Life insurance isn’t a scam, despite what some people think. Sure, with a life insurance policy, you regularly spend money for what seems like nothing. But, when you die, your loved ones will see the value of what you paid for.

However, that doesn’t mean there are no life insurance scams happening. Here, we’ll dive deeper into what life insurance scams look like and teach you how to better deal with them.

Why People Think Life Insurance Is a Scam

Many people think life insurance is a scam because you’re paying for something without immediate and tangible value. But that doesn’t mean life insurance is a scam.

You pay for life insurance to protect your family. When you don’t use the protection, it may seem like you’re paying for nothing. But when you die and the insurer pays out your death benefit, your family will be grateful you paid for insurance.

Think of paying for life insurance as preventing disease. Taking preventative measures to avoid disease may seem like a lot of effort. But when you ignore those preventative measures and get sick, you might regret not doing them.

Life insurance can also be an investment. Whole life insurance and universal insurance provide an investment component that provides returns alongside your coverage. But is investing in life insurance a good idea? Read our guide to whether life insurance is a good investment and decide for yourself.

So, is whole life insurance a scam? It’s not, and neither are other types of insurance.

You might not feel the value of insurance immediately, but you’ll be grateful you paid for it. Life insurance is worth it – read our article to learn more.

Actual Life Insurance Scams

There are many legitimate reasons not to buy life insurance, but thinking it’s a scam isn’t one of them. Unfortunately, however, life insurance scams do exist.

Unscrupulous people may try to use insurance as an excuse to swindle you out of your money. These are the ones you should watch out for.

Common Life Insurance Scams

Life insurance scams take on many forms. Here are examples of commonly-encountered life insurance scams:

- Selling insurance policies to people who don’t need insurance: Scammers and unscrupulous agents sometimes use high-pressure tactics to sell you a policy, even if you don’t need one.

- Selling fake insurance policies: Some scammers may sell you policies that don’t exist. This means they take your money, but you don’t get anything from it.

- Selling insurance with fake benefits: A scammer might try to sell you a policy based on nonexistent benefits. For instance, they might claim that your policy will pay double if you die from a disease when the actual policy has no such benefit.

- Churning: This is a practice where an agent persuades or forces you to cancel your current policy and buy a new one from them. Agents do this to reap commissions from selling you the new policy.

- Lying about your beneficiary status: Scammers might contact you and say you’re a beneficiary to somebody’s insurance policy. They get money from you by claiming you must pay a fee for the death benefit.

- Taking premium payments instead of the company: This scam technique is often called a premium diversion. In this technique, scammers ask you to pay premiums directly to them, not the company. This means they can pocket the money and leave you without any coverage.

- Forging your signature: Scammers may forge your signature to make unauthorized changes to your policy, like increasing your death benefit or naming other beneficiaries.

- Claiming to be from a certain insurer: Fraudulent insurance agents can claim to represent a certain company and attempt to sell you a fake policy.

All the techniques mentioned above are just a sampling of what insurance scammers can do. Be vigilant and contact the authorities or the insurance company if you think you’re being scammed.

Identifying Life Insurance Scams

Scammers and con artists can trick you in so many ways. This means you have to stay on your toes and know how to identify which agents are scammers and which are genuine.

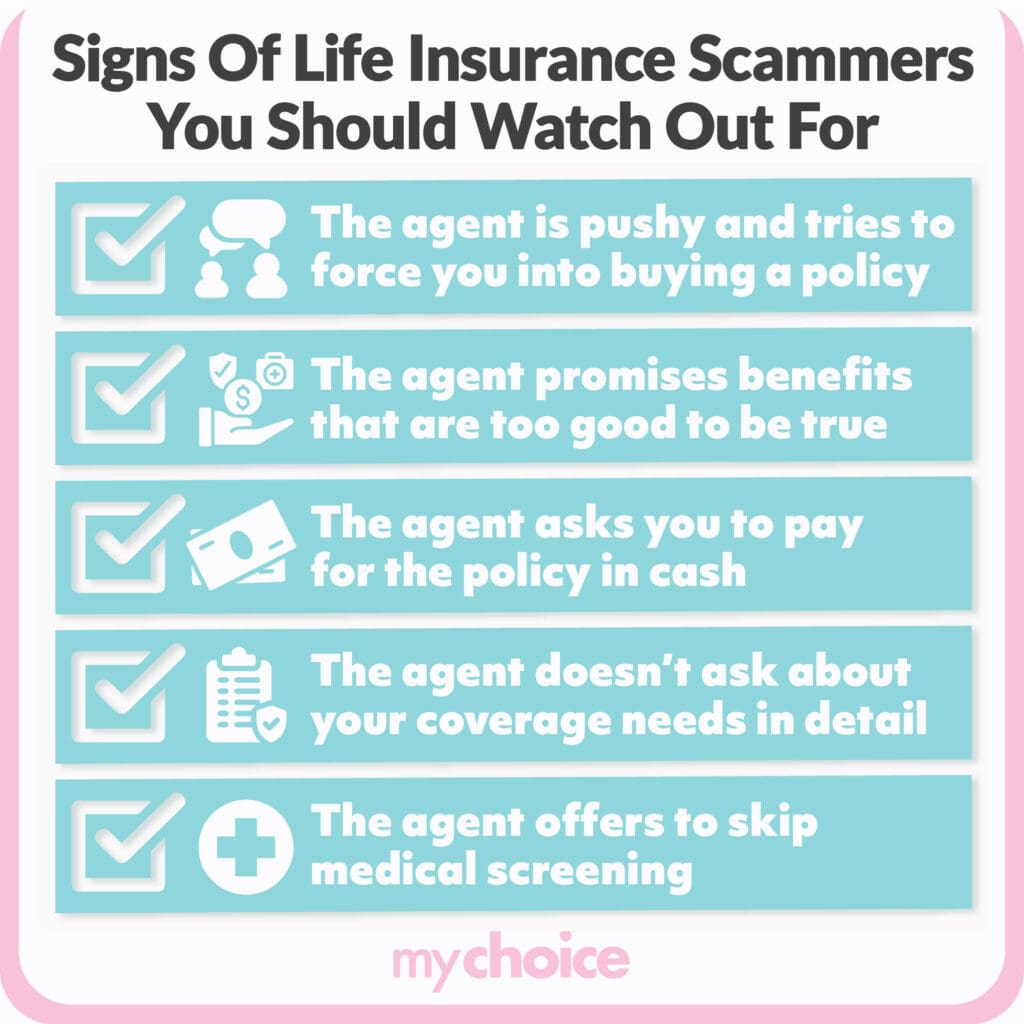

Here are common signs of life insurance scammers you should watch out for:

- The agent is pushy and tries to force you into buying a policy.

- The agent promises unrealistic benefits that are too good to be true.

- The agent asks you to pay for the policy in cash.

- The agent doesn’t ask about your coverage needs in detail.

- The agent offers to skip medical screening for your policy.

Can You Be Scammed When You Have a Policy?

You can still be scammed even when you have a real insurance policy. A scammer may pressure you into paying more money to keep your policy active. They may also force you to cancel your policy and buy a new one so they can pocket the commission.

Common Life Insurance Scam Targets

Life insurance scammers target people from all walks of life, regardless of age or medical status. But some groups of people are targeted more often due to their perceived vulnerability.

Common life insurance scam targets include:

- Elderly people

- People with serious medical conditions

- People with terminally ill family members

- Insurance policyholders

Avoiding Life Insurance Scams

The best way to avoid life insurance scams is to be a well-informed buyer or policyholder. Here are some ways you can avoid and weed out potential scammers:

- Do your research before purchasing a policy.

- Buy insurance only from agents you trust. You can ask friends or family members to recommend you to a trusted agent.

- Ask questions and get every single detail about your policy before purchasing it.

- Verify your insurance agent’s identity with their employer.

- Provide information the agent needs, but don’t overshare. Additionally, you should only provide information through secure channels.

Checking Your Insurance Company and Agent’s Legitimacy

An important step in avoiding life insurance scams is checking your insurer and agent’s legitimacy. Fortunately, life insurance in Canada is regulated by provincial governments.

All life insurance agents must have a licence, whether they’re self-employed or working for a major insurer. What makes insurance agents and brokers different? Read our comparison between insurance agents and brokers to get the answers.

You can run your insurance agent’s name through government-provided resources to ensure their legitimacy. For example, insurance buyers in Ontario can check the Financial Services Regulatory Authority database.

You can also check the life insurance company’s online presence to verify its legitimacy. Be sure to double-check their profile on rating agencies like A.M. Best and Better Business Bureau as well.

Potential Insurance Company Red Flags

Here are some red flags to be aware of when dealing with insurers. Never trust an insurance company that does these things:

- Ask customers to make payments to third parties instead of the company itself.

- Ask customers to share personal information through unsecured mediums like emails and phone conversations.

What to Do After You’ve Been Scammed

Despite your best efforts, you may end up being scammed regardless. But it’s not the end of the world – you can still fix this by taking these steps:

- Contact the local authorities about your scam attempt.

- Reach out to the insurance company that the scammer claims to be from and report the incident.

- Provide the details of your scammer and the incident to your local insurance department.

You can also reach out to the Canadian Anti-Fraud Centre to report the incident.

What Happens if I Get Scammed?

If you get scammed, you stand to lose money. In some more serious cases, you might also be a victim of identity theft. Contact the local authorities and your provincial regulatory body as soon as you realize you’ve been scammed.

The Bottom Line

Life insurance isn’t a scam. However, life insurance scams do exist – and they’re very dangerous. Always verify your insurance agents before giving information and buying a policy from them.

If you unwittingly become a scam victim, contact the local authorities and governing body immediately. They may be able to help you catch the scammer and prevent further losses.