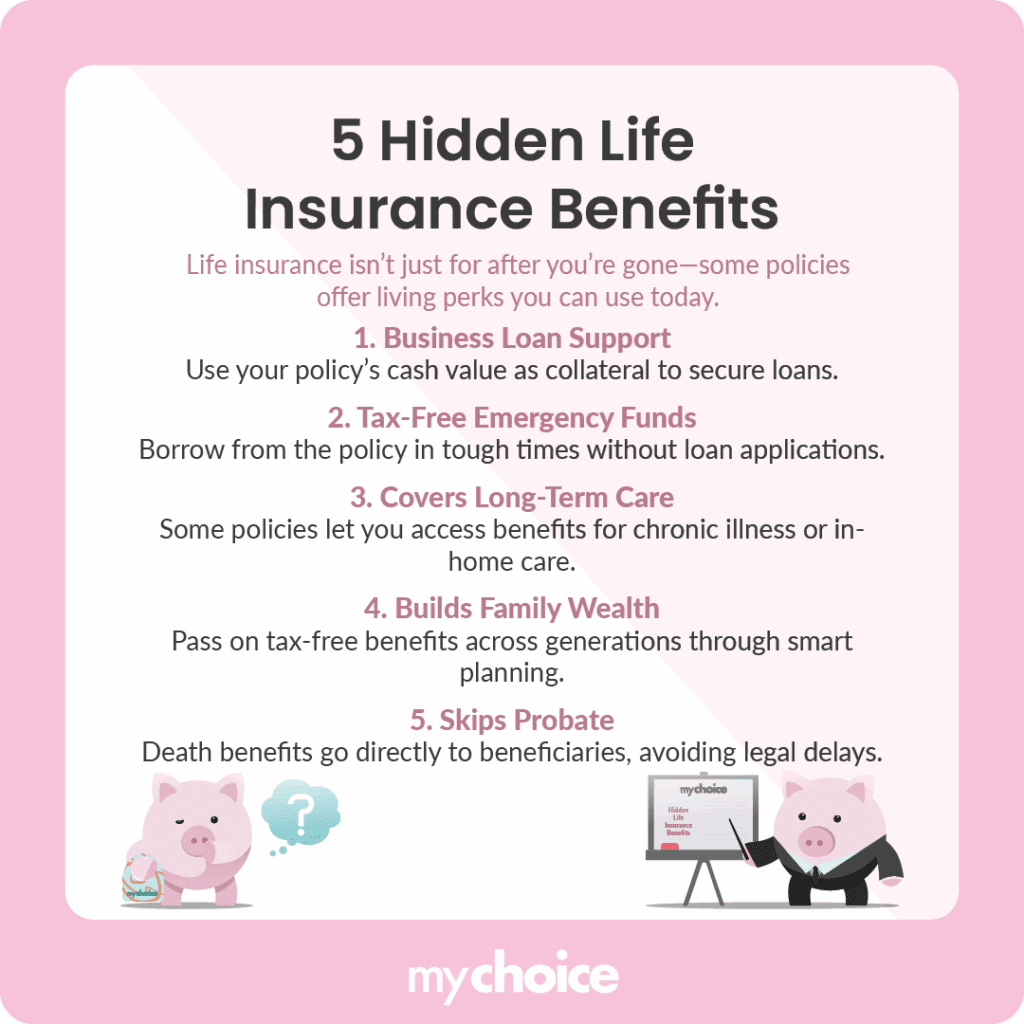

For most people, life insurance is a safety net for their loved ones after they pass away. While this function of life insurance is important, there are other ways to utilize a life insurance policy to help you while you’re still alive. Beyond peace of mind, certain types of life insurance can unlock financial advantages you might not expect.

What are the benefits of life insurance that other people might not be aware of? Can you access life insurance funds while you’re still alive? Read on to find out five little-known benefits of life insurance and how you can take advantage of them.

1. You Can Use It to Secure a Business Loan or Startup Funding

Many startup founders and small business owners don’t realize that you can leverage a life insurance policy to help grow a business. Certain permanent life insurance policies (like whole life or universal life) build cash value over time. This cash value doesn’t just sit there. You can use it as collateral to secure a loan from a bank or financial institution.

When lenders see a stable asset backing your loan, the approval process often becomes smoother. For entrepreneurs without traditional assets or a credit history, this can be a powerful tool for accessing capital. This can be particularly useful if:

- You’re self-employed and planning to expand.

- You want funding without dipping into retirement savings.

- You’re looking for flexible loan terms without giving up equity.

If the loan isn’t repaid before death, the lender simply deducts the balance from the policy’s death benefit. It’s a win-win: your loved ones still receive a payout, and you get the business funding you need immediately.

2. Can Be Tapped as Emergency Funds Tax-Free

If you’ve got a permanent life insurance policy, you might be sitting on tax-advantaged savings without realizing it. As you pay premiums over the years, many whole and universal life policies accumulate cash value, making it a growing pool of money you can borrow from or withdraw while you’re still alive. If structured correctly, this accumulated cash value (ACV) can be accessed tax-free.

Let’s say you hit a rough financial patch in your life due to something like unexpected medical bills, a job loss, or a major home repair expense. Instead of using a credit card to shore up emergency funds, you could use your policy’s ACV to get you through a crisis.

When you borrow from your life insurance policy’s ACV, you don’t need a loan application because you’re borrowing from your own policy. As long as your life insurance policy stays valid, you won’t have to pay any taxes on a policy loan. The best part of borrowing against your own life insurance policy is the flexibility of repayment. You can repay the loan on your own terms, or not at all, though not paying back the loan may reduce the death benefit that goes to your family.

3. It Can Be Used to Pay for Long-Term Care or Chronic Illness

Long-term care (LTC) in Canada isn’t cheap, with monthly payments at a private LTC facility ranging from $6,000 to $15,000. And if you have a chronic illness, provincial health coverage can only take care of so much. Some life insurance policies can help cover these costs without forcing you to sell assets or drain your retirement savings.

Some permanent health insurance policies have living benefits or accelerated death benefits. These benefits allow you to access a portion of your death benefit early if you’re diagnosed with a chronic or terminal illness. You can use these funds to cover expenses such as in-home nursing support, long-term care facilities, medical treatments, therapy, and rehabilitation.

This feature is invaluable for Canadians who do not have private health insurance or long-term care riders. Instead of leaving your policy untouched until death, you can use part of it while still alive to maintain your dignity and comfort.

4. Enables Intergenerational Wealth Transfers

One of life insurance’s most underrated features is its ability to support multi-generational planning. While most policyholders use life insurance to support spouses or children, many are unaware that it can also be structured to build wealth for multiple generations, including grandchildren and even great-grandchildren.

With proper planning, you can:

- Create irrevocable life insurance trusts to control when and how money is distributed.

- Name multiple beneficiaries across generations.

- Use the policy to cover estate taxes, ensuring that more wealth stays in the family.

Because the death benefit payout is generally tax-free, it can help minimize the wealth erosion that often happens during a traditional inheritance transfer. If you want to build a financial legacy for your family that will last multiple generations, life insurance can be one of the cornerstones that help create it.

5. Helps You Avoid Probate Delays

Probate is the legal process of validating a will and distributing estate assets after death. This process can be time-consuming, expensive, and stressful for surviving family members. Fortunately, the death benefit from a life insurance policy is exempt from probate. As long as your primary and contingent beneficiaries are properly named and your policy is active, the death benefit will be paid directly to them without being delayed in court.

Since the death benefit is tax-free and immediate, your surviving heirs can use it to pay estate taxes, cover final costs, and support their daily expenses as they go through a difficult time. This gives life insurance a massive advantage over inheriting Registered Retirement Savings Plans (RRSPs) or inherited property, which might be frozen during probate. This also makes the death benefit quicker and more convenient than inheriting a bank account.

Avoiding probate also keeps things more private. While wills and estate filings are often kept in public records, life insurance payouts are confidential.

Key Advice from MyChoice

- Review your policy regularly. If you want to accumulate cash value, ensure that you have permanent life insurance, as term life policies don’t have this feature.

- When reviewing your policy, ensure that your beneficiaries are listed correctly. A missing or outdated name can negate the probate advantage life insurance offers.

- Use MyChoice’s life insurance comparison tool to get quotes from different providers and get more choice.