People typically view life insurance as a safety net for their loved ones in case the worst happens. However, life insurance policies can be leveraged in other ways to grow your wealth, serve as a tax-advantaged investment, and even provide a stable retirement income. Participating life insurance, often called “par insurance policies”, is a type of life insurance that accumulates cash value over time that the policyholder can use to augment their financial planning.

How does participating life insurance work? Is it worth taking out a participating life insurance plan? How can you benefit from a par life policy while you’re still alive? Read on to learn about how participating life insurance policies can help you grow your investment while safeguarding your family’s future.

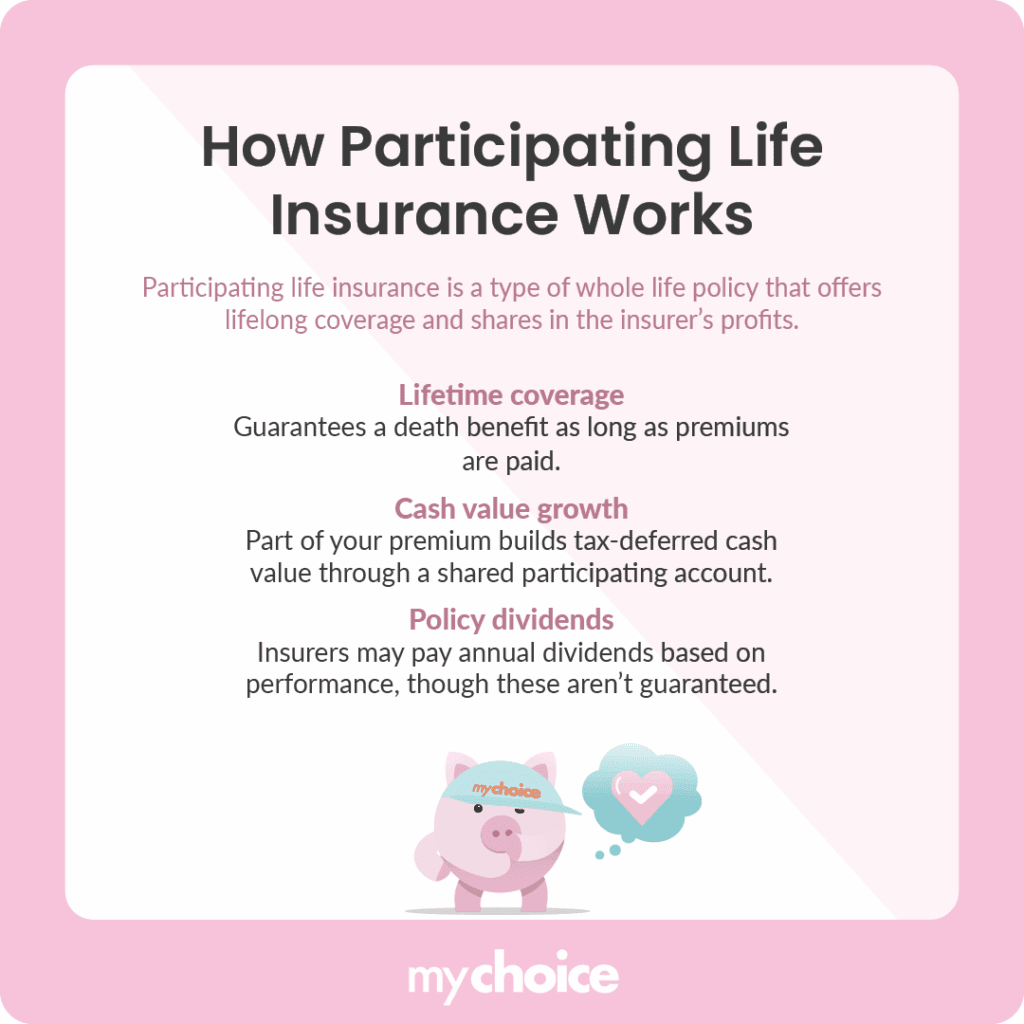

How Participating Life Insurance Works

Participating life insurance is a form of whole life insurance that covers you for the rest of your life, instead of only for a specified term. What makes it unique is its ability to “participate” in the insurance company’s profits by sharing some of the risk. Here’s how it works:

The “Silent ROI” of Participating Life Insurance

Many people are drawn to par insurance for the annual dividend payments, but there’s another layer to its value that often goes unnoticed. Suppose you don’t withdraw your dividends from a participating life insurance policy. In that case, they can be used to purchase paid-up additions (PUAs), small chunks of additional insurance that increase both your death benefit and your cash value. These additions themselves then earn dividends, compounding the value of your policy over time.

Another feature is policy loans. You can borrow against your cash value, often at competitive rates, without triggering a taxable event. This allows you to access liquidity without selling other investments or disrupting your financial plans.

Using Par Policies as a Personal Pension Bridge

One of the most powerful uses of participating life insurance is as a bridge to retirement income, especially during the early years of retirement when income sources like the Canada Pension Plan (CPP) or Old Age Security (OAS) may not have fully kicked in.

Many Canadians in their 50s or 60s use their policy’s cash value to fund a “personal pension” during their early retirement years. You can borrow against the policy or make withdrawals from the cash value, all while your policy continues to grow. This is particularly useful in scenarios where you want to delay drawing on Registered Retirement Savings Plans (RRSPs) or other taxable sources of retirement income.

Par Policies Offer Dividend Stability in a Volatile Market

Many Canadians seeking a stable investment opportunity to grow their wealth often turn to the stock market or real estate. However, these traditional investment opportunities can be unstable, exposing investors to unnecessary risk. While dividend payments from stocks are tied to corporate performance and market cycles, par policy dividends tend to be much more stable.

Canadian insurers base their par policy dividends on a diversified portfolio of long-term investments, such as government bonds, mortgages, and infrastructure. This conservative investment approach yields relatively smooth and consistent dividend rates, even during periods of public market turmoil. Major Canadian insurers have consistently paid dividends on participating policies every year for decades, including through wars, recessions, and financial crises, making par policies one of the most stable asset classes available.

How Participating Life Insurance is Used by Business Owners

Participating life insurance policies have even more utility for business owners. Instead of leaving extra retained earnings sitting in a corporate bank account where it’s exposed to passive investment income taxes, business owners can use those funds to purchase a corporately owned participating life insurance policy. There are a few benefits to this strategy:

How Dividends Can Reduce Estate Tax Pain

In Canada, there is no formal estate tax. However, handling assets after a person’s death can result in hefty taxes, especially for RRSPs, rental properties, and corporations. Participating life insurance offers a way to offset those taxes using dividends and policy value.

As your policy grows, you can use its value to pay for estate taxes or leave a larger, tax-free legacy to your heirs. This is particularly useful for:

- Families with cottages or family businesses that they want to pass on.

- High-net-worth individuals looking to minimize taxes on death.

- Charitable donors who wish to increase the size of their final donation through insurance proceeds.

When you use dividends to increase your policy’s death benefit, you can ensure that your estate has the liquidity it needs to take care of all the miscellaneous tax expenses without your heirs needing to liquidate your assets in a rush.

Key Advice from MyChoice

- Participating life insurance policies command a much higher premium than term life policies. Review your budget and financial goals to determine whether a par insurance policy is right for you.

- Different insurance companies offer varying terms and benefits for participating life insurance policies. Use MyChoice to find a policy that fits your unique needs.

- Withdrawing from or borrowing against your participating life insurance policy may reduce death benefits for your beneficiaries. Ensure that you maintain adequate coverage when taking money out of your policy.