Term life insurance comes in different types, which include decreasing term life insurance and level term life insurance. If you’re looking for term life insurance, it’s a good idea to know the difference so you can make an informed decision.

Level Term vs Decreasing Term Life Insurance: Side-by-Side Comparison

Level term and decreasing term life insurance both sit under the term life insurance umbrella. Individual term life insurance makes up 40% of the value of total policies in force in 2023, according to CLHIA.

However, there are key differences between these two types of term life insurance that you should know. This table outlines all the key differences between the two term insurance types.

| Feature | Level term | Decreasing term |

|---|---|---|

| Coverage amount | Stays constant throughout the policy | Decreases each year |

| Premiums | Stays level throughout its term | Stays level, but usually more affordable than level term |

| Best for | Providing financial protection for young children, ensuring you can pay off a mortgage | Covering debts that go down over time, like a loan or mortgage |

| Recommended beneficiaries | Young children or spouse | Spouse or family members |

| Value over time | Constant | Diminishes annually |

| Flexibility | Offers flexibility by allowing you to qualify for another term after your previous one finishes | Relatively inflexible because your coverage will constantly diminish, meaning it’ll be tough to accommodate unexpected expenses |

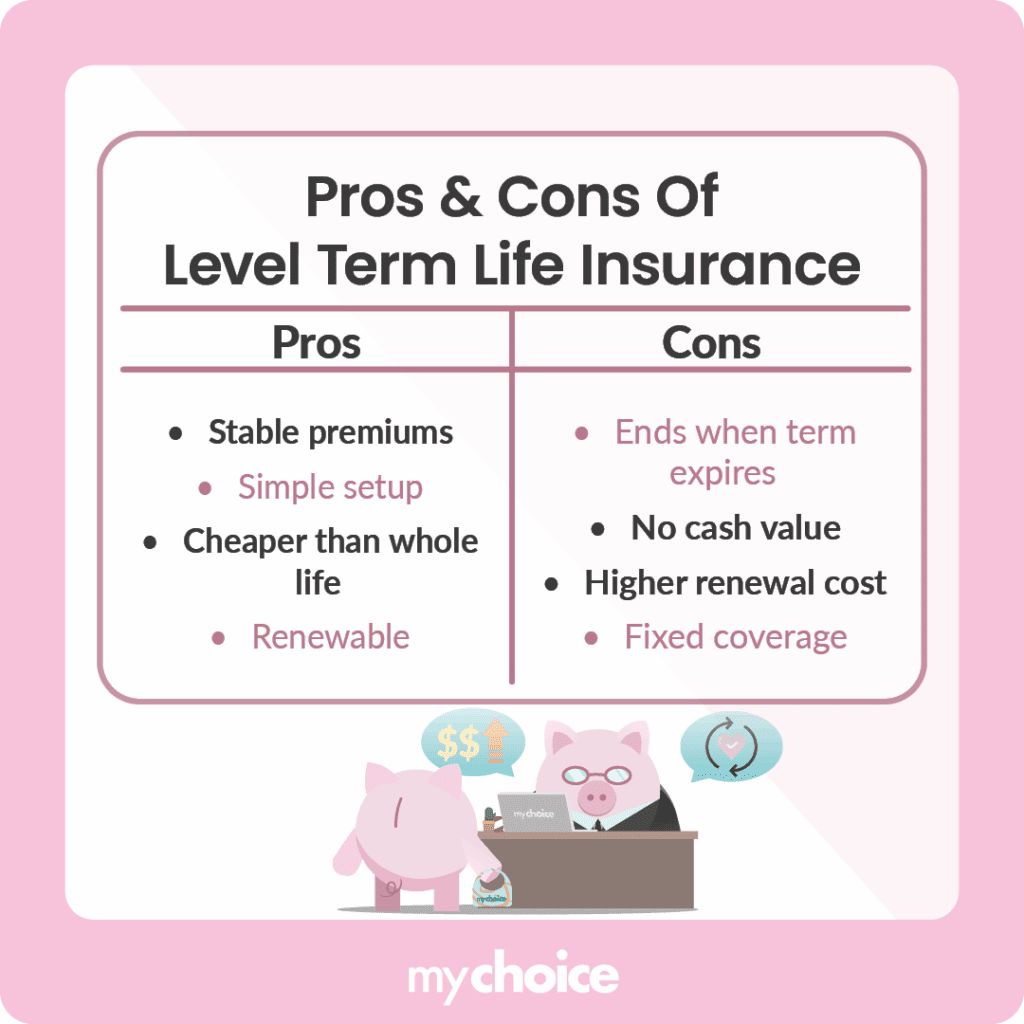

Pros and Cons of Level Term Life Insurance

Naturally, each type of insurance has its own pros and cons. Let’s take a look at the strengths of level term life insurance first:

- Stable, predictable premiums that help you budget for insurance more easily.

- Straightforward and easy to understand. You get a certain amount of coverage for a certain number of years, and that’s all you need to know about how your policy works.

- Typically, it is more affordable compared to permanent or whole life insurance coverage.

- Offers flexibility by allowing you to qualify for a new term policy after the current term expires.

On the other hand, level term insurance also has drawbacks such as:

- A set end date for the insurance coverage. Once the term passes and you don’t renew, your insurance protection is over.

- The policy doesn’t build cash value, so you’re only paying premiums for the death benefit and don’t get any investment returns.

- Policy renewal costs for another term may be more expensive since you’re applying for insurance as an older person.

- The coverage amount is fixed, and it may not fit your financial needs in the future.

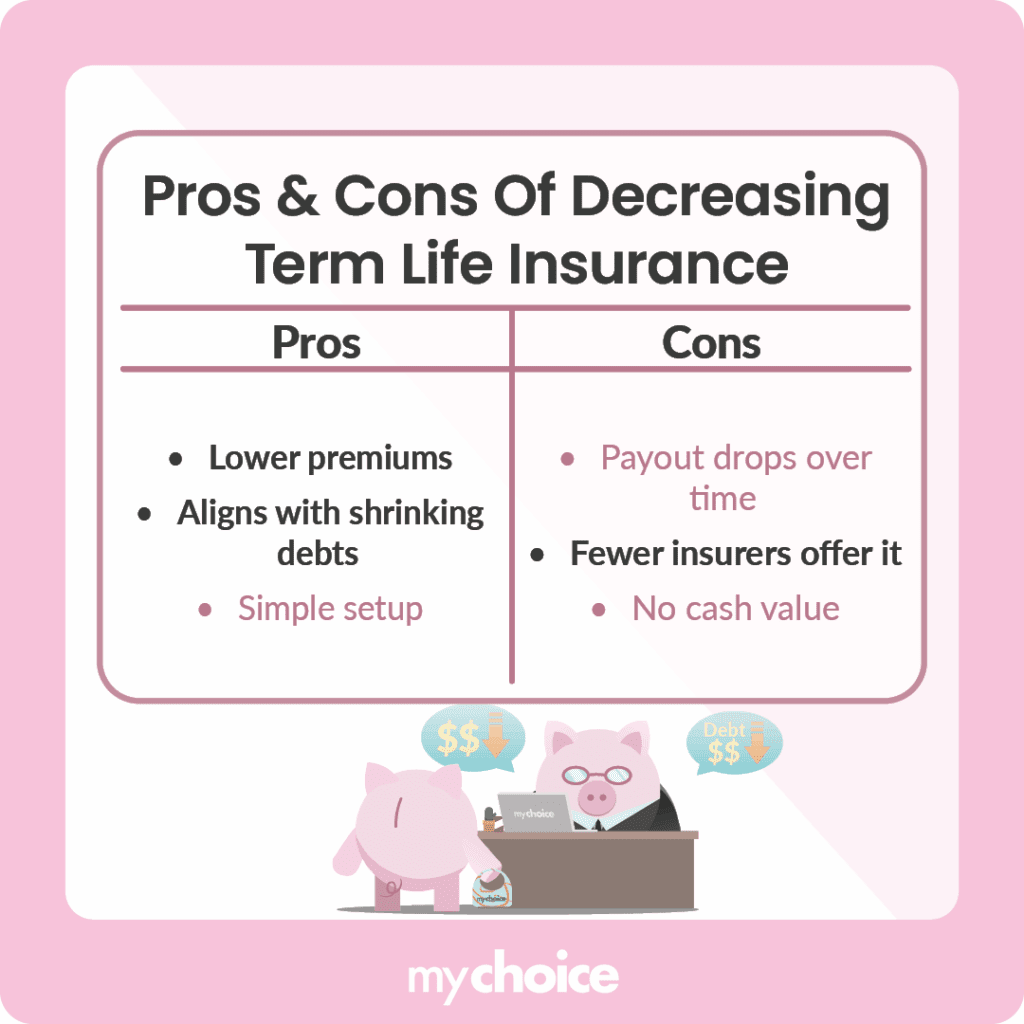

Pros and Cons of Decreasing Term Life Insurance

After examining the pros and cons of level term life insurance, let’s consider its decreasing term counterpart. The strengths of decreasing term life insurance include:

- Generally, lower costs than even level term life insurance.

- The ability to get the exact amount of protection needed to meet a certain financial obligation, like paying a mortgage.

- Simplicity and straightforwardness are typical for term life insurance since you have a decreasing death benefit and no other elements like a cash value component.

Meanwhile, its weaknesses include:

- A declining coverage amount that may not be ideal if your financial needs change in the future.

- Not all insurance companies offer decreasing term life insurance, so you may need to shop around.

- No cash value component, so you won’t build up any value in the policy.

Which One Should I Choose?

The type of term policy you should choose depends on your insurance protection needs. Since both of these are term policies, they have some overlap with each other. However, each policy has its own specialized uses. Let’s take a look:

Term Life Insurance Alternatives

In addition to level term and decreasing term life insurance, you have two other term life insurance options to choose from:

Key Advice from MyChoice

- Choose level term life insurance if you’re looking for general financial protection for your loved ones, like paying for your child’s future education expenses and providing income replacement in your absence.

- Choose decreasing term life insurance if you only want to ensure a certain financial obligation is covered, like repaying your mortgage.

- You can also opt for other term life insurance types, like renewable term and convertible term life insurance.