Canada’s opioid crisis may be stabilizing, but it is far from over. For life insurers, its impact is still developing.

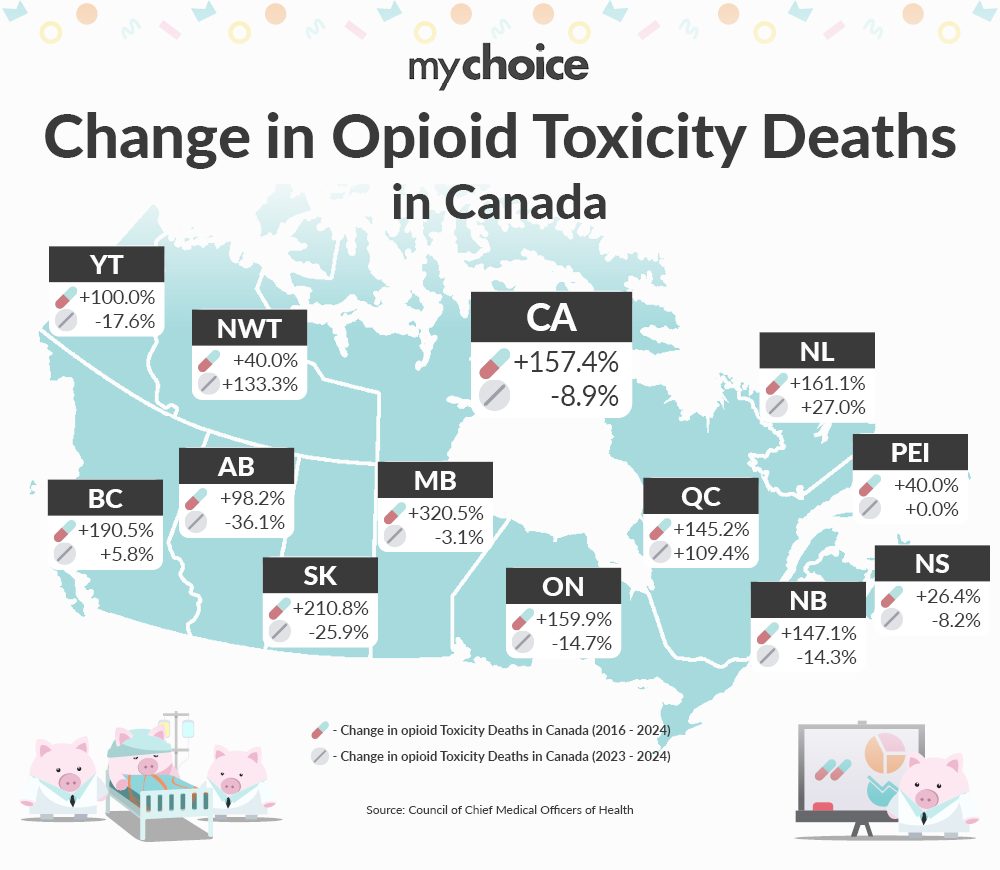

According to national data from the Council of Chief Medical Officers of Health, opioid toxicity deaths decreased by 8.9% in 2024 compared to 2023. While this decline appears significant, about 20 people still die from overdoses each day. This is roughly 2.5 times higher than when the public health emergency was declared in 2016.

For the life insurance industry, this is not a return to normal. Instead, it means risk has stabilized at a higher level.

Which Demographics Are Most at Risk?

About 70% of all opioid-related deaths happen among Canadians under the age of 50. The highest concentration is among those aged 30 to 39. Men account for 72% to 76% of all opioid toxicity deaths.

This group is central for life insurers. People in their 30s and 40s are key holders of term life insurance, mortgage protection, and income replacement coverage. When mortality risk rises in this age group, underwriting models are affected.

The Impact of the Opioid Crisis on Life Expectancy

Changes to life expectancy impact how life insurance companies reevaluate their underwriting risk. While general mortality improvements continue for chronic conditions like cancer and cardiovascular disease, the accidental-death category has seen increased mortality rates.

The surge in opioid deaths slowed life expectancy gains for Canadian men aged 20 to 44. Between 2016 and 2017, life expectancy for Canadian men stalled for the first time in decades, a shift widely linked to overdose mortality, especially in British Columbia and Alberta.

Can I Apply for Life Insurance if I Have an Opioid Addiction?

Applicants with active opioid addiction face significant barriers to traditional life insurance coverage. Most Canadian insurers decline applications involving illicit drug use within the past 12 to 24 months, even if the use was limited.

Underwriting scrutiny in these cases is more intense. The history of substance abuse triggers a detailed medical review, prescription checks, and often postponement rather than immediate approval.

Guaranteed issue and simplified issue policies are available for those who do not want to do a medical exam, offering smaller coverage amounts. The trade-off is higher premiums and lower coverage limits.

What if I’m Currently in Recovery?

For individuals in stable recovery, insurers typically require proof of sobriety before moving on with the application. Three or more years of verified sobriety may allow access to standard or slightly pricier policies, depending on the insurer and the applicant’s overall health profile.

Applications usually involve:

- Medical exams

- Blood and urine toxicology screening

- Review of Attending Physician Statements (APS)

- Prescription monitoring

- Evaluation of any secondary organ damage or related mental health conditions

Eligibility Timelines and Sobriety Windows

Standard underwriting practices in Canada typically decline or postpone applications from individuals who have used illicit drugs within the last 12 to 24 months. The timeline for reconsideration varies significantly by the type of substance and the frequency of use.

For example, a one-time use of a narcotic three years ago may result in a higher premium, while a frequent or ongoing use history leads to an automatic decline for traditional products.

Key Advice from MyChoice

- Read the fine print when purchasing AD&D policies. These types of policies often define “accidental death” very narrowly and contain specific exclusions for “voluntary ingestion” of drugs or “criminal acts”.

- Disclose your full medical history. Material misrepresentation remains one of the most common reasons for claim denial in Canada.

- Wait for sobriety milestones to get better rates. If you are in recovery, the timing of your application significantly impacts your premium.