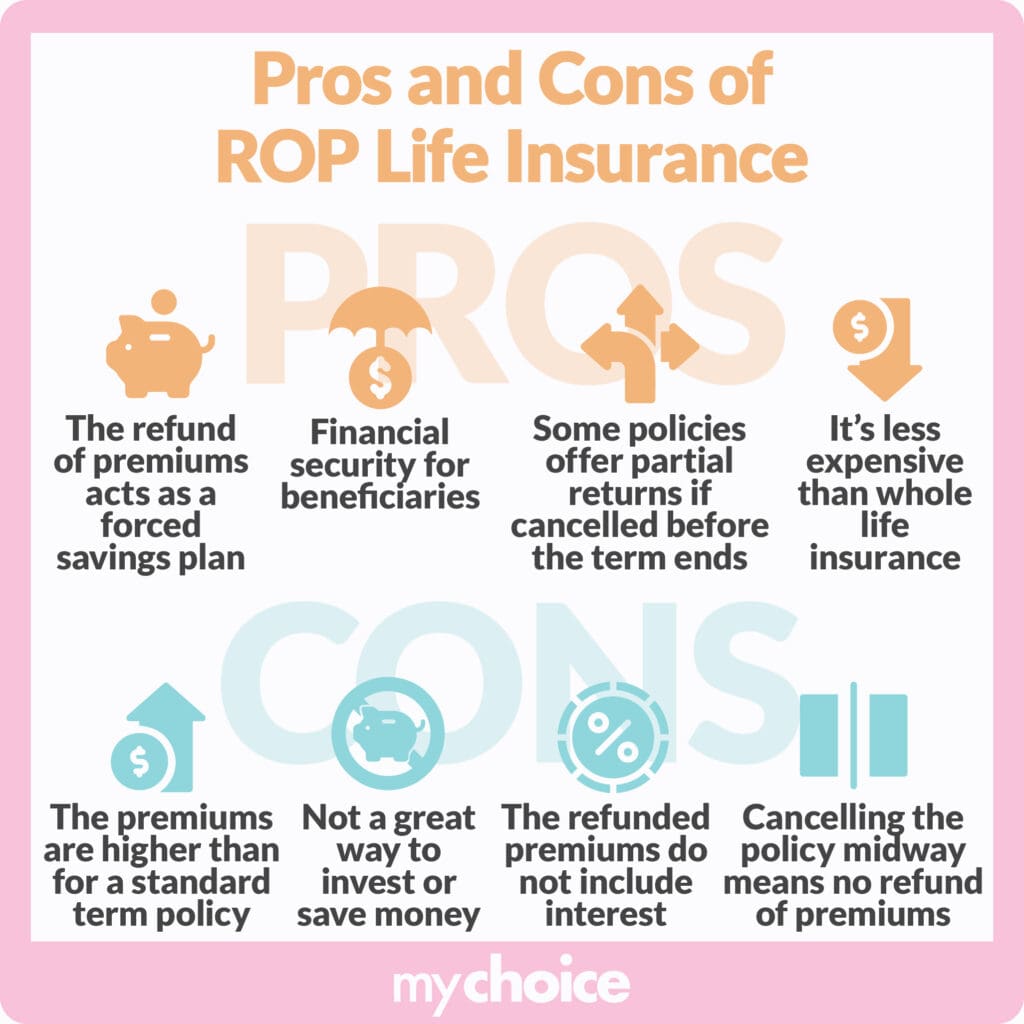

Benefits of ROPs

- ROPs return your money at a later date, acting as a “forced” savings plan.

- You’re protected while your policy is active and can still benefit when it isn’t.

- Policies with ROPs are often flexible, providing partial returns if you cancel them before they expire.

- Return of premium insurance is cheaper than whole life insurance products.

Drawbacks of ROPs

- Term policies with return of premium riders are 2-3x more expensive than comparative coverage without.

- There’s no interest accrual on premium refunds, so you lose value due to inflation.

- It’s less effective as a savings vehicle compared to other insurance products.

- Some insurers impose penalties on cancellation, providing only partial or even no refunds.

Risk Assessment: Is Return of Premium Life Insurance Worth It?

A common reason people choose return of premium insurance is to get their money back if they don’t use the policy. If you expect to outlive your benefits or cancel your policy before it expires, the more expensive ROP premiums could be worth it. After all, it’s better to get a partial refund than to completely surrender the policy and get nothing back.

That said, the higher costs may not make it a great financial decision for those who already struggle to meet payments. If your goal is to save (or even earn) money, you may want to take a look at other types of insurance policies that accumulate a cash value.

Key Advice From MyChoice

Now that we’ve learned more about return of premium life insurance, let’s take a look at some top tips:

- If you’re considering an ROP to “save” on premiums, check out permanent insurance instead. These policies grow a cash value that can eventually pay for all or part of your premiums while keeping you covered.

- Return of premium life insurance doesn’t accrue interest, and the cash value even decreases because of inflation. Maximize your money by purchasing a standard term policy and investing the difference in a higher-yield financial product.

- Every insurer has their own way of calculating premiums. To find cheaper return of premium insurance, shop around for rates on MyChoice.