Filing for bankruptcy can be a stressful, difficult time. You need to surrender your assets, and you may get cuts on your earnings to pay off your debts. In this vulnerable financial state, potentially having your insurance protection jeopardized is another factor that can increase your stress even more. Fortunately, in some cases, you can keep your life insurance policy even in bankruptcy.

What Happens to My Life Insurance Policy if I Declare Bankruptcy?

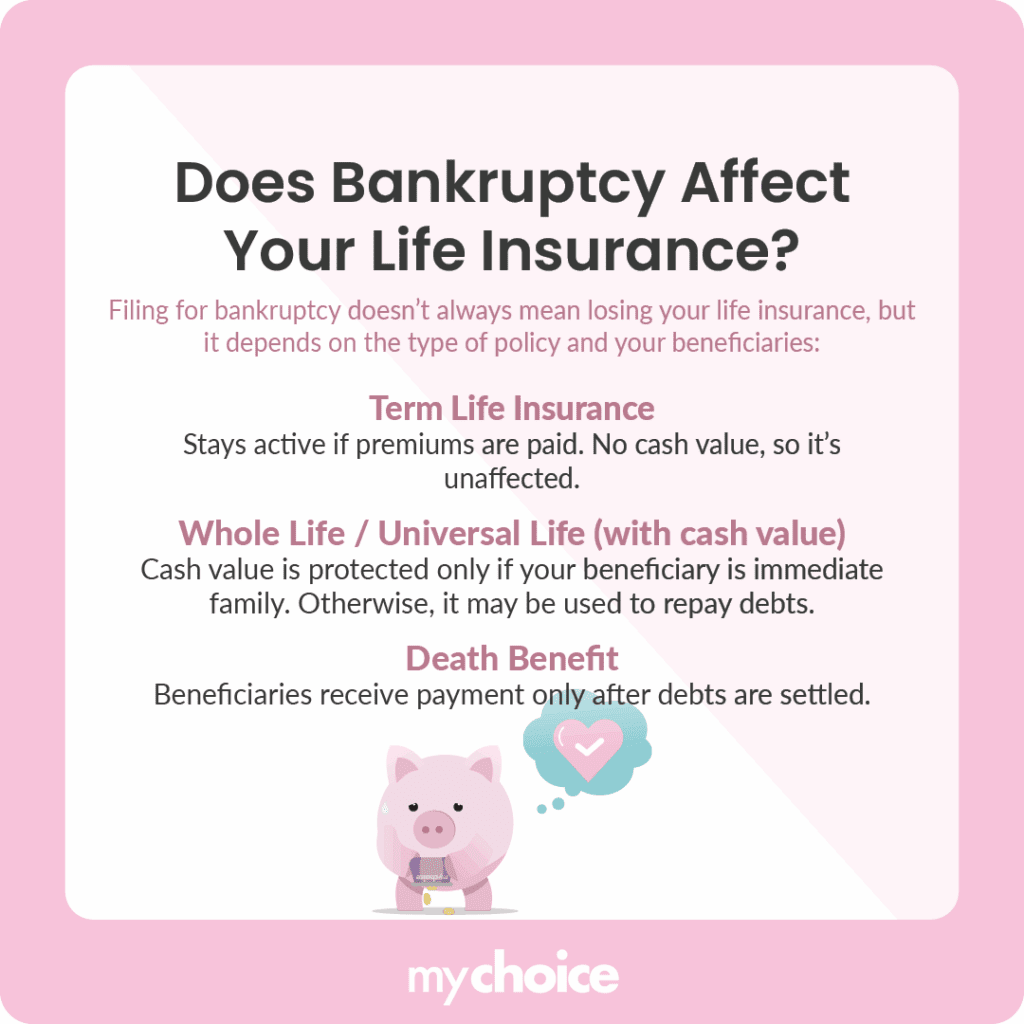

If you file for bankruptcy, your assets will be sold by the trustee. However, you generally can keep your life insurance policy. However, there are some differences depending on whether you have a term or whole life insurance policy. Let’s take a look:

| Life Insurance Policy Type | What Happens to the Policy |

|---|---|

| Term | Unaffected by bankruptcy and will continue to be in effect as long as you pay premiums. |

| Whole life or universal policies with cash value component | The cash value component is considered an investment, but it’s exempt from seizure as long as your beneficiary is a spouse/partner, parent, child, or grandchild. If your beneficiaries don’t fall into those categories, your built-up cash value may be taken by the trustee. |

Will My Beneficiaries Still Get the Payout?

Your beneficiaries can still get the life insurance payout, but only if there’s still money left after paying off your creditors. If all the death benefit goes to paying your creditors, your beneficiaries won’t get any money.

What Happens If I’m the Beneficiary of Someone Else’s Policy?

If you’re the beneficiary of the life insurance policy of someone in bankruptcy, you can receive the payout of their life insurance policy as long as there’s still money left after paying off their creditors.

Can I Still Borrow Against My Life Insurance?

There’s nothing that stops you from borrowing against your life insurance, even if you’re in bankruptcy. However, remember that borrowing against your life insurance policy reduces its death benefit if you pass away before repaying it.

What Happens After You’re Discharged From Bankruptcy?

You can still keep your life insurance policy after you’re discharged from bankruptcy. However, it may give you difficulties if you drop your current policy and plan to apply for another life insurance policy. In that case, you need to disclose your past bankruptcy on your insurance application to ensure you’re not misrepresenting yourself.

Bankruptcies are, unfortunately, somewhat common in Canada. In January 2024, there were over 11,000 bankruptcy or insolvency cases that happened nationwide. But that also means it’s likely not a dealbreaker when it comes to applying for insurance. As long as you disclose your bankruptcy history, you’re still likely to qualify for a policy, even if the insurer may see you as a high-risk applicant.

Key Advice from MyChoice

- While declaring bankruptcy won’t jeopardize your life insurance policy, your insurance payout may be used to pay debtors before going to your beneficiaries.

- To avoid your life insurance cash value from being taken by the trustee, you can list your immediate family member or partner as a beneficiary.

- You can still keep your life insurance policy after you’re discharged from bankruptcy. However, you may be considered a high-risk applicant if you apply for a new policy after filing for bankruptcy.