In a nutshell, the cash surrender value of life insurance is the sum of money you receive if you forfeit, or “surrender”, a policy before its maturity date. Most people purchase life insurance policies primarily for the death benefit. Still, some plans may offer a few financial options that allow for a little more flexibility to deal with the ups and downs of life.

Sometimes, this can come in the form of a savings account or trust attached to your policy, a loan made against your plan’s total amount, or something more concrete like a bit of liquid cash if you no longer wish to maintain your insurance.

The Cash Surrender Value of Life Insurance at a Glance:

- Cash surrender value is the amount of money you’ll get from forfeiting your plan – though this is subject to cancellation fees and taxes.

- Not every plan has this option. Generally speaking, only permanent insurance plans can pay out upon surrender.

- Giving up your coverage can be a big step, so consider your situation closely before choosing to surrender.

Ready to learn more about the cash surrender value? Let’s dive in deeper together.

What Exactly is Cash Surrender Value?

As we mentioned earlier, the cash surrender value of a life insurance policy is the amount of money you receive if you give up on a plan before it’s completely mature. This value usually differs from a death benefit (which tends to be much larger) and scales instead with the actual value you’ve built in your policy over time given predetermined cancellation or surrender-related fees.

How it Works

Throughout your insurance plan’s life, you’ll be making regular payments for coverage – and this builds something called “cash value” over time in specific kinds of policies. Naturally, policies that haven’t been around for very long, like a couple of years, won’t hold too much value compared to a few decades down the road.

This is important to note because the amount you’ll receive upon surrendering a policy scales directly with the amount of money you’ve put into it, meaning it may not be the wisest move for a relatively new plan. But if you do decide to forfeit your plan, here’s what you can expect:

- Lump sum or periodic payment plans: Based on your plan, you generally have an option to receive your cash surrender value in lump sum or through periodic payments – though folks usually go the lump sum method to gain quick and easy liquidity when they need it most. Double check your policy to get the specifics for your situation.

- Tax-deferred payments: When you make payments toward a plan, the value held becomes tax-free as long as it’s contained within the policy. However, withdrawing or removing that cash value makes it subject to taxes, so keep this in mind when calculating how much you’ll get from surrendering.

How Your Cash Surrender Sum is Calculated

We touched on it a bit earlier, but the total cash surrender value of your policy does not equal the death benefit you were paying to maintain. Instead, your total sum is determined by a few things:

- Policy’s total cash value: Once you’ve started to accrue cash value in your plan, you can check the total balance with your insurer to get a good baseline for the amount you’ll receive. Again, this naturally builds over time and may sometimes be too small to make a real financial impact.

- Cancellation or surrender fees: Based on the contract you signed at the start of your coverage, the amount you withdraw will be subject to your provider’s cancellation or surrender fees. In some cases, this can be as large as 10%, but it really depends on your specific circumstances.

- Outstanding taxes: When receiving your cash-out from a policy surrender, you’ll pay a few taxes. You can contact a financial professional to get a better idea of state or city-specific taxes that you’ll need to consider.

- The type of policy: While most policies will pay out depending on your plan’s cash value, some types of insurance have a guaranteed cash value, which changes the playing field a little.

Which Policies Have a Cash Surrender Value?

Not all policies are made equal, and some plans don’t have a savings or value-building component at all. So before you consider surrendering your policy for the potential spoils, make sure you’ll be able to collect at all. Here are the plans that offer a sum if you surrender them.

Universal life insurance is a flexible kind of policy that builds cash value over time while also providing coverage for your entire life. On top of this, premiums can be paid on a sliding scale to match your current payment capacity, and this also applies to your potential surrender value – meaning you may get a little more or a little less depending on current market conditions.

Whole life insurance is, in a way, a boilerplate life insurance type that comes with stability and value-accruing components that make it an attractive option for folks who want something straightforward. Generally speaking, a whole life plan will accumulate value at a predetermined rate, though this can quickly skyrocket if you also have an investment component that accrues dividends.

As the name suggests, variable life insurance comes with a bit of risk and variation. This is due to its complex nature and capacity to be reinvested in subaccounts or even the stock market. As such, you have the potential to grow your cash value – and therefore your surrender sum – exponentially, but there’s also a risk of losing it all or at the very least shrinking it to a negligible amount.

Indexed universal life insurance is another complex type of plan with its value tied to an index like the S&P/TSX Smallcap. Because of this, the embedded cash value will shrink and balloon with the ebb and flow of the market, and your returns vary greatly with overall performance. As a result, you aren’t guaranteed any results but you also don’t have a ceiling for how much you can gain.

When Should I Consider Surrendering My Policy?

Life insurance policies are meant to protect and provide security for your family and loved ones long after you’re gone, so surrendering this safety net is a massive decision that needs to be weighed properly. However, sometimes the immediate benefit of a cash infusion can be life-changing. Here are a few scenarios when you may want to consider surrendering your policy:

- You need liquid cash right now: Life can sometimes throw lots of things at you very fast, and this may require lots of money on your end to deal with it. Significant hospital bills, emergency repairs, or any other sort of pressing financial issue may warrant surrendering your policy to help pay things down and keep you afloat.

- Life insurance is no longer necessary: The main reason people have life insurance is to provide for their loved ones, but when children grow older and become self-sufficient, they may no longer need that kind of cushioning. In this case, you could opt to surrender your policy and enjoy a bit of money.

Alternatives to Surrendering Your Plan

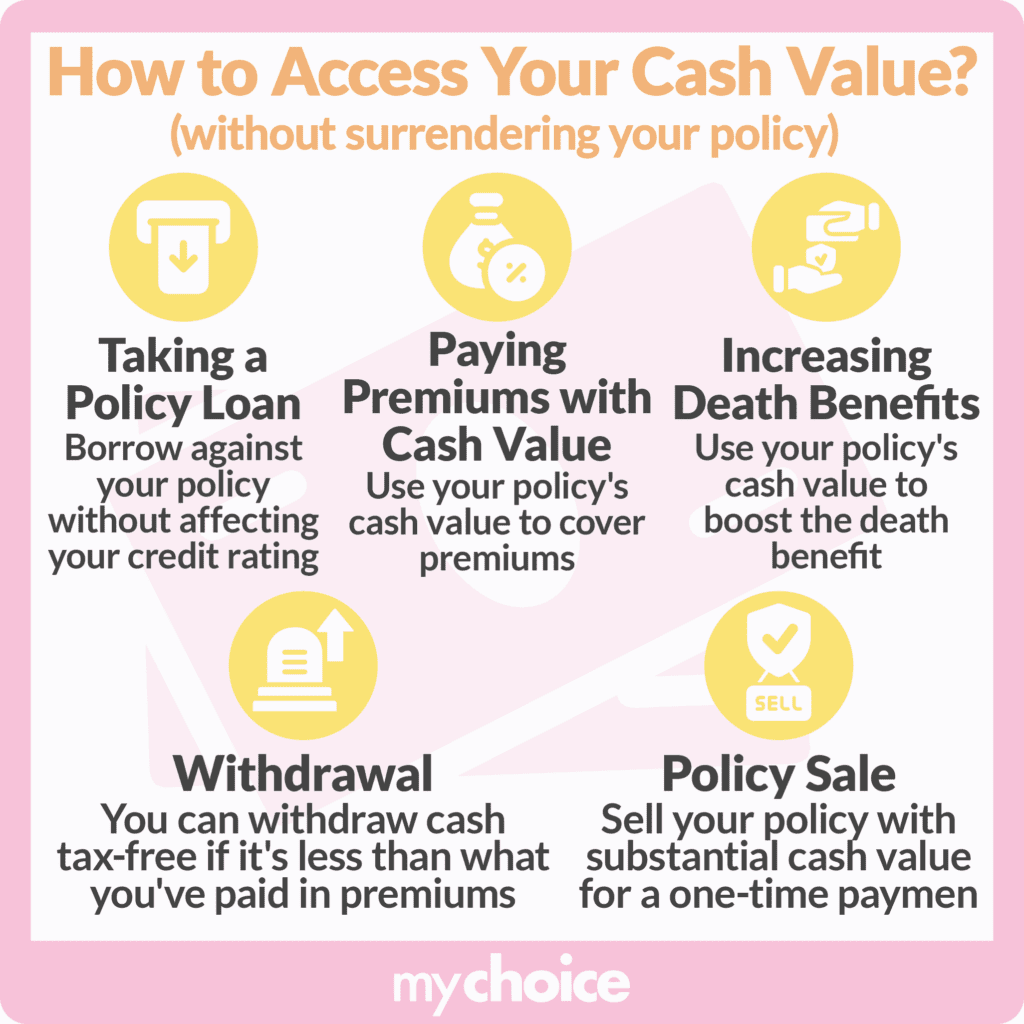

Generally speaking, folks tend to surrender their life insurance plans because there’s an urgent need for lots of money. However, there are a few alternatives to forfeiting your coverage altogether. Consider the following options before making any big decisions that could impact you long term:

- Make a smaller withdrawal instead: Some plans allow policyholders to withdraw from the total cash value while they’re still alive without having to pay it back. However, this is taken from the total death benefit, meaning your beneficiaries will only receive the remaining cash value. You can also work with your financial adviser to see exactly how this will impact your plan’s performance.

- Take a cash value loan: Rather than completely giving up your coverage and receiving the surrender sum, you could opt to borrow money that’s worth slightly less than your policy to maintain your death benefit. In some cases, this could be up to 95% of the plan’s total amount, making it a viable option for folks with a plan. Please note, however, that you will need to repay this loan with interest.

- Re-route your cash value into premiums: In the event you struggle with paying premiums either due to change in circumstance or income, you may be able to borrow a little bit of money from your plan to pay off future premiums.

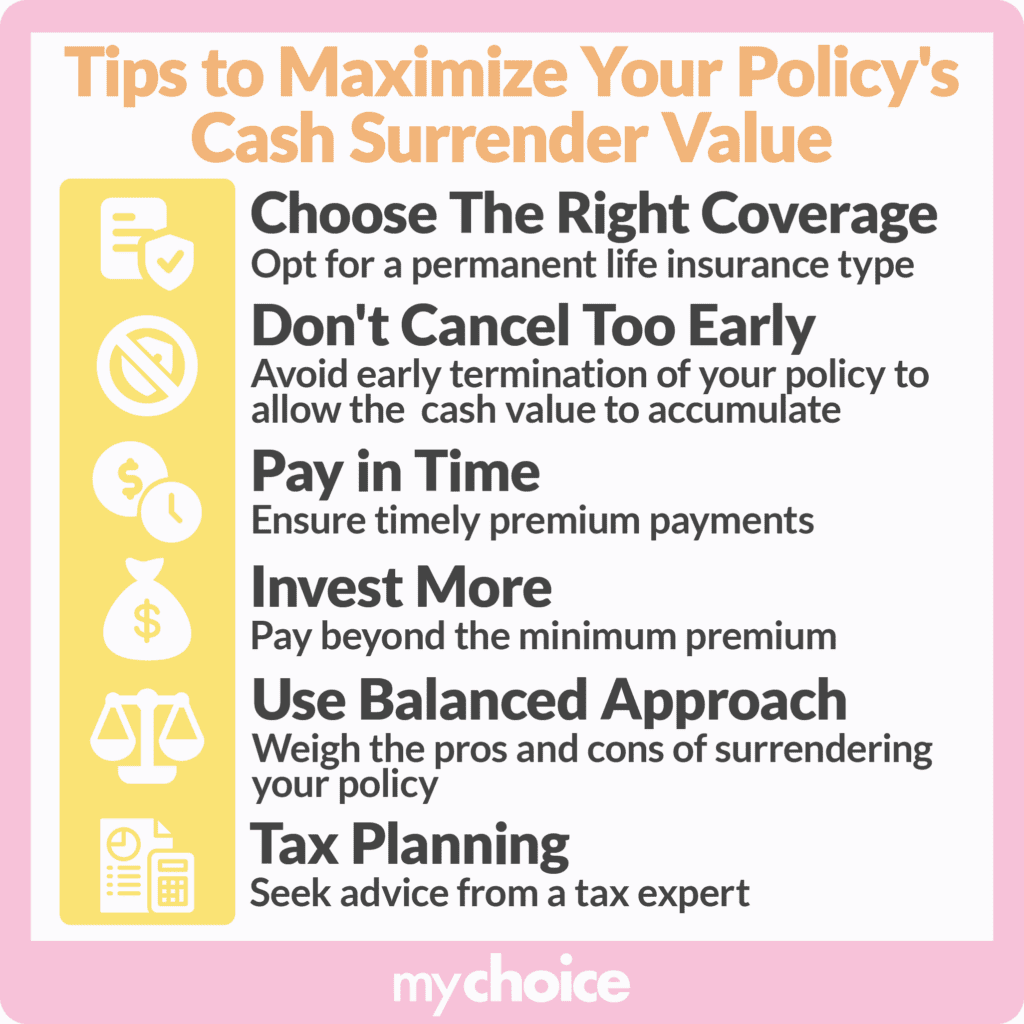

Key Advice From MyChoice

- The cash surrender value of your insurance plan can be a great boon for folks who need a bit of money quickly, but this can come at the cost of coverage and protection for your family.

- Surrender sums can be paid out in lump sum or periodically, but this mostly depends on your provider.

- While forfeiting can seem like a good idea when facing a large problem, there are alternatives that maintain your coverage while also getting you the cash infusion you require.

- Consider all your options and weigh the pros and cons before making any decisions!