Generally, life insurance pays out when the insured person passes away. However, there are some conditions where a life insurance policy won’t pay out. Let’s take a look:

Why Life Insurance Won’t Pay Out at a Glance

- There’s not enough evidence for the policy to provide payment. The evidence should confirm that the policyholder passed away and the claimant has the right to receive payment.

- The policyholder commits suicide within a certain period of time. You can read our article about how suicide affects your life insurance to learn more.

- The beneficiary is a minor or is otherwise under a legal incapacity. In this case, the money may be paid out to their representative, if there’s one.

- The policy lapsed because the insured didn’t pay premiums on time. However, if the insured person is still alive, they can reinstate coverage by paying the overdue premium within 30 days after the grace period ends.

- The insured person didn’t give accurate answers to their health questionnaire.

- The insured person passes away before coverage fully kicks in.

- The insured person commits fraud.

Now that we’ve learned what disqualifies life insurance payout, you may have more questions, like “How do you make a life insurance claim?” or “What happens if your claim gets denied?” We’ve got you covered. Keep reading to learn more.

Claiming the Insurance Payout

Contact the insurance company or agent to claim a life insurance death benefit. Ensure you have supporting documents like a death certificate to back your claim up.

From there, the insurance company will review the policy and decide whether the death benefit can be paid out. However, they may ask you for supporting documents like accident reports or medical records to ensure your claim isn’t fraudulent.

Life Insurance Death Benefit Payment Period

The period between making a claim and receiving the payout varies and can take anywhere from a couple of weeks to a few months. But generally, death benefits take 30 to 60 days to pay out. You can read our guide to life insurance payouts in Canada to learn more.

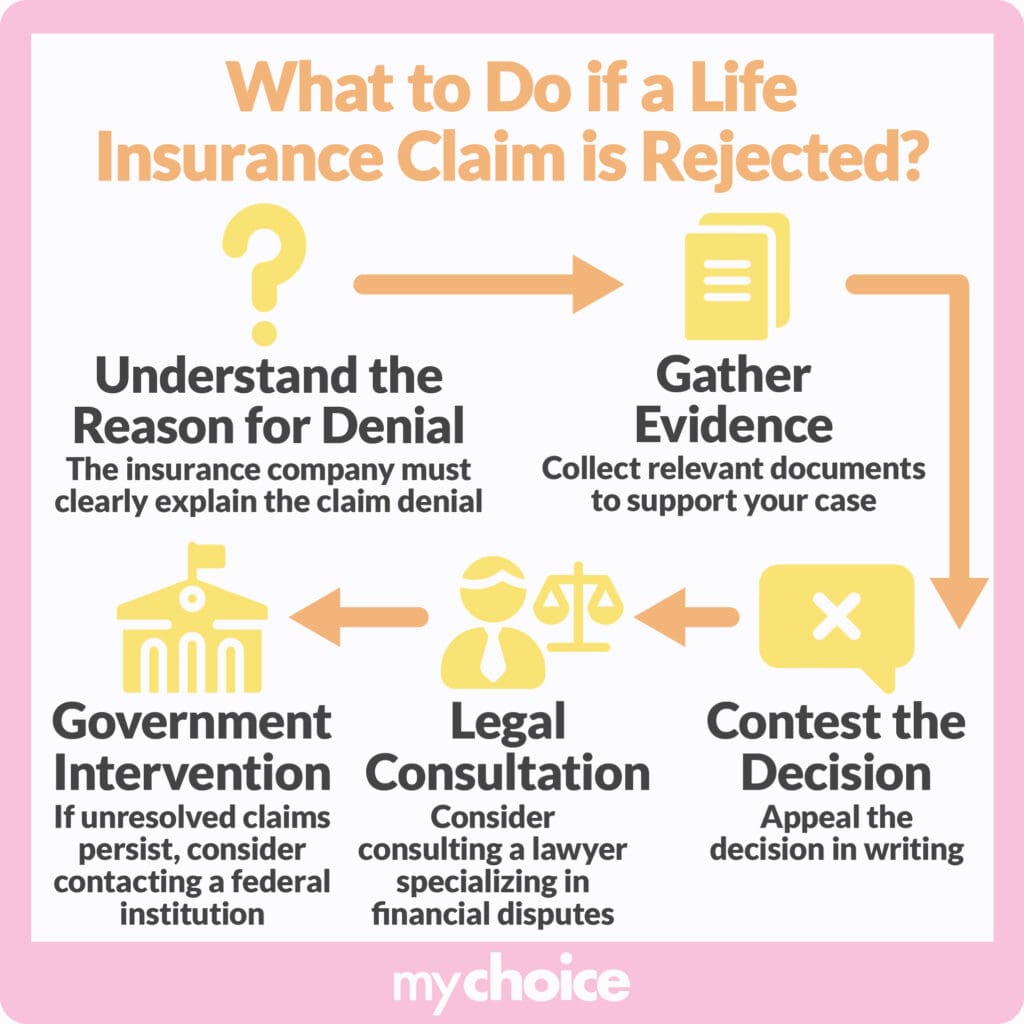

What Happens When Your Life Insurance Claim Gets Denied

When your life insurance claim gets denied, then you won’t receive the death benefit payout. Your insurer must explain why your claim was denied, so be sure to ask them for more details and document the conversation to support your case if you want to contest the decision.

Resolving Life Insurance Claim Denial

You can contact the insurance company’s head office to try resolving a life insurance claim denial. If you’re unsatisfied with the outcome, contact the OmbudService for Life and Health Insurance (OLHI) or your local insurance regulator for more assistance.

To make it easier to understand, here’s a step-by-step guide to resolving life insurance claim denials according to the Financial Consumer Agency of Canada:

- Discuss the denial with your insurance company. During this process, you should provide your name, policy details, and supporting documents, as well as record the conversation and the person speaking. You should also ask the insurer for a written record of the denial decision.

- If your problem still remains unresolved, you can seek a third-party review from the OLHI or the L’Autorité des marchés financiers (AMF) if you live in Quebec.

Preventing Claim Denials

With the risk of claim denials, your life insurance policy in Canada may become useless, and you may not be able to protect your beneficiaries. Fortunately, there are ways for you to prevent claim denials. Here’s how:

Work With Trustworthy Insurance Brokers or Agents

Ensuring the claim on your policy won’t be denied starts at the very beginning. Pick an insurance broker or agent with a good track record for honouring claims. Check reviews, ask trusted friends or family members, and ask as many questions as you need before you decide on an insurance company or broker.

A good insurance broker or agent isn’t just focused on selling their product. They listen to your concerns, understand your needs, and pick life insurance coverage to address them. Independent brokers should also have a great knowledge of life insurance products offered by various insurers.

Understand Your Insurance Policy

Your insurance policy document may have lots of unfamiliar and complicated terms, but you have to understand it fully. Read the document from top to bottom and make sure you learn all of its nuances. If you don’t understand something, don’t be afraid to ask your broker or agent. Don’t sign an agreement or purchase a policy until you fully understand your policy.

Consult Your Doctor

Sometimes, life insurance doesn’t pay out because the answers on your health questionnaire or your health exam results don’t align with reality. If you can, talk to your doctor before completing a health exam or undergoing a medical exam. With a full picture of your health, you can complete the questionnaire accurately and ensure nothing is missed during your medical exam.

Pay Your Premiums on Time

A lapsed policy might mean your beneficiaries won’t get your death benefit payout or receive less money than they should. Make sure to stay current on your premium payments so your policy will still be active even if you pass away unexpectedly.

Tell Your Beneficiaries and Prepare the Paperwork

Life insurance death benefits are only good if your beneficiaries can claim them. Make sure your beneficiaries know about your life insurance policy so they don’t have to spend time checking whether you have one. It’s also a good idea to let them know where your insurance documents are so they instantly know where to look after you pass away.

Appoint Multiple Beneficiaries if Possible

If you pass away when your primary beneficiary is deceased and you don’t have a secondary beneficiary, the money will go to your estate. If you want your money to go directly to a loved one, make sure you appoint primary and secondary beneficiaries. For instance, you can appoint your spouse as the primary beneficiary and your child as the secondary.

Get Insured Earlier

Life insurance policies usually have a two-year contestability period. This is a period starting from when you sign up for the policy and when an insurer can investigate your beneficiaries’ claims regardless of your cause of death. Insurers implement this to reduce misrepresentation and fraud, which means the claim on your policy may be subject to more scrutiny if you die within the two-year period.

Since we can’t predict when you die, it may be wise to get insured earlier so you can get the contestability period out of the way faster. As an extra benefit, getting insured earlier means you may get lower rates since age affects your life insurance premiums.

Key Advice From MyChoice

Now that we’ve learned the top reasons why your life insurance death benefit may not be paid out, here are some top tips to remember:

- Life insurance may not pay out or provide a reduced payout for various reasons. Some examples include a lack of evidence, insurance fraud, inaccurate answers on the health questionnaire, and a lapsed policy.

- To claim a life insurance payout, you need to contact the insurance company and provide supporting documents. The claims process can take anywhere from a couple of weeks to a few months, but they generally take 30-60 days to pay out.

- If your life insurance claim gets denied, you can discuss the denial with the insurance company. If your issue still isn’t resolved, you can ask for help from a third-party organization like the OLHI.

- To prevent claim denials, you should work with trustworthy insurance brokers, understand your policy, prepare your beneficiaries, and pay insurance premiums on time.