Mental health awareness has been on the rise in the past decade, with a 2022 study finding that over 5 million Canadians aged 15 and older met the diagnostic criteria for a mood, anxiety, or substance use disorder. With more diagnoses and a greater demand to address mental health care needs, it’s key for everyone to know how mental health and suicide affect life insurance policies.

Life Insurance and Suicide at a Glance

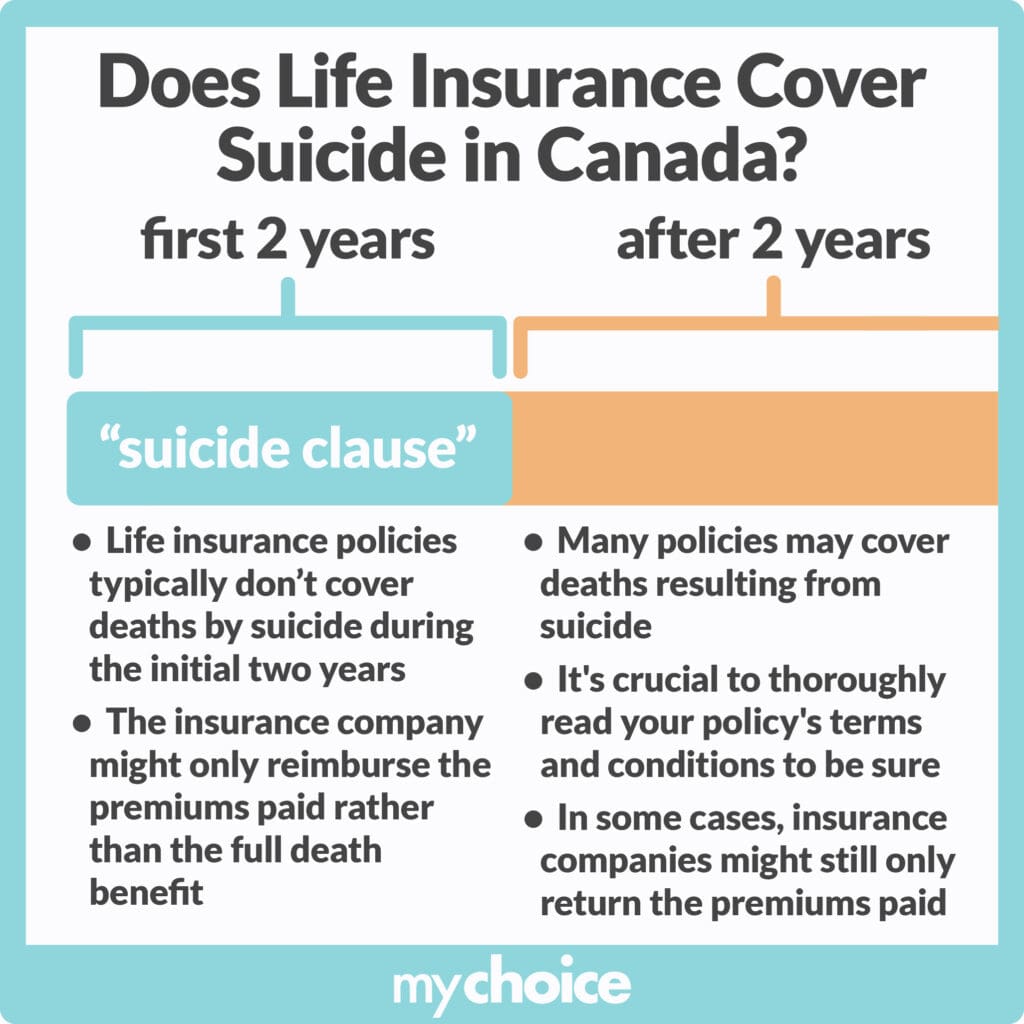

- Many life insurance companies won’t pay out death benefits if the policyholder dies by suicide within the “suicide clause” period, which is usually the first two years of the policy.

- In some cases, an insurer will only return the premiums that were paid even if the policyholder dies by suicide after the clause period has passed.

- Those who have trouble qualifying for traditional life insurance can still get coverage through simplified or guaranteed issue life insurance.

If you’re dealing with a mental health illness, you may be wondering about coverage options and what is usually included in life insurance policies. Read on to find out how suicide affects a life insurance claim, how mental health illnesses impact premiums, and what alternatives you can choose from to get coverage.

Suicide Clause Explained

A suicide clause is a provision in life insurance policies that states how claims will be handled in the event a policyholder dies by suicide. It typically has a waiting period of two years from the policy’s start date, where the insurer won’t pay out the death benefit if the policyholder dies by suicide during this period. Instead, the insurer returns the full value of all premiums paid so far, sometimes with a small amount of interest.

After that two-year period has passed, the life insurance provider will typically honor the policy and the full death benefit is payable to the beneficiaries. Others, however, may still specifically state in a policy’s terms and conditions that they’ll only return the premiums that were paid. Check your policy’s terms to find out more about your coverage.

Note that there may be special circumstances where denial of a claim on a policy held for less than two years can be challenged in court by the family of a policyholder who died by suicide. Consult a lawyer to learn more about what happens in this situation.

How Do Mental Health Conditions Affect Life Insurance Quotes?

Having a mental health illness can increase your life insurance premiums, just like having other conditions like diabetes or high blood pressure. Depending on the severity of the mental health condition, you may be asked to provide more medical records, go through a more detailed application process, or be offered higher quotes to get coverage.

The cost of insuring an applicant with a mental health illness increases because of these factors that increase the risk of insuring them:

- Severity of the diagnosis

- Having multiple mental health illnesses

- History of hospitalizations

- Symptoms that affect daily life

- Current treatment plan, including therapy and any prescription medications

Different life insurers will have different underwriting processes, and some may offer lower quotes even with the same conditions and factors. Shop around and compare quotes using MyChoice to see who provides the most affordable coverage.

Can I Be Denied Life Insurance Because of My Mental Health Illness?

Unfortunately, you can be denied life insurance by some Canadian insurers because of a mental health illness. Life insurance companies consider different factors to assess risk and determine how much coverage to give, such as age, occupation, and lifestyle. One of these factors is mental health, and some companies may consider those with mental health conditions as higher-risk applicants.

In some cases, this will result in an approved application but with higher premiums. However, some insurance companies may deny an application for traditional life insurance altogether. If your application was denied, look into alternative forms of coverage provided by trusted life insurance providers in your area.

How Do I Get Coverage if My Life Insurance Application Was Denied?

There’s always a chance that a life insurance application can be denied for different reasons, such as gender or a family history of certain diseases. However, there are great alternatives to traditional life insurance that still provide coverage and financial security for your dependents in the future. Here’s a quick overview of each:

A simplified life insurance policy offers coverage without undergoing a medical examination. Instead, applicants fill out a questionnaire with basic information about their medical history to qualify for coverage. Simplified life insurance can be permanent or term with coverage terms lasting anywhere from 5 to 25 years. Compare life insurance products online to see which providers offer this coverage type in your area and which company has the most affordable rate.

Guaranteed issue life insurance is a type of life insurance policy that provides coverage without undergoing a medical examination or answering a health-related questionnaire. Its premiums are typically higher, but because its application process is less rigorous, it’s a convenient option for people with pre-existing conditions or other factors that make it hard to qualify for traditional life insurance.

Key Advice from MyChoice

- Most life insurance policies have a suicide clause where they don’t pay death benefits if the policyholder dies within the first two years of the policy.

- Having a mental health illness may increase your life insurance quotes, but companies have different underwriting processes and will differ in the amount of coverage they offer. Shop and compare to find the best deal for life insurance.

- It’s important to be transparent about any health conditions you have during the life insurance application process, including mental health issues. Not only does this ensure that you get the appropriate coverage, but concealment of pre-existing conditions may cause your policy to be voided.

- If you’ve been denied traditional life insurance because of your mental health illness or condition, consider getting simplified life insurance or guaranteed issue life insurance for coverage.