In 2022, Canada recorded 993 workplace deaths. While you can’t always predict when an accident will happen, there are things you can do to ensure you and your family have a safety net in the face of life-altering events. Accidental death and dismemberment (AD&D) insurance is one such measure, providing coverage in case an accident leads to death or physical disability.

Accidental Death and Dismemberment Insurance at a Glance

- AD&D insurance is an important life insurance add-on for people in high-risk occupations.

- AD&D insurance can provide benefits for things like funeral costs, hospital stays and physical rehabilitation, grief counselling for surviving family, home and vehicle modifications, and spousal occupational training.

- Some accidents, such as those that happen while driving under the influence, during dental or surgical treatments, or while serving in the armed forces are not always covered by this policy add-on.

Understand the intricacies of AD&D insurance, what it covers, who it benefits, and why it’s an essential component of financial planning.

AD&D Insurance Explained

AD&D or accidental death and dismemberment insurance is a specialized component of life insurance that covers you and your family if you die, lose a body part or function (such as vision, hearing, or speech), or become disabled due to an accident.

When Should You Consider AD&D Insurance?

It’s important to remember that AD&D is not a substitute for traditional life insurance, but rather an add-on that certain individuals should consider. People in high-risk occupations, such as those who do outdoor work, construction and roofing, manufacturing, and anything involving heavy machinery are among those who should consider getting this type of insurance.

Some AD&D insurance policies also cover losses such as disappearances in an accident while travelling, for example, if the means of transportation you’re using disappears, sinks, is wrecked, or forced to land and your body is not found within a year.

If you are the sole breadwinner or main source of income for your family, AD&D insurance is a good way of providing some financial security for them in the event of your untimely death. This will also help keep you and your family afloat should an accident affect your ability to work or rack up sizable medical bills.

What Does AD&D Coverage Look Like?

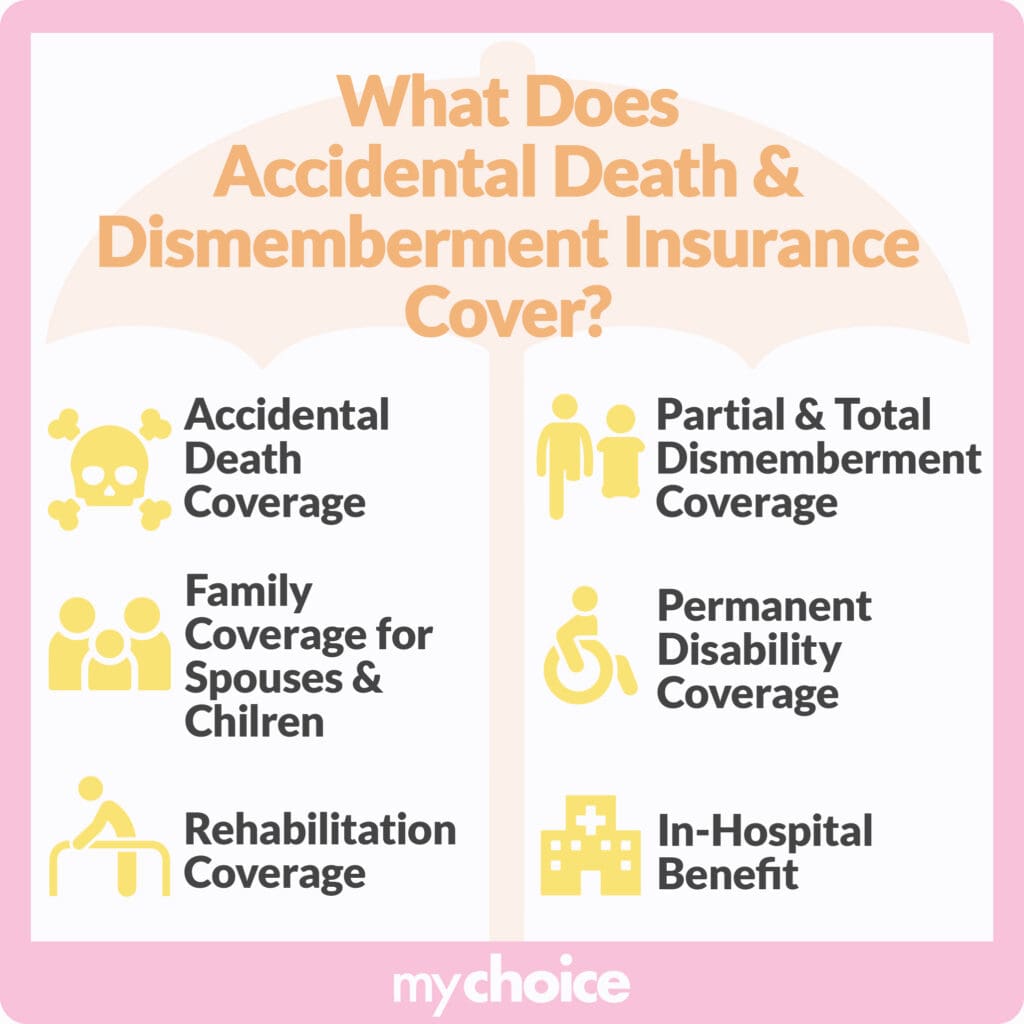

AD&D insurance can offer the following types of coverage and benefits:

- Accidental death coverage: This provides your beneficiaries a lump-sum payment if you pass away from anything outside of what your insurer considers natural causes.

- Dismemberment coverage: This provides coverage for serious injuries like loss of a body part or function such as hearing, vision, or speech. Partial dismemberment coverage provides a percentage of the benefit for the loss of one limb, sight in one eye, hearing in one ear, etc. Total dismemberment offers the full benefit for loss of multiple limbs, blindness, etc.

- Family coverage: This enhances the coverage limits for employees and extends it to their spouses and children.

- Permanent disability: This provides a lump sum if an accident leads to total disability that impacts the affected person’s daily activities.

- In-hospital benefit: This benefit comes in the form of monthly payments for hospital confinement, as well as extra costs for transportation, childcare, etc.

- Rehabilitation: This covers the cost of rehabilitation treatments, physical therapy, and other necessary treatments for injuries caused by an accident.

- Repatriation benefit: If you die more than 100km from your home, this reimburses some or all of the expenses needed to prepare and transport your body for burial or cremation.

- Spousal occupational training benefit: This provides your surviving spouse with the expenses necessary to undergo occupational training for a new occupation.

- Child education benefit: This reimburses the cost of tuition for eligible children attending a post-secondary educational institution.

- Home/vehicle modification benefit: If an accident leaves you confined in a wheelchair, this benefit provides coverage for one-time modifications to make your home and/or vehicle accessible.

- Workplace modification benefit: This covers the cost of special adaptive equipment and modifications that would be necessary for you to return to full-time work at your workplace.

- Bereavement benefit: This provides your spouse and dependent children with a set number of grief counselling sessions.

- Burn benefit: This covers injury and disfigurement from a third-degree burn.

- Critical disease benefit: This provides a lump sum payment in case you are diagnosed with a critical disease such as, but not limited to, encephalitis, Huntington’s Disease, Parkinson’s Disease, tuberculosis, etc. This coverage is often limited to policyholders diagnosed before the age of 65.

Here’s an example of the percentage of the benefit amount that will be payable to you or your beneficiaries in case of death or dismemberment following an accident:

| Percentage of Benefit Amount Payable | |

|---|---|

| Loss of life | 100% |

| Loss of or loss of use of both hands or both feet | 100% |

| Paralysis (hemiplegia, paraplegia, or quadriplegia) | 200% |

| Loss of sight of both eyes | 100% |

| Loss of one hand and one foot | 100% |

| Loss of one foot and sight of one eye | 100% |

| Loss of one hand and entire sight of one eye | 100% |

| Loss of speech and hearing in both ears | 100% |

| Loss of or loss of use of one arm or one leg | 75% |

| Loss of or loss of use of one hand or one foot | 75% |

| Loss of sight of one eye | 75% |

| Loss of speech or hearing in both ears | 75% |

| Loss of thumb and index finger or at least four fingers of one hand | 33% |

| Loss of four toes of one foot | 25% |

| Loss of hearing in one ear | 25% |

AD&D Exclusions and Limitations

Depending on your policy and insurance provider, some losses may not be covered by an AD&D insurance policy. This may include:

- Self-inflicted injuries and attempted suicide

- Operating a vehicle with a blood alcohol level over 80 mg of alcohol per 100 ml of blood

- Active participation in acts of terrorism, riots, or civil commotions

- Training or service in the armed forces

- Flying while receiving flying lessons or serving as a pilot or crew member of an aircraft as a passenger or an aircraft used for purposes other than transportation

- Participating in a criminal offence

- Drug overdose

- Getting an Infection — unless it was caused by an external wound received in an accident

- Inhalation or ingestion of poisonous substances and gas

- Undergoing a dental or surgical procedure

Are There Any Downsides to Getting AD&D Insurance?

While AD&D insurance has its benefits, it may not be for everyone. If you don’t work in a high-risk occupation, paying for this add-on may not be necessary. It’s also important to consider the many limitations of this type of insurance. Some factors that affect your ability to get insurance include your age, medical history (i.e. if you’re diabetic, have cancer, or are immunocompromised), and lifestyle.

If you don’t read the fine print, you may fail to consider key conditions that could disqualify you from receiving benefits.

On top of this, you can also lose your AD&D coverage if you switch jobs, especially if you purchase your policy through your employer. Injured workers can get financial support from their employers to cover things like immediate transportation to medical facilities, but AD&D coverage is not guaranteed.

If you want to keep having this type of coverage regardless of where you work, consider buying AD&D insurance independently.

Making a Claim for AD&D Insurance

The claims process for AD&D insurance varies depending on the insurer. Oftentimes, you or your beneficiaries will have to take the following steps:

- Complete a claim form

- Provide a doctor’s statement for accidental dismemberment or physical disability

- Provide proof of loss, such as a death certificate, medical examiner’s report, or autopsy

- Provide a copy of the original enrollment form indicating the beneficiary designation

Usually, you or your beneficiary must file a claim within a certain amount of time after the date of the accident — typically 30 to 90 days.

Key Advice From My Choice

- Consider AD&D insurance if you work in a high-risk profession, such as construction or manufacturing.

- Understanding the breadth of your policy’s AD&D benefits will guide you and your family in the event of a tragedy.

- Don’t forget to read the fine print and make sure you know your plan’s exclusions and limitations.