Life insurance is a crucial financial safety net, ensuring your loved ones remain financially secure even after you’re gone. Understanding the tax implications of life insurance can be complex. This article delves into the specifics of whether life insurance premiums are tax deductible in Canada. If you’re seeking clarity on this topic, read on for a comprehensive overview.

Understanding Life Insurance

Before we delve into the tax intricacies, let’s understand life insurance at its core. Life insurance is a contract between an individual and an insurance company. In exchange for regular payments, known as premiums, the insurance company promises to pay a lump sum to the beneficiaries upon the insured person’s death. Sounds simple, right? But things can get a bit more complicated when tax season rolls around.

Tax Contributions of Canadian Life and Health Insurers

Canadian life and health insurers play a significant role in the country’s economy by providing essential financial protection and contributing substantially to the nation’s tax base.

In 2020, these insurers contributed over $8.2 billion in taxes. This amount was distributed between the federal government, which received $2.7 billion, and provincial/territorial governments, which were allocated $5.5 billion. Out of the total tax contributions, insurers directly bore $4.3 billion, while $3.9 billion was collected from customers and employees and then paid to the respective governments.

Such substantial tax contributions underscore the industry’s commitment to supporting the nation’s financial infrastructure and highlight the importance of understanding the tax implications associated with insurance products.

Is Life Insurance Tax Deductible in Canada?

For individuals, life insurance premiums are generally not tax deductible. If you’re paying premiums for your personal life insurance policy, you can’t claim these costs on your income tax return. But wait, there’s a twist!

If you’re a business owner and pay life insurance premiums on your employees’ behalf, these expenses may be deductible. This is especially true if you offer life insurance as part of an employee benefits package. However, there are certain conditions to meet:

- The life insurance should be part of the employee benefits package.

- Neither the company nor any business owner should benefit from the life insurance policy.

According to the Canada Revenue Agency, in most cases, life insurance premiums are not deductible. However, in case the above conditions are met, and you pay the premiums regularly without any discrimination based on gender or age, you can potentially write off the entire cost from your income tax.

Why Isn’t Life Insurance Always Deductible?

Life insurance premiums are typically viewed as personal expenses. Hence, they don’t qualify for tax deductions. Moreover, in most scenarios, the death benefits received from a life insurance policy are not taxable. This means that if you’re named as a beneficiary in someone’s life insurance policy, and you receive a payout after their death, this money is usually tax-free.

Exceptions and Considerations

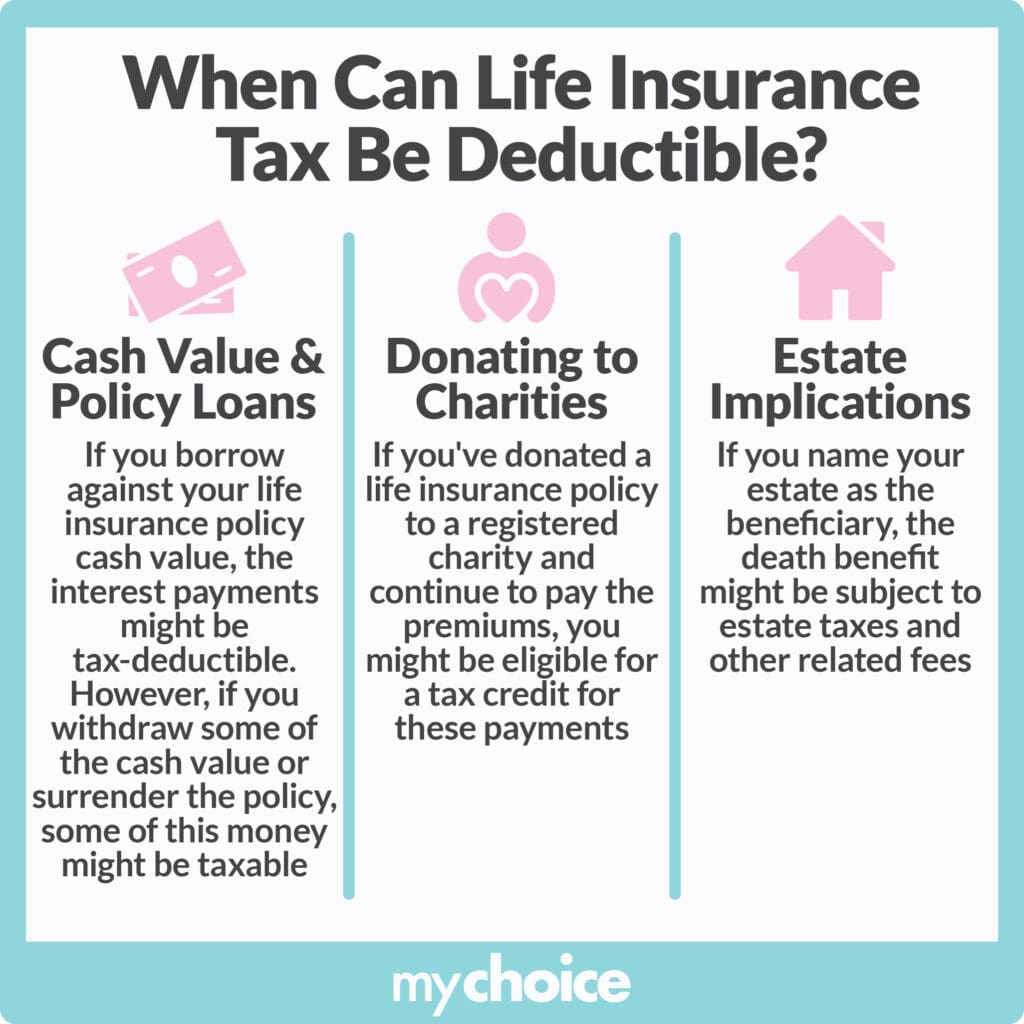

- Cash Value & Policy Loans: Some life insurance policies, like whole life or universal life, can build up a cash value of your life insurance policy over time. If you borrow against this cash value, the interest payments might be tax-deductible if the loan is used to earn income from a business or property. However, if you withdraw some of the cash value or surrender the policy, some of this money might be taxable.

- Donating to Charities: If you’ve donated a life insurance policy to a registered charity and continue to pay the premiums, you might be eligible for a tax credit for these payments.

- Estate Implications: If you name your estate as the beneficiary, the death benefit might be subject to estate taxes and other related fees. It’s always a good idea to consult with a tax professional to understand the implications fully.

Final Thoughts

Navigating the world of life insurance and taxes can be a bit daunting. While life insurance premiums are not typically tax deductible for individuals, there are exceptions, especially for business owners. It’s essential to be informed and consult with tax professionals to ensure you make the best financial decisions.

Remember, life insurance is more than just a tax consideration. It’s about securing the financial future of your loved ones. So, while it’s essential to understand the tax implications, the primary focus should always be on the protection and peace of mind that life insurance offers.