In today’s dynamic financial landscape, Canadians constantly seek ways to optimize their assets and secure their financial future. One such avenue that’s gaining traction is borrowing against life insurance policies. But why is this becoming a popular choice?

The economic environment in Canada has been fluctuating, with the Consumer Price Index (CPI) witnessing a rise of 3.3% year over year in July 2023. This acceleration in consumer inflation was primarily due to gasoline prices. Excluding gasoline, the CPI saw an increase of 4.1%. Furthermore, electricity prices in Alberta surged by a staggering 127.8% in July on a year-over-year basis. Such economic indicators highlight the volatility in the market and the need for Canadians to have a financial cushion.

On the other hand, the Bank of Canada’s Monetary Policy Report from July 2023 indicates that while inflation in Canada remains high, it’s expected to stay around 3% in 2024, returning to the 2% target by the mid-year of f 2025. With such economic forecasts, Canadians seek ways to leverage their assets most beneficially.

Borrowing against a life insurance policy offers a unique advantage. It allows policyholders to access funds without liquidating other assets. This can provide a much-needed financial boost in times of economic uncertainty or personal financial strain. Moreover, with the current economic indicators and projections, having an additional financial resource can offer peace of mind.

Life Insurance Insights: More Than Just a Safety Net

Life insurance is often perceived as a mere safety net, ensuring that our loved ones are financially secure in the event of our untimely demise. However, it’s much more than that. Life insurance provides a one-time, tax-free payment known as a death benefit, which can be used in various ways. It can replace lost income, ensuring that the family maintains their standard of living, cover funeral expenses, pay off debts, or even be donated to charity. Moreover, the beneficiary isn’t limited to family members; it can be a friend, a charitable organization, or even an estate.

Interestingly, permanent life insurance policies, such as whole and universal life insurance, can also serve as financial tools. They often build up a cash value, which means if you decide to cancel your policy, you receive a portion of the money back. Furthermore, these policies might allow you to take out a loan using the cash value, providing flexibility in financial planning. However, it’s crucial to remember that borrowing against the policy might reduce the eventual death benefit. As life situations change, periodically reviewing and updating beneficiary designations’s a good practice, ensuring that the death benefit is directed as per your current wishes.

While life insurance is a legitimate and beneficial financial tool, it’s essential to be aware of potential scams. Learn more about differentiating between genuine life insurance policies and scams here.

Borrowing Against Your Life Insurance Policy: A Financial Lifeline?

Life insurance, for many, is a safety net. It’s a promise that your loved ones will be taken care of financially in the event of your untimely demise. But what if that safety net could serve a dual purpose? What if your life insurance policy could also act as a reservoir from which you could draw funds in times of financial strain? This is where the concept of borrowing against your life insurance policy comes into play.

Why Consider Borrowing Against Your Life Insurance?

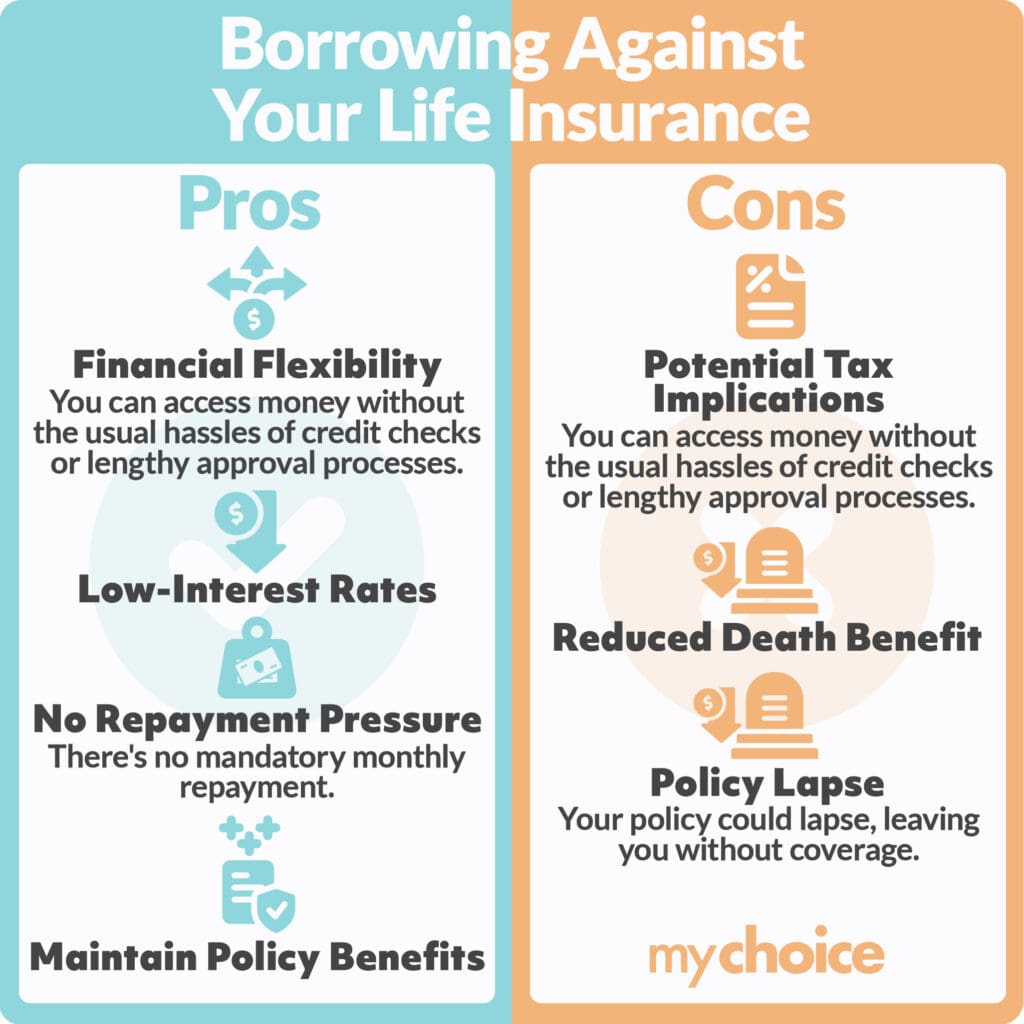

- Financial Flexibility: Life is unpredictable. There might be instances where you need immediate financial assistance. Instead of taking out a high-interest loan or liquidating assets, borrowing against your life insurance can provide the funds you need. It offers a way to access money without the usual hassles of credit checks or lengthy approval processes.

- Low-Interest Rates: Typically, the interest rates for borrowing against life insurance are lower than other forms of credit. This makes it a cost-effective option for those in need of funds.

- No Repayment Pressure: Unlike traditional loans, there’s no mandatory monthly repayment. The loan amount and any interest accrued will be deducted from the death benefit when the policyholder passes away. This ensures that your beneficiaries still receive a portion of the policy’s payout.

- Maintain Policy Benefits: Borrowing against your policy doesn’t mean you’re giving up its benefits. The policy continues to remain in effect, and depending on the type of policy, it might still earn dividends or interest.

Reasons Not to Borrow Against Your Life Insurance

Having life insurance has its benefits, but there are also reasons not to buy life insurance in the first place. Similarly, below are some considerations to keep in mind before borrowing against your life insurance:

- Reduced Death Benefit: If the loan isn’t repaid, the death benefit your beneficiaries receive will be reduced by the loan amount and any interest accrued.

- Potential Tax Implications: In some cases, if the loan amount exceeds the policy’s cash value, it could result in taxable income.

- Policy Lapse: If the interest on the loan combined with the loan amount exceeds the policy’s cash value, the policy could lapse, leaving you without coverage.

Is It Right For You?

Borrowing against your life insurance policy can be a valuable financial tool, but it’s not suitable for everyone. It’s essential to assess your financial situation, understand the terms of your policy, and consult with a financial advisor before making a decision. Also, make sure to read our guide on whether it’s worth buying life insurance in the first place.

In the ever-evolving financial landscape of Canada, having options is crucial. Borrowing against your life insurance policy is one such option, offering both advantages and points of consideration. As with any financial decision, it’s essential to be informed, consider the current economic climate, and align choices with your long-term financial goals.