An attending physician statement (APS) is a written report summarizing your current health condition. Life insurance providers typically ask an applicant to obtain an APS to get a clearer picture of the applicant’s overall health, and how this might affect their risk classification.

Attending Physician Statements at a Glance

- Many life insurance providers require applicants to provide an APS before qualifying for coverage.

- Insurers usually request an APS from those with pre-existing medical conditions or whose medical information and paramedical exam results show conflicting results.

- Getting an APS is a relatively straightforward but lengthy process.

Understanding the Attending Physician Statement

When you purchase insurance, your application goes through a process called “underwriting”. This is where your insurance provider will assess the risks involved with insuring you and consequently, the amount of insurance coverage you’ll be eligible for and your premium rate.

For life and health insurance, underwriters look for factors such as your age, gender, and lifestyle, as well as things that could contribute to early death, illness, and injury. This is why they require clients to provide their medical information, such as family history, acute or chronic conditions you have had in the past, specific conditions you have at the moment, and any prescription medications you’re taking. Insurers also ask their clients to undergo a paramedical exam, which involves taking your vitals, blood pressure, pulse, and the like.

Oftentimes, this is enough to assess whether you qualify for life insurance. However, depending on your medical history and paramedical results, you may be required to provide an APS.

When and Why Do Insurers Ask for an APS

Insurers usually ask for an attending physician’s report if:

- They need more details or context regarding the medical information you provided in your application

- You’re currently being treated for a health issue, such as diabetes, hypertension, or bipolar disorder

- Your paramedical exam results show “abnormal” findings or point to symptoms of a potential condition

But why? Since insurance companies are all about managing risks, they want to make sure you’re currently or working on managing any symptoms or conditions that would put you at a higher risk for critical illness, hospitalization, disability, and early death.

Are There Types of Insurance Where an APS is Not Required?

Insurers don’t look for an APS when you’re applying for simplified or guaranteed life insurance. These policies are designed to streamline the process of getting life insurance, especially for those with pre-existing conditions. Thus, they’re a beacon of hope for those who might otherwise be deemed too high-risk to insure, and offer a safety net without the need for extensive medical disclosures. However, it goes without saying that the premiums for these policies may be higher to offset the insurer’s blind spot regarding your medical history.

Where Can You Get an APS?

You’re required to obtain an APS from a doctor who has treated you in the past or is already providing treatment. So, if for example, you’re being treated for liver disease, you can request an APS from your hepatologist. You can also obtain an APS from your primary care physician or a medical facility you’ve received treatment from or are currently being treated in.

How Much Do Attending Physician Statements Cost?

An APS can cost $75 to $300, depending on how long it’ll take your physician to write up the statement. Some insurance companies offer to pay for the APS.

How to Obtain an APS

Your life insurance provider will notify you if they need an APS whether they require one from a specialist. This is often the case for applicants with pre-existing conditions.

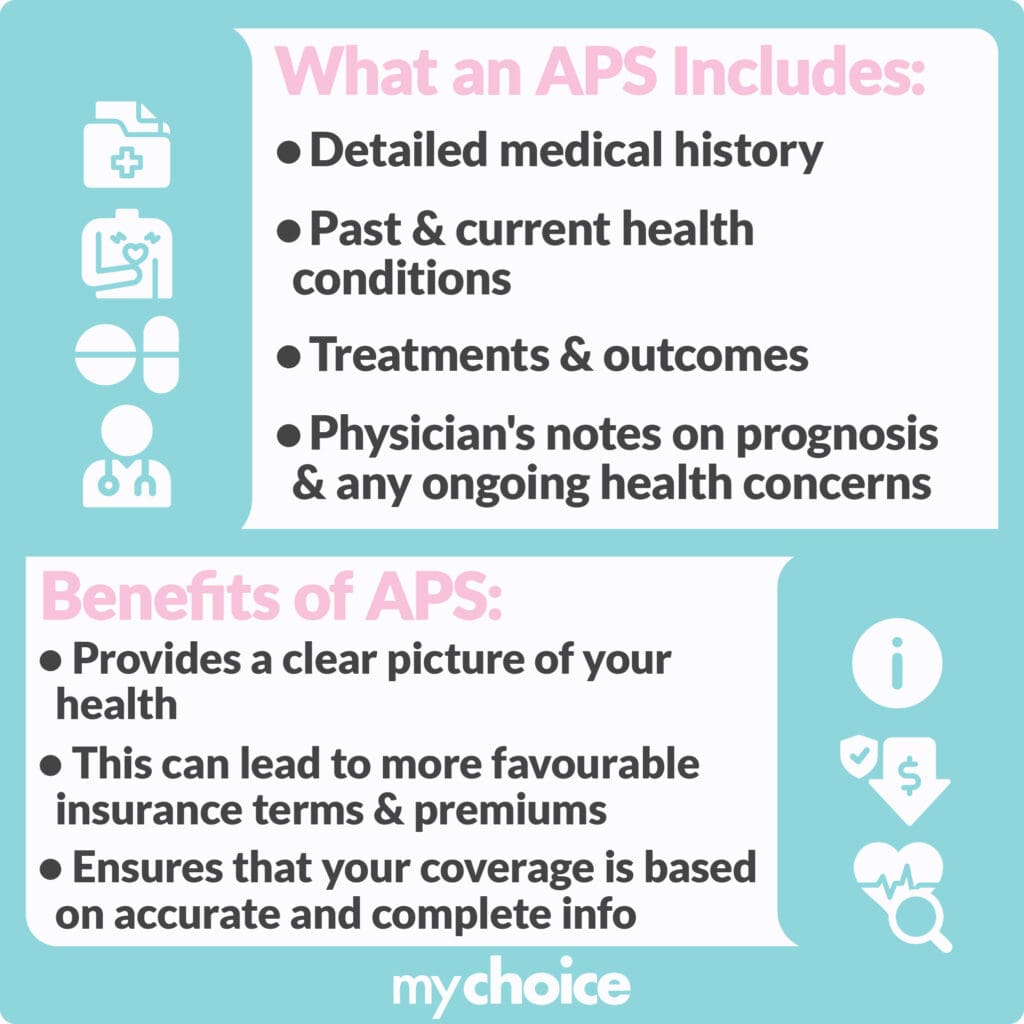

To obtain an APS, contact your physician to make the request. Most physicians know what to include in an APS. But if you want to be thorough and ensure your application goes off without a hitch, here are some key elements insurers look for:

- Your complete name

- Your date of birth

- Your height and weight

- The primary and secondary diagnosis

- Your current symptoms

- Objective findings, including the dates performed and the results

- Whether the condition is due to pregnancy or an accident

- The dates of your first appointment and latest appointment

- The frequency of your appointments

- When the symptoms first appeared

- Similar or related conditions

- Hospitalizations, confinements, and surgeries related to the condition

- Clinical finding

- Current medication and treatments

- Your compliance with the recommended treatment plan

- Restrictions or limitations caused by the condition

Although getting an APS is relatively simple, it’s one of the most time-consuming parts of the underwriting process. An APS takes roughly 21 calendars to be completed — but some providers may take longer depending on their busyness and the complexity of your case. Because of this, make sure to maintain open lines of communication with your healthcare provider and double-check the APS before submitting it to avoid further delays.

APS Privacy and Confidentiality Concerns

The contents of your APS — and all your personal health information, for that matter — is protected by the Personal Health Information Protection Act (PHIPA).

Under the “recipient rule”, the PHIPA states that, when an insurance company receives personal health information from a custodian (meaning a physician or medical facility), they “may only use or disclose the information for the authorized purpose for which the information was disclosed or for the purpose of carrying out a statutory or legal duty.”

Insurance companies must also have your express consent to collect and use your personal health information.

Key Advice From MyChoice

- When applying for life insurance, always be honest and upfront about your medical history — this will help your application process go smoothly and increase your chances of getting approved.

- If you don’t want to go to the trouble of obtaining an APS, consider purchasing simplified or guaranteed life insurance instead.

- While applying for life insurance can feel like an arduous process, it can be made easier with MyChoice. Use our site to shop around and find the best quotes available today.