Pregnancy is a significant life event for you and your family, bringing more responsibilities and a greater need to prepare for the future. Getting a life insurance policy during this time can be a strategic way to make your family’s finances more secure, especially with new expenses like education. However, timing your application is important to secure affordable life insurance.

Life Insurance While Pregnant at a Glance

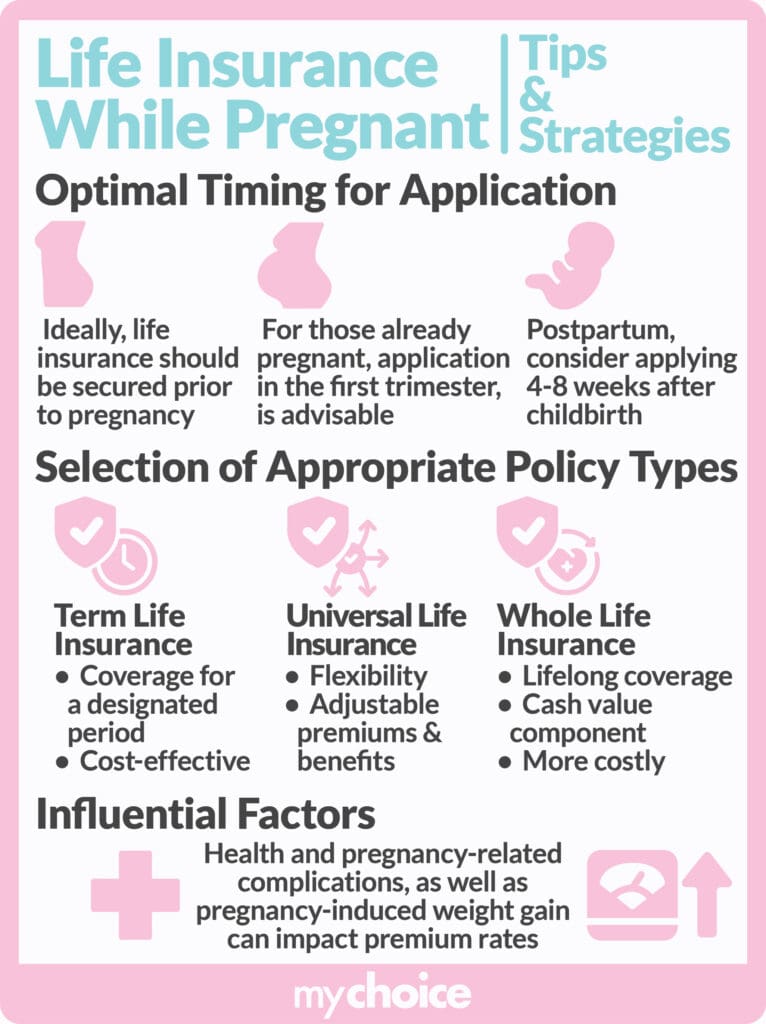

- The best time to get life insurance is before pregnancy as certain health changes may increase your quotes. But if you plan to get insured while pregnant, try to get a policy early in your first trimester.

- After giving birth, you should review your existing coverage to see if you need to update your policy to protect your child’s financial future.

- Those with a high-risk pregnancy should consider getting additional riders like a child rider or critical illness rider for enhanced coverage.

Can you get life insurance while pregnant? Learn how your pregnancy may affect your life insurance application, if you should get term or whole life insurance, and what factors to consider when calculating policy coverage.

Can You Get Life Insurance While Pregnant?

You can get life insurance while pregnant in Canada, and you can get it at any stage of pregnancy. However, many insurers consider pregnancy as a pre-existing condition that can increase your quotes or lead to outright denial of your application. To find affordable coverage, keep these points in mind:

- Timing your application is key: Applying before pregnancy or in the early first trimester is typically more favourable. If you get life insurance while pregnant, certain health changes and risks like weight gain will increase your premiums.

- If you’re already in a later stage of your pregnancy, consider applying after you’ve given birth instead: If you’re already in the last trimester, your premiums may be too high for your policy to offer good value for money. Consider a postpartum application instead. Ideally, your application should be made a few weeks after childbirth to potentially avoid higher premiums linked to pregnancy-related health changes.

- Consider additional coverage with riders: You can always add riders like a child rider or a critical illness rider to enhance coverage for your growing family’s needs.

- Assess your coverage needs: Aim to replace 5 to 10 times your annual income, plus consider debts and future expenses like childcare and education.

Calculating Life Insurance Coverage When Pregnant

Your life insurance should provide for the financial future of your loved ones and their long-term well-being. Here are some things to keep in mind when deciding on a coverage amount and type of life insurance policy:

- Health conditions: Pre-existing health conditions and those developed during pregnancy may lead to policy exclusions or higher life insurance quotes.

- Coverage needs: Apart from lost income, consider increasing your coverage for future educational needs, childcare, and shared expenses for household maintenance.

- Policy type: Term life insurance provides coverage anywhere from 5 to 30 years depending on your needs. While temporary, it’s more affordable and can at least cover you until your child reaches adulthood. Whole life insurance is more expensive, but it offers lifelong coverage and a cash value you can borrow against. Universal life insurance has lifelong coverage too but its premiums and benefits are adjustable, offering greater financial flexibility.

Considerations for High-Risk Pregnancies

Life insurers consider an applicant’s overall health status to estimate the risk of paying out a claim. In the case of those getting life insurance while pregnant, they will have extra considerations if they’re carrying a high-risk pregnancy. Here are points to keep in mind so you can get the best possible rates:

- Prepare for higher costs: A high-risk pregnancy results in higher premiums than a standard pregnancy, so be financially prepared to pay more for a term or permanent life insurance policy.

- Get a term life policy if cost is your primary consideration: Permanent life insurance can be expensive. If you are worried about committing to hefty regular payments, consider getting term life insurance. Term life insurance can protect you and your beneficiaries for a period ranging from 5 to 30 years and provide affordable coverage until your child reaches a certain age.

- Look for insurers that will accommodate high-risk pregnancies: Some trusted companies are known for accommodating applications from women with high-risk pregnancies. Look for providers that will offer coverage and more affordable rates for women with conditions that cause high-risk pregnancies, such as gestational diabetes and hypertension.

- Consider adding riders for additional protection: Anything can happen during a high-risk pregnancy, and you may want to get riders tailored to your circumstances and expectations. For example, a hospitalization income rider can help cover lost income during a prolonged hospitalization, while a child term rider can secure funeral costs in case something happens to your child. Talk to your insurance provider to see which riders they provide and may be useful in your situation.

Postpartum Insurance Needs

After giving birth, it’s important to review and make necessary changes to your life insurance coverage to ensure your loved ones’ financial security. Here are some important considerations for postpartum insurance:

- Beneficiary designations: Update your life insurance policy’s beneficiaries to protect your child’s future. It’s common to name a spouse or partner as a primary beneficiary so they can use the policy’s death benefit to provide for your child.

- Consider also setting up a trust: You may want to create and name a trust as a beneficiary in your life insurance policy so your child can receive its funds when they reach adulthood. Avoid directly naming your child as a beneficiary to avoid legal complications should anything happen before they reach the age of majority.

- Update your policy’s coverage: Post-childbirth, you may want to increase your existing coverage to provide for new future needs such as childcare and education.

- Disclose pregnancy-related health conditions: It’s important to disclose any health complications you experienced during pregnancy to your life insurance provider, such as preeclampsia or

Key Advice from MyChoice

- It’s best to get a life insurance policy before you’re pregnant to lock in the lowest possible rates. But if you’re applying for life insurance while pregnant, consider comparing quotes using MyChoice to find the best deal for your preferred coverage.

- If you have a high-risk pregnancy, consider adding riders like hospitalization income or child term for more financial protection.

- Childbirth is a major life event that affects your insurance needs. Review your policy after giving birth to see if there’s anything you want to update, such as the coverage amount or beneficiary designations.