Deciding whether to surrender your life insurance policy or keep it depends on your financial situation and family needs. In Canada, you can cash out permanent life insurance policies, but not their term life counterparts, unless you purchased the return of premium option.

But the question is, should you cash out your life insurance policy under any circumstances? We’ll explore the reasons why you should or shouldn’t.

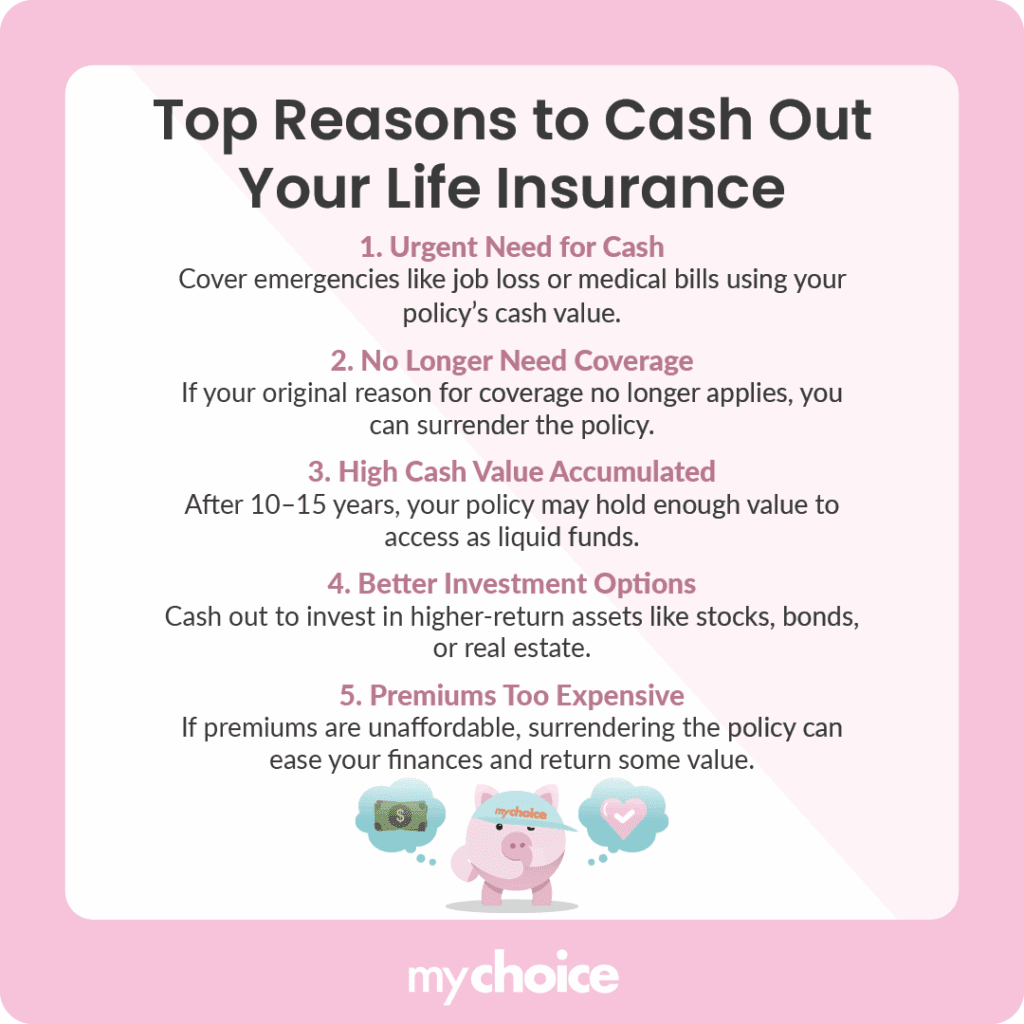

Reasons to Cash Out Your Life Insurance Policy

If you’re reading this guide, there’s probably a reason why you’re considering cashing out your life insurance policy, and it might be one of these.

When You Shouldn’t Cash Out Your Life Insurance Policy

While cashing out your life insurance policy can give you what feels like instant finances, there are some cases in which this can do more harm than good.

Alternatives to Cashing Out Your Life Insurance Policy

If you’re struggling to maintain your policy or need a significant amount of cash fast, don’t assume surrendering your life insurance is the only option. Here’s what you can do instead.

Key Advice from MyChoice

- Consult with a financial advisor before making a decision. They can help you understand the implications of each choice.

- Meticulously weigh the reasons to cash out versus the reasons for keeping your policy.

- Always review whether the surrender amount will become taxable.