Divorce is often an emotionally (and financially) difficult time. You have a lot to sort out, and there’s a good chance your life insurance affairs might slip through the cracks. Fortunately, life insurance doesn’t automatically get invalidated or changed during a divorce. Let’s take a look at how life insurance changes during a divorce in Canada.

What Happens to My Life Insurance Policy During a Divorce In Canada?

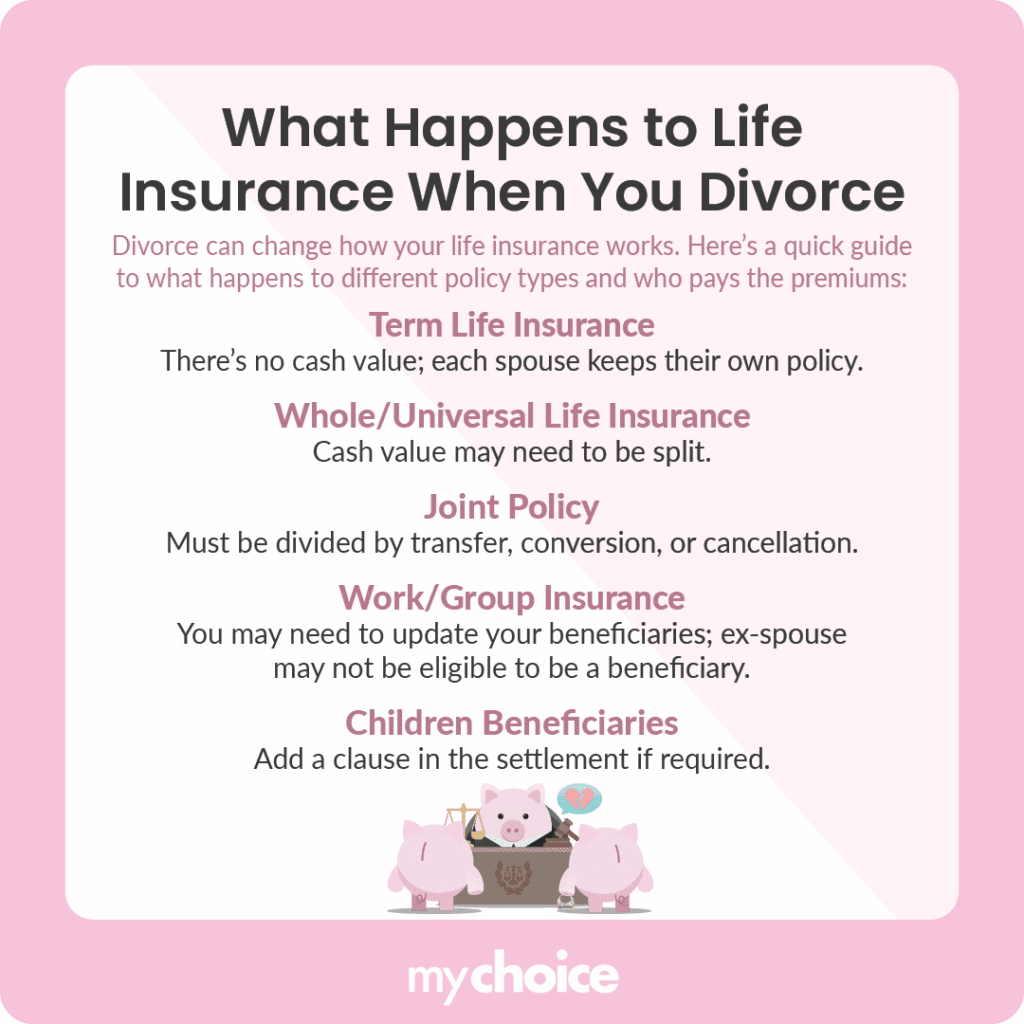

What happens to your life insurance policy during a divorce in Canada ultimately depends on your policy type. Some policy types undergo minimal changes, while others may need to be equalized or even ended altogether. Check the table below to learn about what happens to different life insurance types during divorce:

| Policy type | What happens during divorce? | Common next steps |

|---|---|---|

| Term life insurance | The policy holds no value unless the policyholder dies, so it isn’t considered a divisible marital asset. | If both spouses hold individual term policies, they can continue each policy unchanged. |

| Whole life or universal life insurance | The cash value built up in a permanent policy can be considered a financial asset. | Your accumulated cash value may be included when your properties are being equalized under Canadian divorce law. |

| Joint life insurance | Joint policies are required to be equalized after a divorce. | You can either assign the entire policy to one spouse, convert it into two individual policies, or cancel the policy altogether. |

| Group life insurance through work | Your ex-spouse may not be eligible to be a beneficiary once the divorce is finalized. | You may need to change beneficiaries on your group life insurance policy. |

| Policies with children as beneficiaries | What happens to the policy depends on its type. | You can include a stipulation in your divorce settlement to name the children as beneficiaries, so that if the child support payer dies, they still leave money to fulfill their obligation. |

Who Pays the Premiums After Divorce?

Who pays the premiums after a divorce in Canada depends on who owns the policy after the divorce is settled. For individual life insurance policies, the owner must pay their own premiums. The same goes for joint policies that get broken up into individual policies.

Getting New Coverage After Divorce

If you had a joint life insurance policy with your ex-spouse that was dissolved after the divorce, you may be left without insurance protection. If divorce turns you into a single parent, getting life insurance is essential because if you pass away, your children may be left without a financial safety net.

Here are some reasons why you should get life insurance as a single parent:

- Cover your children’s living expenses in your absence.

- Settle any outstanding debts you left before you pass away.

- Keep your home or residence from being repossessed.

- Fund your children’s education.

That said, you can still benefit from life insurance after divorce even if you don’t have kids. Your life insurance payout can cover final expenses and settle debts, as well as leave gifts to charity or remaining family members upon your passing.

In terms of qualifying for a new policy, being divorced isn’t a direct life insurance risk factor, so your divorce status won’t raise your premiums. However, you’re likely older than the last time you qualified for a life insurance policy and may have developed health issues in the meantime so that you may land higher life insurance premiums.

Common Life Insurance Mistakes to Avoid During a Divorce

We understand that divorce is often a challenging time, and you may forget important things that could have negative consequences later on. To ensure you have your bases covered and minimize the risks of encountering insurance issues in the future, here are some common life insurance mistakes to avoid during (and after) a divorce:

Key Advice from MyChoice

- Consider getting a new life insurance policy if you still need insurance protection and have cancelled your joint policy after a divorce.

- Update your life insurance beneficiaries when getting divorced to ensure the right people receive your death benefit payout.

- Assign a trustee to your minor children if you plan to have them receive your death benefit to ensure the money is managed correctly before they reach the age of majority.