Education costs in Canada are rising steadily, and many parents are exploring various tools to prepare for these expenses. The Registered Education Savings Plan (RESP) is a traditional way to fund a child’s education, but a lesser-known, potentially powerful alternative is using life insurance for funding.

It may seem unconventional at first glance, but permanent life insurance can be a flexible, tax-efficient way to help pay for your child’s education and other expenses as they grow up.

Life Insurance as a Savings Tool

Most people equate life insurance strictly with death benefits. But with a participating whole life insurance policy, each premium you pay does two things:

- Pays for coverage: Guarantees a death benefit

- Contributes to cash value: This is like a mini investment account within the policy that grows over time.

Your insurer invests the cash value on your behalf. As those investments grow, they generate dividends that can be reinvested to purchase more insurance (increasing death benefit and cash value), reduce your premium, or be taken as cash. The earlier you start, the more time you give the cash value to grow and the more options your child will have down the road.

Successful Case Studies

A real-life example was in an issue of The Globe and Mail, where a Canadian family took out a participating whole life insurance policy on their daughter when she was just a baby. They contributed about $2,600 every year ($216 per month).

After 20 years, the policy had grown to around $70,000 at an assumed 6.35% annual dividend, which was enough to help cover her master’s degree expenses. Had they contributed the same amount to an RESP, they estimated they could’ve had about $95,000, including government grants. But they chose a mix of RESP and insurance for more flexibility.

If their daughter hadn’t gone to school, the policy funds could have been used for a home down payment, business, or retirement. Left untouched, the cash value could have grown to $135,000 by age 30, $250,000 by 40, and close to $1 million by 65. And if the unthinkable happened, the policy would’ve paid out a $300,000 tax-free death benefit. These are features RESPs don’t offer.

RESP vs. Life Insurance for Education

Here’s a simple comparison table to illustrate their differences more clearly:

| Feature | RESP | Participating Life Insurance |

|---|---|---|

| Government Grants | Yes, with $7,200 lifetime maximum amount that can be received from the CESG until age 17. | No government grants |

| Flexibility | Must be used for post-secondary education | Can be used for anything |

| Returns | Market-dependent, approximately 4% | Typically 4% to 6% with stable growth |

| Fees | Low to moderate, depending on investment | Higher premiums, especially in early years |

| Liquidity | Withdrawals allowed with conditions | Access via withdrawal, policy loan, or bank loan |

| Ownership Transfer | Not directly transferable to child | Can be transferred tax-free after child turns 18 |

When Life Insurance Might Make Sense for Education

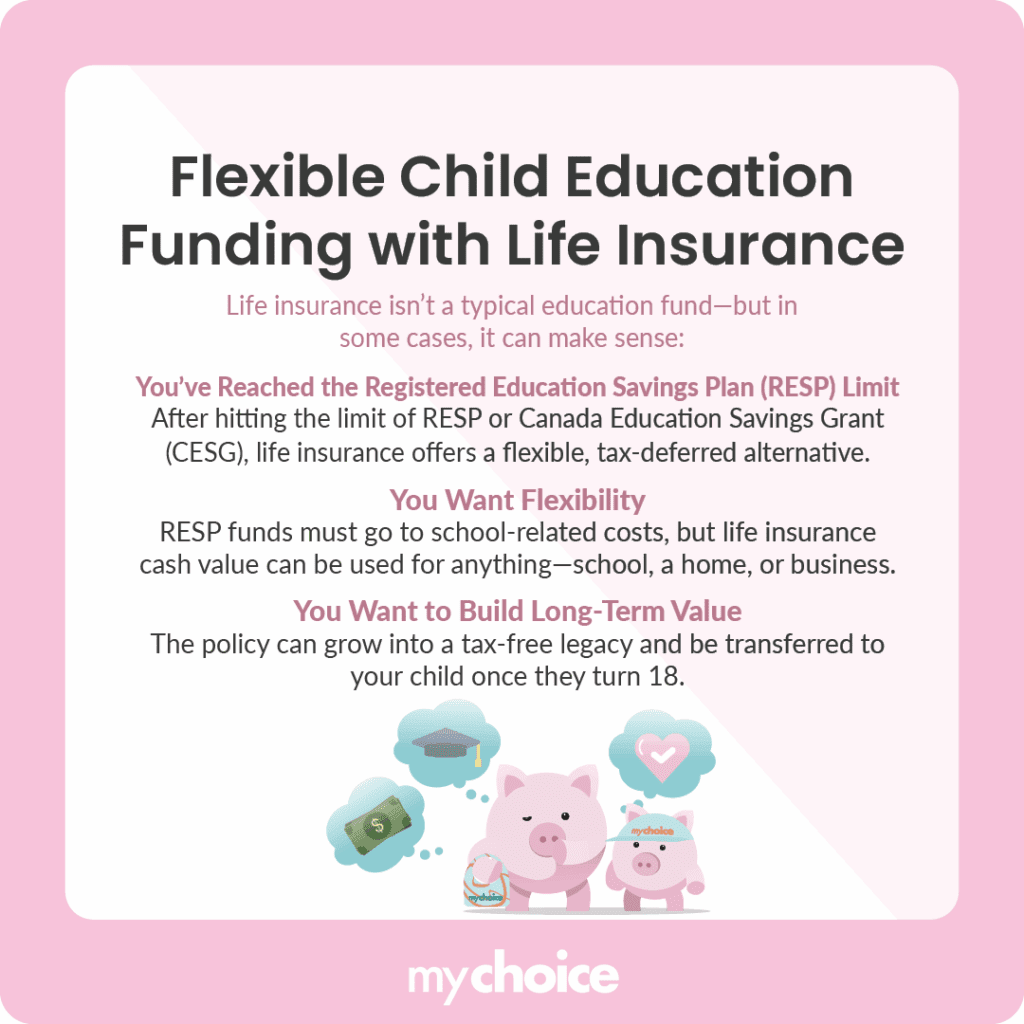

Life insurance for education funding isn’t always the right move, but it can be in situations like these:

Key Advice from MyChoice

- Not all life insurance policies build cash value. Look specifically for participating whole life insurance, which offers stable, tax-sheltered growth and annual dividends.

- Look into policies that can be set up to be fully paid in 10 or 20 years. You’ll be done contributing by the time your child reaches post-secondary age, but the policy will keep growing.

- Consistency is key. Whether it’s $100 or $250 per month, choose a premium that fits your budget long-term.