Getting a life insurance policy in Canada isn’t a set-and-forget measure. With nearly a third of Canadian adults having a life insurance coverage gap, keeping your coverage constant and adequate is more important than ever. As you go through different phases of your life, your life insurance coverage should reflect your responsibilities and obligations. Reviewing your coverage helps ensure that you’re neither under- nor over-insured as you experience major life changes.

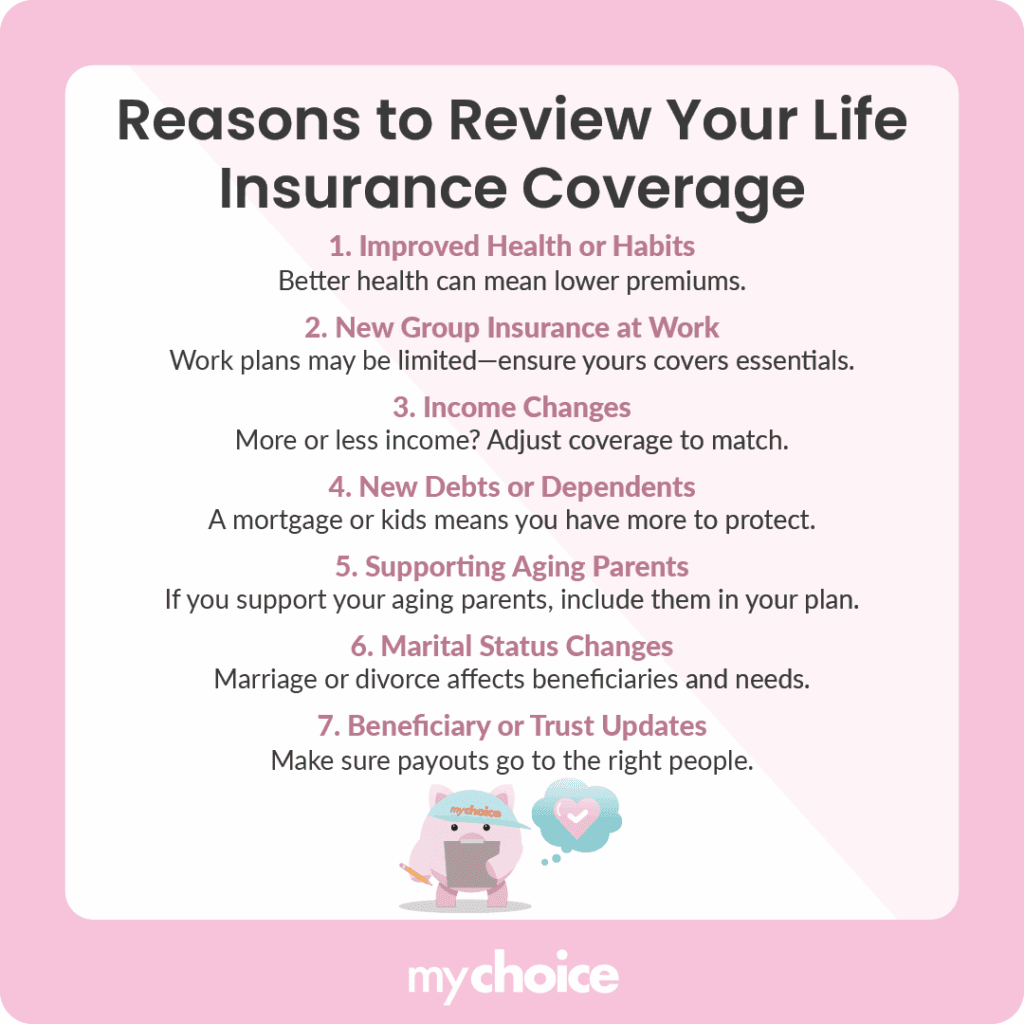

What necessitates a life insurance policy review? Is this something you should do on a regular basis? What should you do when reviewing your policy? Read on to learn about the top seven reasons you should review your life insurance coverage.

Reason 1: You’ve Improved Your Health or Lifestyle

Have you quit smoking, lost weight, or started managing a health condition more effectively? Insurance companies reward better health with better rates. If your lifestyle has improved significantly since you first got coverage, a review could lead to lower premiums or a stronger policy for the same price.

Reason 2: You’ve Joined a Group Insurance Plan at Work

Many employers offer life insurance as part of their benefits package. While it’s a nice perk, these group policies often have limitations such as low coverage amounts or loss of benefits if you leave the company. Reviewing your personal policy helps you coordinate both plans and avoid relying solely on a policy that might not follow you if you leave the company.

Reason 3: Your Income Changed

Whether you’ve received a raise, started a business, or experienced a drop in earnings, your life insurance should scale with your financial situation. Higher income often means more assets to protect and a lifestyle you want your family to maintain. On the other hand, if your income decreases, you may need to adjust your coverage to keep it affordable without compromising protection.

Reason 4: You have New Financial Obligations

If you’ve bought a house, taken on student loans, or had children since your last policy review, it’s time to update your coverage. These responsibilities increase your need for protection, ensuring your loved ones won’t struggle with unpaid bills or lost income if something happens to you.

Reason 5: You’re Now Supporting Aging Parents

As your parents age, you may find yourself providing financial support. This makes you responsible for taking care of your parents, along with any other dependents. Over 4 million adult Canadians provide care for both their children and aging parents. A policy review can help you make sure that your coverage accounts for your parents’ care if your support suddenly ends, so they won’t be left in a tough spot.

Reason 6: Your Marital Status Has Changed

Getting married, divorced, or widowed can dramatically shift your financial responsibilities and beneficiaries. Marriage might mean merging policies or increasing coverage for a shared future. Divorce might require removing a former spouse or updating your family trust documents. A review ensures your policy reflects your current relationship and future goals, instead of your past.

Reason 7: You Want to Reevaluate Beneficiaries and Trust Designations

Life insurance is as much about who receives the benefit as it is about the amount. Kids grow up, family relationships evolve, and you may wish to include or exclude specific individuals. It’s also smart to consider setting up a trust, especially if you have young children or complex estate planning needs. Regularly reviewing these details ensures your policy still reflects your wishes.

The Life Insurance Review Checklist

Reviewing your life insurance policy can be a little bit confusing, especially when you have so many factors to consider. Here’s a checklist that you can follow to make your life insurance review a little bit easier:

- Check your policy’s face value: Ensure that your death benefit, as well as any other policy benefits, match your current needs and responsibilities.

- Update your beneficiary designations: Review your primary and contingent beneficiaries to ensure that they align with your will or estate plan.

- Review any term limits if you have term life insurance: Know when it expires and whether you want to convert or renew it.

- Assess your riders or add-ons: You may want to add or remove features like disability waivers, accelerated death benefits, or child coverage.

Key Advice from MyChoice

- Review your life insurance regularly. Ideally, review your policy every one to two years, or after any major life change.

- Think beyond just death benefits. Life insurance can support income replacement, debt payoff, and future financial planning.

- If you took out a term life insurance policy when you were younger, consider whether your current circumstances justify converting it into a permanent life insurance policy. Parents often add a child rider to their plan to cover final expenses if their child unexpectedly passes away.