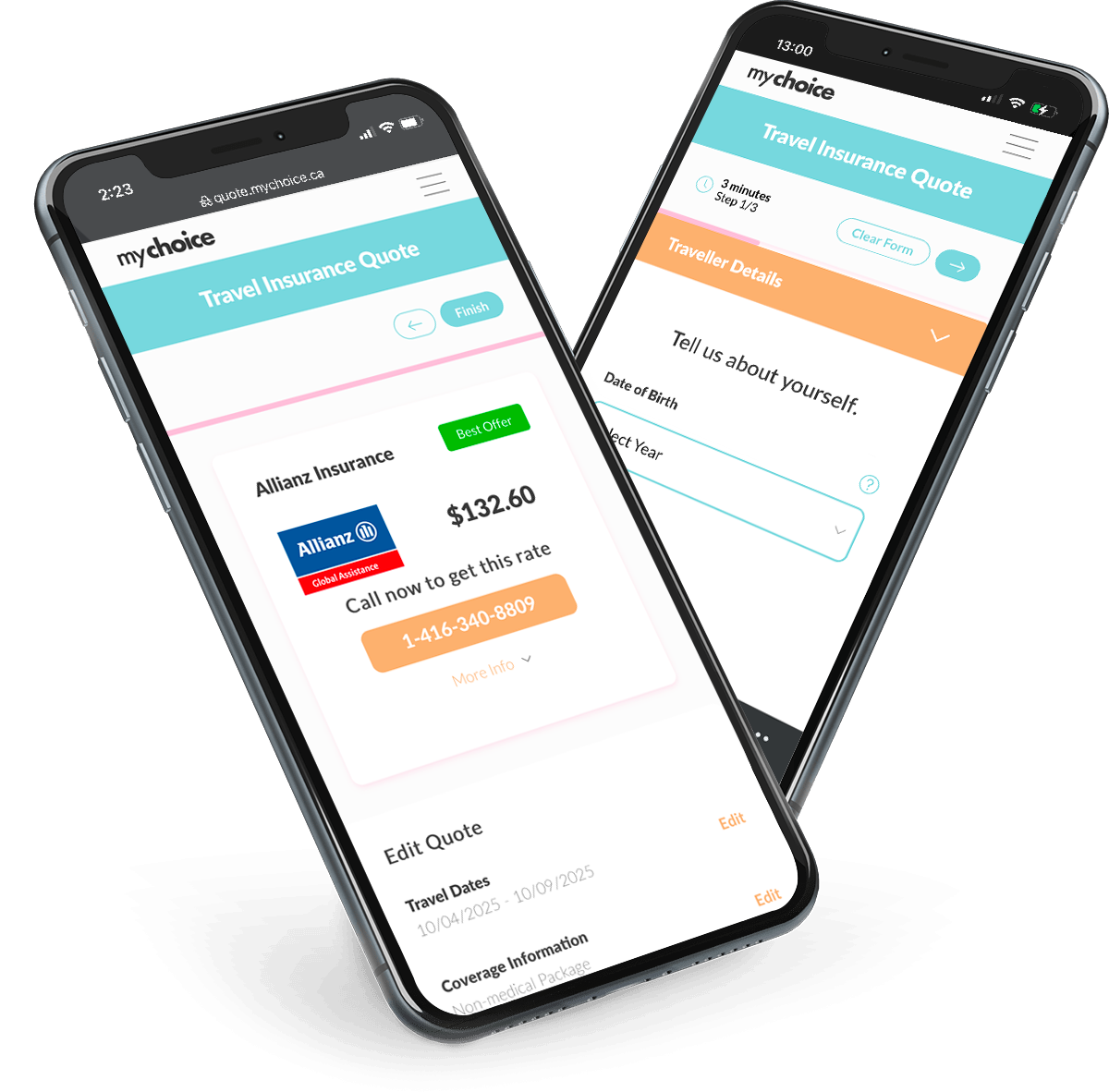

Find Your Best Travel Insurance Company in Canada

The Canadian Government highly recommends getting travel insurance if you plan to travel outside the country, even for a day trip to the United States. The good news is that many insurance companies in Canada offer travel insurance, providing you with numerous options. However, having multiple options can often make it more challenging to choose the best travel insurance for your specific needs.

To help you come to an informed decision, we’ve gathered some of Canada’s best travel insurance providers.

Check the table below for a list of the top 10 travel insurance companies in Canada. We also display their online ratings and highlight their key features to provide a clearer understanding of what each company offers.

| Life Insurance Provider | Average Online Rating | Key Features |

|---|---|---|

| Allianz | 4.5/5 | Optional extreme sports coverage available, comprehensive emergency medical coverage including return fees for travelling companions or dependent children, 24/7 psychiatrist and psychologist assistance worldwide |

| TD | 1.3/5 | Up to $10 million in coverage, top-ups for other travel insurance plans, no extra charge for dependent children coverage on select family plans |

| Manulife | 1.1/5 | Single-trip and multi-trip insurance options, comprehensive emergency health coverage, up to $10 million in medical coverage |

| Blue Cross | 1.7/5 | Customizable insurance coverage, no deductible, annual travel insurance plan |

| Travel Guard Canada | 2.8/5 | Multiple coverage plans, add ons like pre-existing medical condition waivers and rental vehicle damage coverage, bundles for pet coverage |

| CAA | 3.0/5 | Lower premiums are possible by increasing deductible, discounts and benefits for CAA members, top-ups and extensions for longer trips |

| World Nomads | 4.3/5 | Coverage for various adventure activities, up to $10 million in medical coverage, ability to get extra insurance while at the destination |

| RBC | 1.5/5 | Coverage for various adventure activities, up to $10 million in medical coverage, ability to get extra insurance while at the destination |

| TuGo | 4.1/5 | Multilingual insurance assistance, specialized packages for senior travellers, hotel, meal, and transport reimbursements in case of a trip cancellations |

| Merit Travel | 3.7/5 | Plan selection assistance by travel experts, 24/7 hotline for medical emergencies in collaboration with Allianz Global Assistance |

Which Travel Insurance Company Should You Choose?

What makes choosing a travel insurance company in Canada easier is breaking each company down by what it does best. Here’s a list of our top Canadian travel insurance companies broken down based on what they do best.

Please note that this list is based on our research, and we recommend conducting your own research or consulting with a broker for a more in-depth understanding of each company’s offerings. You should also remember that whichever travel insurance provider you choose, you should still exercise caution and pay attention to the Government of Canada’s travel advisories before setting off on your trip.

Allianz

Key Features: Wide global reach and strong coverage options.

Allianz is one of the most trusted names in travel insurance, backed by an A+ financial strength rating and decades of global experience. Canadian travellers choose Allianz because it offers comprehensive coverage options, from single-trip to annual multi-trip plans, along with strong emergency medical and evacuation protection.

Their 24/7 global assistance team is known for stepping in quickly during emergencies, and their claims process is smooth and user-friendly thanks to tools like the Allyz TravelSmart app.

Pros: Expansive global network, wide coverage choices

Cons: Limited rental car protection

TD

Key Features: Family travel insurance, travel coverage extensions

While primarily known for its car and home insurance offerings, TD also provides family-first travel insurance, ensuring you and your dependent children are covered. TD also offers coverage extensions for pre-existing travel medical insurance, allowing you to add an extra coverage period if your trip exceeds the existing plan’s coverage.

Pros: Family coverage, annual plans

Cons: Lower coverage limit, medical questionnaire requirements for seniors

Manulife

Key Features: Comprehensive emergency health coverage, single-trip and multi-trip insurance options

Manulife is a good choice for senior travellers thanks to its comprehensive health coverage that is flexible and easily extendable if needed. With up to $10 million in medical coverage, a Manulife travel policy should cover most of a senior traveller’s medical needs.

Pros: High coverage limit, covers pre-existing conditions

Cons: Lower trip benefits, long medical questionnaire

Blue Cross

Key Features: Customizability, no mandatory medical questionnaire

A major name in health insurance, Blue Cross offers comprehensive travel coverage that includes emergency medical, trip cancellation, travel delay, and baggage protection, among other benefits. Its greatest strength lies in its ability to combine and customize the protections you need.

Pros: Customizable coverage, flight delay protection

Cons: No online quotes available for people over 75, no extreme sports coverage

Travel Guard Canada

Key Features: High medical coverage amount, multiple coverage tiers

Travel Guard offers multiple coverage levels, ranging from the basic package to its premium Platinum package with comprehensive medical, trip cancellation, accident, travel delay, and baggage insurance. It also offers add-ons that cover lost or stolen business equipment, wedding cancellation coverage, and entertainment benefits in case of a return travel delay.

Pros: Unlimited medical coverage for policyholders under 54, Cancel for Any Reason upgrades

Cons: Not available for Quebec residents, coverage’s maximum age is 85

CAA

Key Features: Travel insurance customizability, coverage for dependents and pets

CAA is well-known for its car insurance offerings, but it also provides travel insurance policies with high customization options. As an extra benefit, you’ll get a 10% discount on premiums if you’re a CAA member.

Pros: Customizable policy, discount for CAA members

Cons: Medical questionnaire for applicants 60 years and up, limited coverage for extreme sports activities

World Nomads

Key Features: Mid-trip insurance extensions, a wide range of adventurous activity coverages

World Nomads is a good choice for digital nomads who don’t have a set trip schedule. Thanks to its flexibility, you can extend your policy mid-trip if you’re about to run out. World Nomads is also great for adventurous travellers who want to engage in activities that may be dangerous, like skiing and rafting, with coverage for over 200 activities.

Pros: Coverage extensions available mid-trip, high flexibility

Cons: Lacks Cancel for Any Reason coverage, no pre-existing medical condition waivers

RBC

Key Features: Unlimited medical emergency coverage (with an active government health coverage), no deductibles

RBC’s travel insurance offers a very robust medical plan for travellers aged 64, with unlimited medical emergency coverage and no deductible through its Classic Medical Plan. Additionally, this plan doesn’t require you to answer any health questions and offers multiple trip durations of up to 60 days.

Pros: Multiple trip duration options, stable pre-existing medical condition coverage

Cons: No Cancel for Any Reason coverage, low maximum medical coverage if you don’t have government health coverage

TuGo

Key Features: High customizability, Cancel for Any Reason upgrade

TuGo’s travel insurance is highly customizable, with options to modify the amount and types of coverage you need. You can either select its package options or choose individual coverage to build your ideal package. TuGo also offers additional riders for sports and activities such as BASE jumping, paragliding, and wingsuit flying.

Pros: Up to $10 million in emergency medical coverage, coverage for extreme sports activities

Cons: All-inclusive package is limited to travellers 59 and under, and medical questionnaire requirements for travellers over 60

Merit Travel

Key Features: Travel professional assistance, collaboration with Allianz Global Assistance

Rather than an insurance company, Merit is a travel agency that offers travel insurance. However, it does offer travel insurance in collaboration with Allianz Global Assistance, which provides a robust network of healthcare providers worldwide. The website also states that you can talk to a Merit Travel Expert for more information on the company’s insurance offering.

Pros: Uses Allianz’s global network for medical and travel assistance

Cons: Limited information available online

How Do You Buy Travel Insurance in Canada?

To buy travel insurance in Canada, you can go through any of these different insurance purchase channels:

How Do You Make Travel Insurance Claims in Canada?

Follow these steps to make a travel insurance claim in Canada:

Methodology for Selecting Our Top Canadian Travel Insurance Companies

Our assessment and selection of Canada’s top travel insurance providers take into account factors that can impact a policyholder’s satisfaction with an insurer’s performance. Here are the factors we take into account to create this list: