Life insurance can provide your loved ones financial security when you pass away, so they can cover costs like living expenses while they regain their footing. But if you want more control over how your life insurance payout is distributed to your loved ones and when, consider getting a life insurance trust.

Life Insurance Trusts at a Glance

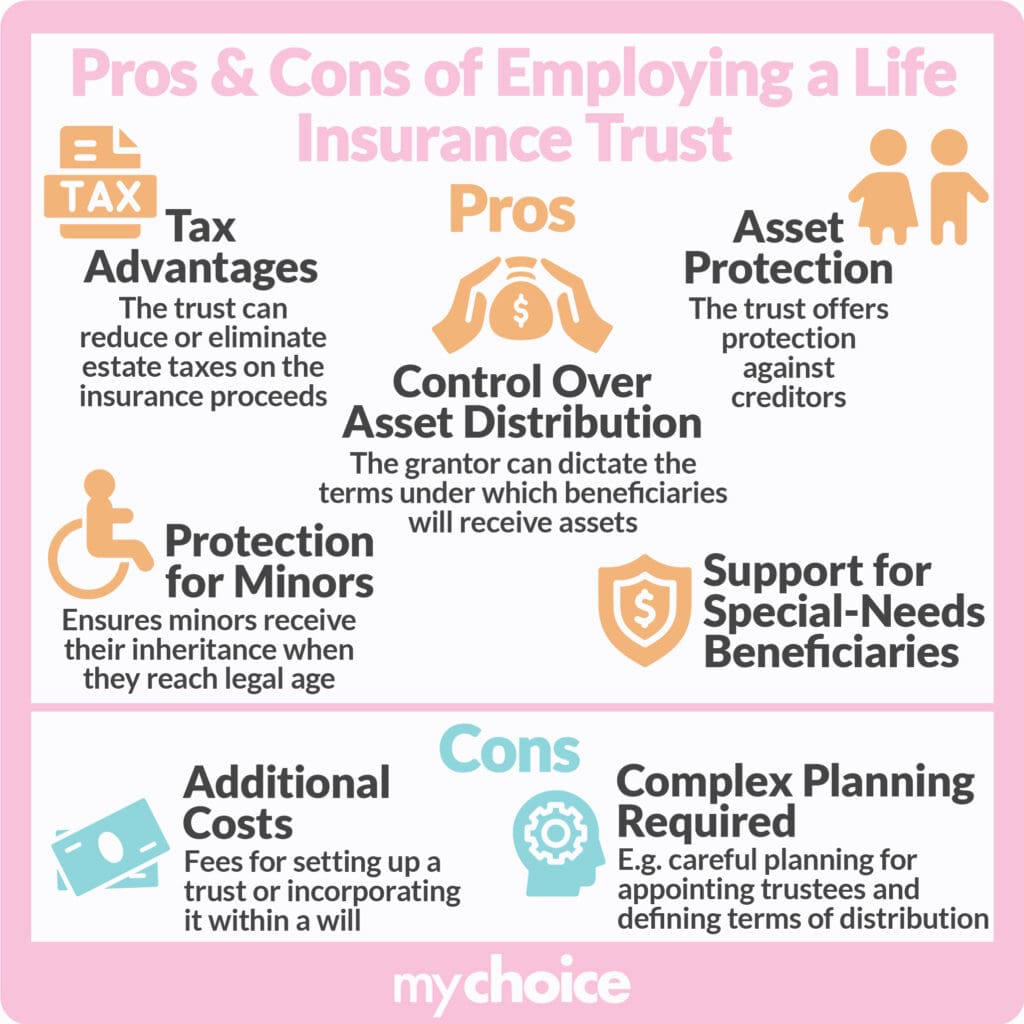

- A life insurance trust allows you to reduce taxes, control when and how beneficiaries receive death benefits, and protect your assets from creditors.

- However, a life insurance trust is also complicated to set up and has additional costs like legal fees.

- Set up a life insurance trust if you want control over how your policy is distributed, or if you have a large estate that you want to protect from taxes and creditors.

Below, we explain why you should use a life insurance trust and compare it to other estate planning tools to help you prepare for the future.

What Is a Life Insurance Trust?

A life insurance trust lets the owner of a life insurance policy plan when and how their policy’s proceeds are distributed. When you establish a life insurance trust, the trust becomes the owner of the policy and the policy’s proceeds will be given out according to the terms of your trust agreement.

There are three parties in a life insurance trust:

- The beneficiaries: These are the people who will receive the proceeds of a life insurance policy under the terms of a trust.

- The grantor: This person holds the life insurance policy and is using it to fund the trust. The grantor names the trustee and dictates when and how life insurance policy proceeds will be distributed to their beneficiaries.

- The trustee: A life insurance trustee manages a trust’s assets (such as your policy) according to the terms of the trust before distributing them to beneficiaries.

Irrevocable vs Revocable Trusts

There are two kinds of trusts you can set up: irrevocable and revocable trusts. In both types, your assets are placed within it for distribution upon your death.

However, these types have distinct differences. Here’s how they work:

In a revocable life insurance trust, the grantor keeps control even when the trust has become the legal owner of the life insurance policy. Revocable trusts are more flexible, allowing you to change their terms or cancel the trust during your lifetime.

Because you’re still the owner of the policy under the trust, your life insurance policy will be included in your estate.

Consider getting a revocable life insurance trust if you:

- Want the power to change the terms of your trust at any time

- Have no unpaid debts and so don’t need to protect your estate from creditors

An irrevocable life insurance trust can’t be changed or cancelled once a grantor sets it up. If you’re putting a permanent life insurance plan into this type of trust, you lose access to its cash value. But because your policy is now owned by the trust, it’s protected from your estate’s tax liability and your creditors.

Get an irrevocable life insurance trust if you:

- Can sacrifice financial flexibility so your beneficiaries get a larger sum

- Want to reduce estate taxes

- Plan to keep your policy’s proceeds away from creditors

How Do I Set Up a Life Insurance Trust in Canada?

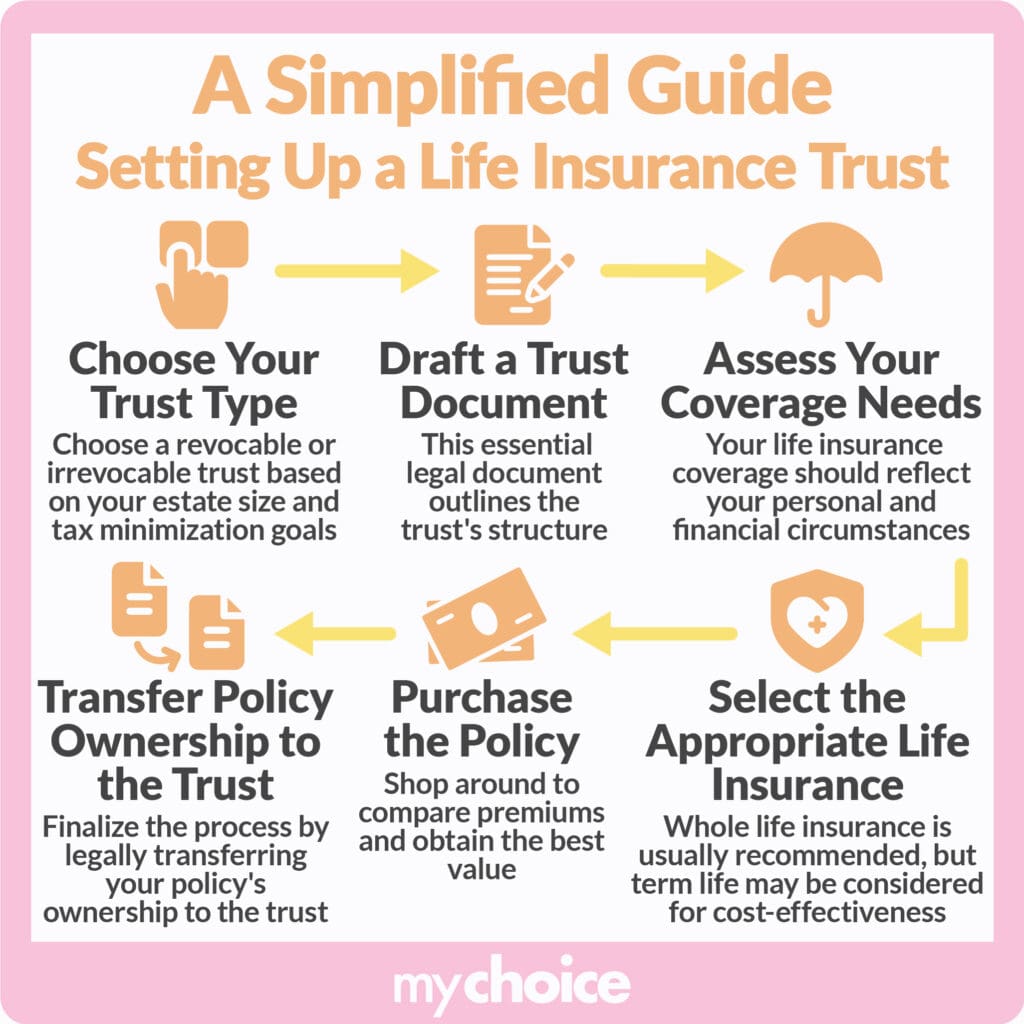

Follow this step-by-step guide to establishing a life insurance trust in Canada:

- Choose what type of trust to set up: Choose between a revocable or irrevocable trust. Generally, you should choose an irrevocable trust to reduce estate taxes if you have a large estate.

- Create your trust document: A trust document is legally binding and sets out the structure of your trust, including the grantor, trustee/s, beneficiaries, and instructions for distribution.

- Think about how much coverage you’ll need and what type: Deciding between whole vs. term life insurance? Whole life insurance is typically best because it doesn’t expire and has guaranteed benefits. If you have a lot of financial responsibilities and a limited budget, term life insurance may be more cost-effective.

- Buy the life insurance policy: Rates vary wildly between different companies. Shop and compare premiums between different providers using MyChoice.ca to find the best deal.

- Transfer ownership of the policy: Consult an estate attorney to transfer policy ownership and ensure that your trust fulfills all legal requirements. After the transfer, the trust will be responsible for managing your policy, paying premiums, and distributing proceeds.

Why Should I Use Life Insurance Trusts?

Many people use life insurance trusts to protect their dependents’ financial security and control how they receive benefits. Here’s why you should use a life insurance trust:

Tax Advantages

By putting your policy in a trust, you make the trust the owner and keep it from being taxed along with the rest of your estate. Reducing or even eliminating this tax liability ensures that your beneficiaries will receive a larger lump sum.

Control Over Distribution

You may want your beneficiaries to receive their share according to specific terms like when they achieve or reach milestones such as buying their first home or getting married. As long as the conditions comply with Canadian law, you can decide exactly how and when your beneficiaries receive their inheritance.

Asset Protection

When you die, your estate will be used to settle any amounts you owe to creditors. If your life insurance policy isn’t part of a trust, a creditor might file a claim over it to pay your debts.

But if you set up a life insurance trust, your policy is owned by the trust. Because it’s separate from your estate, it won’t be eaten up by debts and will go directly to your loved ones.

Protection for Minors

Children under 18 can’t receive control over death benefits. If you name your minor children as beneficiaries in your life insurance policy without establishing a trust, their share of your policy’s proceeds may be held by the province or territory until they turn 18 years old.

With a life insurance trust, your policy’s payout will be held by the trust and given to minor beneficiaries when they reach the age of majority.

What Are the Cons of Life Insurance Trusts?

The cons of life insurance trusts are that they can be costly to set up and administer, and they require careful planning. Here’s a brief explanation of these drawbacks:

Additional Costs

If you’re creating a life insurance trust agreement, prepare for additional legal and administrative costs. Whether you’re planning to set up a life insurance trust within a will or a separate trust, you’ll have to spend for legal assistance.

Complex Planning

A life insurance trust needs methodical planning for distribution. These are just some of the factors you’ll need to take into consideration:

- When and how proceeds will be distributed

- Who will be the beneficiaries

- Who to appoint as a trustee

Life Insurance Trusts vs Other Estate Planning Tools

There are other ways you can plan your estate and the distribution of your policy proceeds and other assets. Some of the most common estate planning tools are:

Taking out a life insurance policy without creating a trust can still ease the financial burden on your loved ones’ shoulders. If creating a trust is too costly and you only plan to leave your policy proceeds to one or very few beneficiaries (such as your spouse), simply getting a life insurance policy is worth it for planning your estate.

However, if you have many beneficiaries or want to create conditions for distributing your policy proceeds, a trust is the better option. Further, a trust is a must if you plan to make a minor your beneficiary.

In a will, you name beneficiaries who will receive money, items, and other things that make up your estate. Beneficiaries of wills can include people outside of your immediate family circle such as friends or cousins.

To find out if a will is valid, it undergoes a process called probate. During probate, the executor gives all beneficiaries a copy of the will and ensures equal, fair treatment according to the wishes of the one who passed away.

While a will is useful for distributing everything you own (and not just your life insurance policy) to specific beneficiaries under set conditions, there is one big drawback: the loss of privacy. Probate proceedings are a matter of public record, and some families may prefer to keep their personal business away from prying eyes.

There may be times when you are incapacitated which will not trigger a claim under your life insurance policy. To protect your assets, you may want to grant power of attorney (POA). Through this, a person is assigned as attorney-in-fact and can manage assets according to the POA’s conditions.

An attorney-in-fact can only do what is set out in the POA – if a power such as granting donations isn’t listed there, they’re legally barred from doing it. This is useful for managing your assets in case you are incapacitated, but it can be tricky to assign someone with enough experience or knowledge.

How to Set Up a Life Insurance Trust

The below infographic should guide you and be a useful point of reference should you chose to set up a life insurance trust.

Key Advice from MyChoice

Now that we’ve gone through what life insurance trusts are and compared them to other estate planning tools, here are some top tips from MyChoice:

- A life insurance trust gives you control over how and when the proceeds of your policy will be distributed.

- Setting up a life insurance trust can protect your policy’s proceeds from creditors and estate tax.

- If you want to name a minor as a beneficiary, set up a life insurance trust.

- A life insurance trust has additional costs and needs careful planning. It may not be worth it if the expenses are too big and you only have a few beneficiaries. Learn more about life insurance and trusts by reading our full articles on MyChoice.ca.