The time between your life insurance claim and receiving a life insurance payout can vary depending on the insurer and the circumstances of the policyholder’s death. But generally, life insurance pays out between 14 and 60 days after you make the claim.

Life Insurance Payouts at a Glance

- The average life insurance payout period is 14 to 60 days after the insurer receives the claim.

- The duration between claim and payout can differ due to factors like the circumstances of the policyholder’s death.

- The death benefit payment may be delayed due to reasons like misrepresentation, policy lapses, and the policyholder dying from a non-covered cause.

Learning more about the life insurance claims process first is a good idea to ensure it goes smoothly. Keep reading for our guide to the life insurance claims process and how to deal with issues you may encounter.

Claiming a Life Insurance Payout in Canada

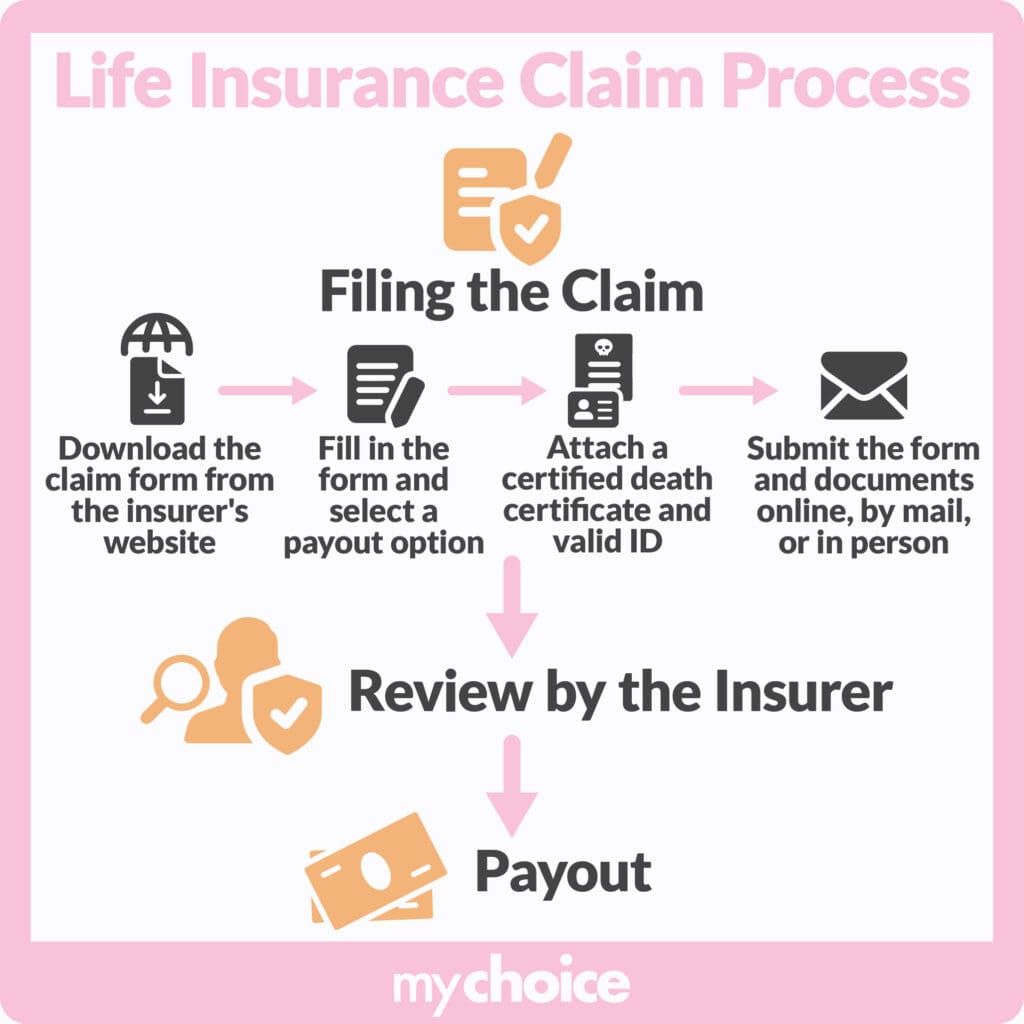

While the claims process details may differ slightly between insurers, the general steps are similar. Here’s a step-by-step guide to making a life insurance claim according to the Government of Canada:

- Before making your claim, check whether the insurance company covers the policyholder’s cause of death and how long you have to submit the insurance claim.

- Contact the insurance agent or company.

- Provide the required documents, such as the deceased’s death certificate.

- You can receive the death benefit payout if the insurance company approves your claim.

If you want to claim an old or lost life insurance policy, you need to find the document first. You can ask the OmbudService for Life and Health Insurance (OLHI) for assistance with finding the policy.

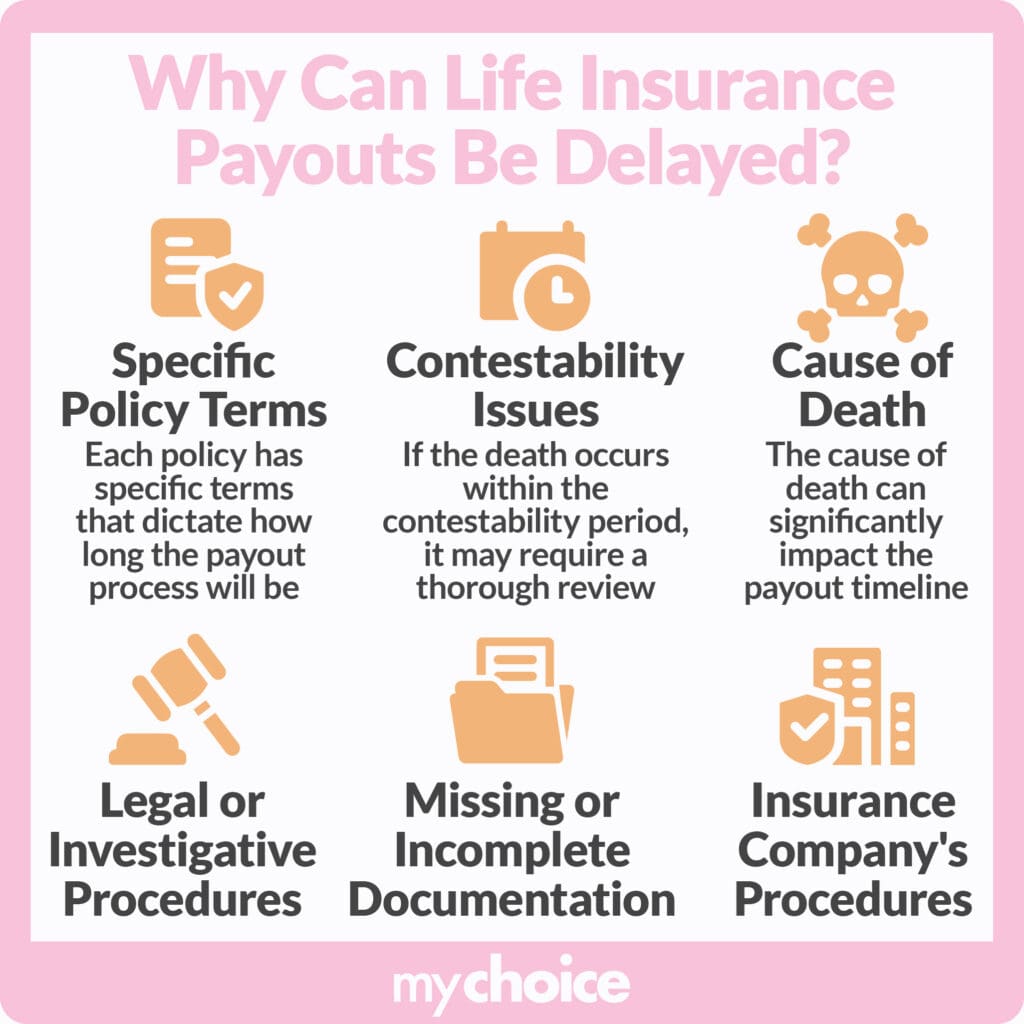

Why Your Claim Might Be Rejected or Delayed

Life insurance claims aren’t 100% guaranteed to get paid out. Insurance companies will examine your claim to ensure everything is in order before they can pay death benefits. So, several things may result in a claim rejection or delay.

Let’s take a look at what factors may hamper your insurance claims process and how you can avoid these issues in your life insurance policy:

- Misrepresentation: Missing or incorrect details on a policy, whether done knowingly or not, can be a reason for insurers to deny a claim. That’s why ensuring you have all the correct details available before filling out your policy is important.

- Policy lapse: Lapsed policies are one of the more common reasons for claims delays or rejections. Generally, life insurance policies lapse because they haven’t been paid. So, keeping your policy paid is essential to ensure it won’t lapse when you pass away.

- Deaths due to excluded causes: A life insurance policy may have exclusions, which are death circumstances that aren’t covered. Common exclusions include suicide, certain diseases, and dangerous activities. Check your policy and discuss these exclusions with the insurer before agreeing to sign it to ensure you aren’t excluded for causes of death from which you want to be covered.

- Deaths before the waiting period ends: Depending on the insurance company, there may be a two to three-year waiting period where if the policyholder dies, the death benefit won’t be paid out. Instead, their beneficiaries will only receive a premium refund. Getting insured early is the best way to ensure the waiting period is over before you pass away. Age also affects life insurance rates, so getting insured earlier may land you cheaper premiums.

- Insurance fraud: Attempts at insurance fraud, like lying about the cause of death, are generally grounds for claim denial. Therefore, you shouldn’t try to commit insurance fraud.

Dealing With Claim Disputes or Delays

You’re not powerless if your life insurance claim is denied or delayed. You can try addressing the dispute to resolve the issue.

Here are the four steps to addressing insurance disputes:

- Talk to your insurance agent or representative: The first step is to discuss your claim denial or delay with the agent. Ask them detailed questions about why your claim was denied, and record everything said during this conversation. You should also record the name of the agent or representative that you spoke to.

- Speak with the insurer’s ombudsman: If your issue persists, ask your insurer for their ombudsman’s contact information. When talking to the ombudsman representative, provide all the essential information and documentation, including the record of your earlier conversation.

- Ask the General Insurance OmbudService (GIO): If talking with the insurer’s ombudsman still doesn’t resolve your issue, request a final position letter from your insurer and get in touch with GIO. GIO is an independent dispute-resolution system for insurance, staffed by licenced insurers.

- Contact your Superintendent of Insurance: If your insurance dispute still isn’t solved, you should contact your province or territory’s Superintendent of Insurance.

Speeding Up the Claims Process

Life insurance payouts taking a long time to process can hamper your family’s financial stability, especially if the deceased was a breadwinner. If you or a loved one still has an active life insurance policy, here are some top tips to ensure the eventual insurance claim goes smoothly:

Be Honest to the Insurer

Misrepresentation or putting down false information on your policy can seriously hamper your chances of getting a claim paid out on time. Misrepresentation can happen intentionally or unintentionally, so ensure all your information is accurate before writing it down on your policy.

Tell Your Beneficiaries About Your Documents

One factor that can delay starting the claims process is missing documents. To ensure your loved ones can make a claim as soon as possible after you pass away, place essential documents like insurance policy papers, hospital records, and personal identification somewhere safe and tell them how to access them.

Keep the Policy Active

While most insurance policies have grace periods that keep the protection active after the due date passes, it’s still a very good idea to keep your policy active by paying on time. Keeping your policy active means your beneficiaries won’t have to deal with a lapsed policy if you pass away unexpectedly.

Key Advice From MyChoice

Now that we’ve learned more about life insurance payment periods and what factors can influence the payment period, here are some of our top tips:

- Generally, life insurance pays out between 14 and 60 days after making the claim.

- Claims may be delayed or denied due to factors like misrepresentation and fraud.

- Being honest in your policy and keeping it active can help your beneficiaries speed up your insurance claims process.