Naming someone as a beneficiary of your life insurance policy is a serious decision that could greatly impact the future of your loved ones in the event of your death. Revocable and irrevocable beneficiaries are two types of life insurance beneficiaries with vastly different meanings for you and your life insurance policy.

Revocable vs Irrevocable Insurance Beneficiary at a Glance

- Revocable beneficiaries can be taken off of your life insurance policy at any time, without needing their signed consent.

- Irrevocable beneficiaries cannot be taken off of your life insurance policy without their consent. You need their signature before removing or changing your primary beneficiary.

- Most life insurance policies will name your beneficiaries as revocable by default, though you can name specific entities or individuals as irrevocable for a good reason.

Taking out a life insurance policy is important if you want to make sure that your family, partner, or loved ones have financial security after your passing. There are two main types of beneficiaries, with revocable beneficiaries allowing you the flexibility to adapt to changing life circumstances and irrevocable beneficiaries signifying a deliberate commitment.

An important thing to note about life insurance beneficiaries is that they are legally entitled to the death benefit regardless of what’s in the policyholder’s will or the wishes of their family. Most people choose their spouse, children, or other family members to be life insurance beneficiaries, but you can also choose to name a charity or business to be a beneficiary.

What’s the difference between irrevocable and revocable beneficiaries? What do you need to consider before naming someone a revocable or irrevocable beneficiary? Read on to learn about these types of beneficiaries, and how to decide who gets named as such in your insurance policy.

Types of Life Insurance Beneficiaries

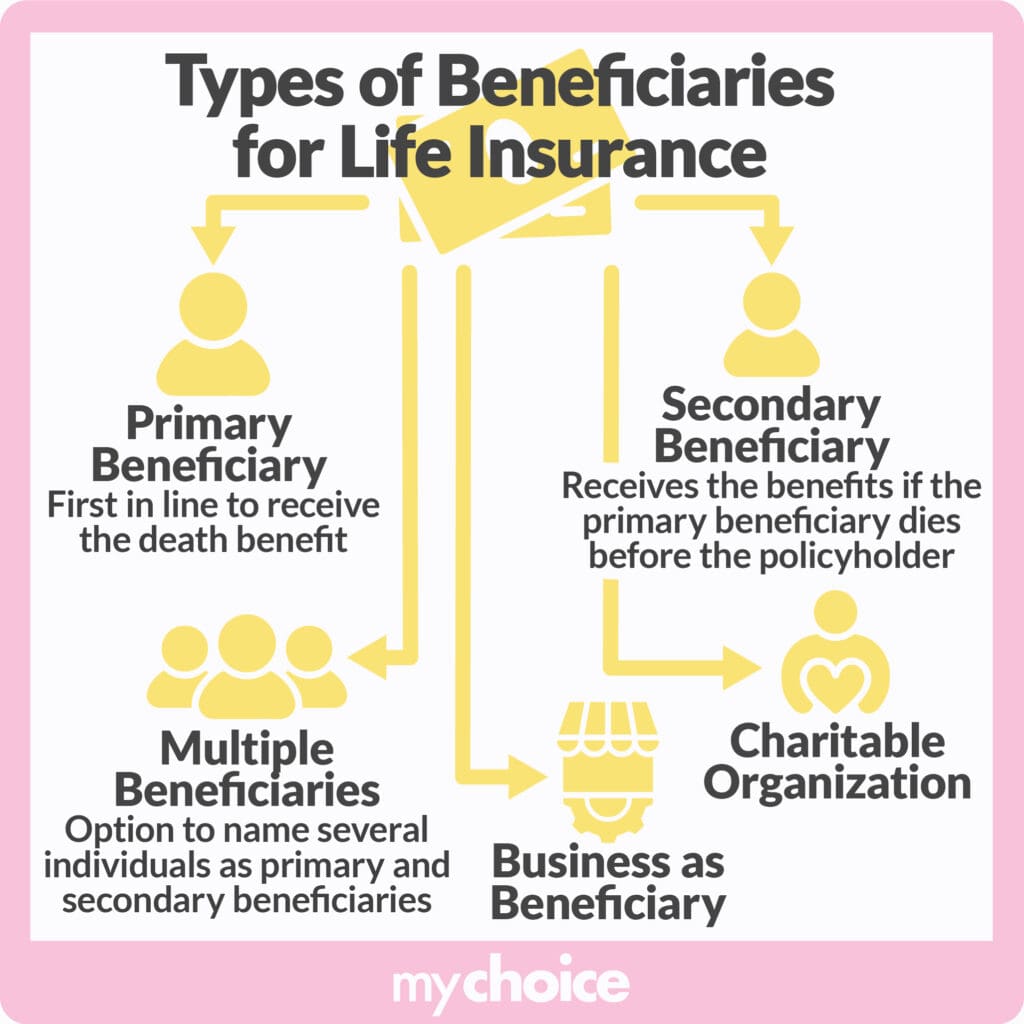

When designating a life insurance beneficiary, you need to be aware of the different types of beneficiaries there are. Here’s a brief rundown of the types of beneficiaries:

- Primary Beneficiary: The person or entity first in line to receive a death benefit in the event of the policyholder’s passing.

- Contingent or Secondary Beneficiary: The people or entities next in line to receive a death benefit. They only receive a death benefit if the primary beneficiary predeceases the policyholder, or is unable to receive the death benefit.

- Multiple beneficiaries: Multiple people can be named primary or secondary beneficiaries of a life insurance policy. This commonly includes the policyholder’s spouse and children. These beneficiaries will receive a tax-free lump sum to help pay for expenses such as funeral costs, estate taxes, bills, and living expenses.

- Charitable Organization as Beneficiary: You can choose to name a charity as a beneficiary of your life insurance policy. Life insurance premiums are usually not tax deductible in Ontario, but if you name a charity registered with Revenue Canada as a beneficiary, then your premiums can be tax deductible.

- Business as Beneficiary: you can choose to name a business as a life insurance beneficiary. This is usually used in corporate planning and is applicable for key person insurance or buy-sell agreements.

All of these beneficiary types can be classified as revocable and irrevocable beneficiaries. Most insurance policies will default to revocable beneficiaries, but there are certain situations where you may want to designate someone as an irrevocable beneficiary. Next, we’ll cover the differences between revocable and irrevocable beneficiaries, as well as when you should list someone as either.

What Does Irrevocable Beneficiary Mean?

An irrevocable beneficiary is a type of beneficiary that can’t be taken out of the insurance policy without their signed consent. Irrevocable beneficiaries have a strong claim to the death benefit, giving them security and predictability in the event of the policyholder’s passing.

The primary beneficiary of a life insurance policy is most often an irrevocable beneficiary. Declaring a beneficiary as irrevocable is a big decision that limits a policyholder’s ability to change the life insurance policy later on. Children, spouses, and other close members of the policyholder’s family are commonly listed as irrevocable beneficiaries.

There are also circumstances where you name an entity as an irrevocable beneficiary as part of a legal or financial obligation, such as if you’re the head of a business or when taking out a loan using your life insurance as collateral. This ensures a degree of security for entities that you have an obligation or duty to protect.

What Does Revocable Beneficiary Mean?

If you designate someone as a secondary beneficiary, they’re usually also a revocable beneficiary, meaning that you can take them out of your life insurance policy without their consent. These beneficiaries are usually secondary or revocable beneficiaries.

Listing someone as a revocable beneficiary gives you a lot more control over your life insurance policy. Having revocable beneficiaries is good if your personal or financial circumstances are unpredictable and can change suddenly.

When Should You Name A Revocable vs Irrevocable Beneficiary

Choosing whether to name someone a revocable or irrevocable beneficiary is a serious task. Your decision can have a huge impact on the security and stability of your loved ones in the event of your passing. That being said, there are some scenarios where it makes sense to name someone a revocable or irrevocable beneficiary.

Changing Family/Relationship Dynamics

Keeping your beneficiaries revocable can be useful to allow you to control exactly who receives a death benefit from your insurance and how much they receive.

Say you’re getting on in your twilight years and need extra care. Initially, you had two of your adult children as revocable beneficiaries in your policy with an equal split. But Child 1 visits you more often and shows more care for your well-being than Child 2. You may want to give Child 1 a bigger portion of your death benefit, without needing the consent of Child 2.

In this situation, if your children were irrevocable beneficiaries, you would need Child 2 to sign off before you could change the disbursement amount. By keeping both of your children as revocable beneficiaries, you can change your life insurance payout at will, ensuring that those most important to you receive the lion’s share of your death benefit.

Support After the Passing of a Divorced Parent

Naming someone an irrevocable life insurance beneficiary is a big step in making your loved ones secure after you pass. In the case of a divorce, one parent is usually paying child support to help with the financial burden of raising a child. However, if that parent suddenly passes away, this can cause great financial difficulty for the surviving parent and child.

If you have your former partner as an irrevocable beneficiary, that can help give your child a security net in the event of your passing. With this type of beneficiary, your life insurance policy is protected from unauthorized changes without the consent of your former spouse.

Life Insurance Policy as Collateral for a Loan

In some cases, you need to access the money in your life insurance policy while you’re still alive. In those situations, you can take out a loan from a bank by naming them as an irrevocable beneficiary as collateral. By doing this, you can access part of your life insurance payout as a loan during your lifetime.

If you’re able to pay the loan off, then you can remove the lender from your life insurance policy. However, if you pass away before the loan is paid off, the lender will be paid out from your death benefit. Having a lender as an irrevocable beneficiary gives them to confidence to allow you to take out a loan even if they’re not sure you can pay it back before you pass.

Should I Regularly Review My Insurance Beneficiaries?

Yes, you should regularly review your insurance policy and the people you list as beneficiaries. Unpredictable life events can affect how you want your life insurance beneficiaries to be protected. Events such as getting married, divorced, having kids, the passing of a loved one, or buying a new home can all have implications for your life insurance policy.

Whenever something big happens in your life, it’s important to review your life insurance policy to make sure that it remains aligned with your intentions and life circumstances. Doing regular policy reviews will help ensure that the ones closest to you are taken care of and your legacy is managed according to your wishes.

Key Advice From MyChoice

- You can choose whether to make someone a revocable or irrevocable beneficiary in your life insurance policy.

- Revocable beneficiaries offer you more flexibility and complete control of your insurance policy, while irrevocable beneficiaries ensure the financial security of your loved ones.

- You can take out loans using your life insurance policy as collateral if you name the lender as an irrevocable beneficiary.

- Choosing whether to name someone a revocable or irrevocable beneficiary is a serious decision that depends on whether you prioritize flexibility or commitment.

- Conduct a life insurance policy review regularly, or when your life circumstances change. This ensures that your life insurance payout will only go to those you want it to.