For high net worth (HNW) Canadians, life insurance isn’t just about providing security for their loved ones. It’s also a financial planning tool that can enhance wealth and ensure legacies are correctly executed. With the right strategies, a policy can help business owners, professionals, and other HNW individuals find opportunities for investment, philanthropy, and estate planning.

How can you use life insurance to further your financial goals? What specific strategies do high net worth individuals use? Read on to learn how to leverage life insurance for better financial planning and how to choose the right life insurance policy.

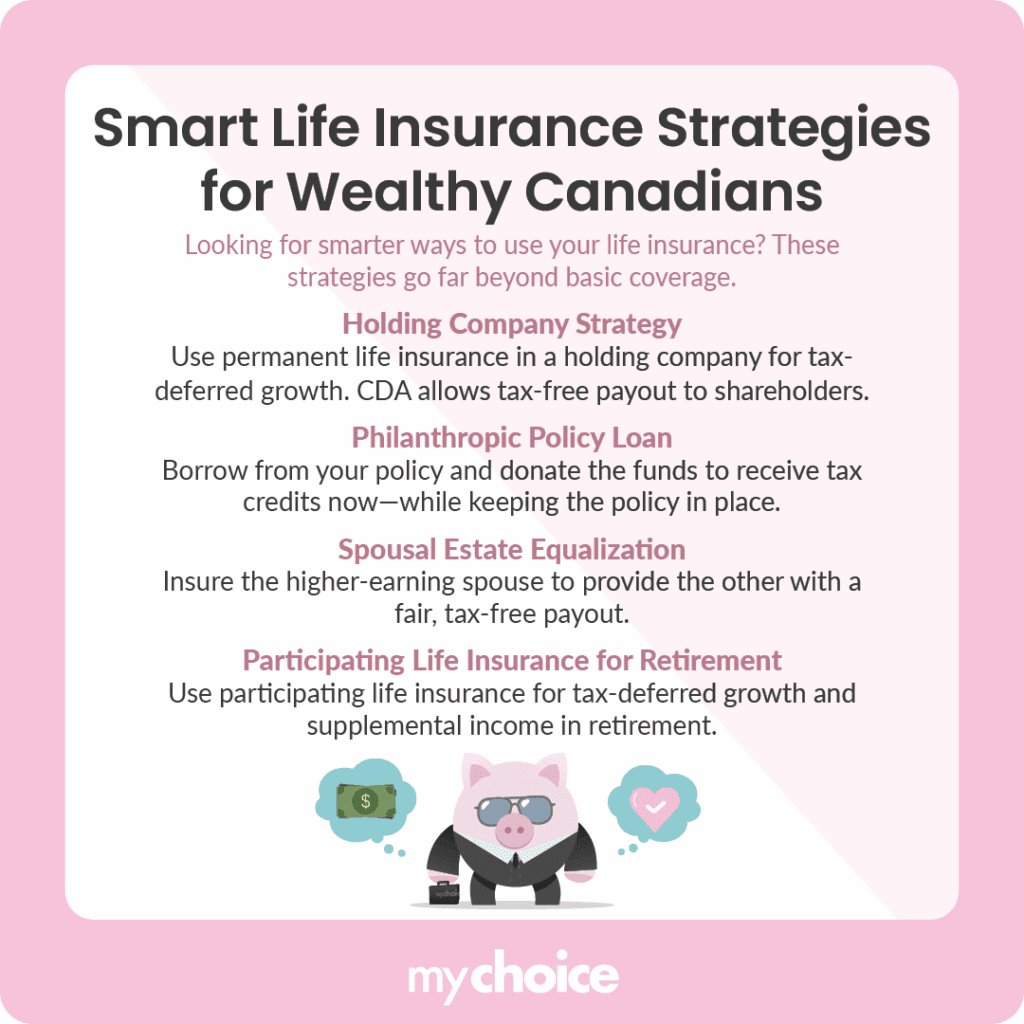

Advanced Life Insurance Strategies for High Net Worth Individuals

When used strategically, life insurance can be a powerful tool beyond basic protection. Let’s explore how you can use a policy to optimize your tax outcomes and enhance estate plans:

1. Life Insurance as a Leveraged Investment Inside a Holding Company

A permanent life insurance policy held within a holding company offers asset growth and enhanced estate planning benefits. The cash value within the policy grows tax-deferred, often with significantly more stability than equities or mutual funds. This strategy is gaining popularity with business owners who have surplus corporate capital and are looking for long-term, tax-advantaged investments.

But how does this work for the holding company? It acts as a form of collateral, allowing the company to borrow against its cash value, providing a source of liquid capital for investment or business expenses. Upon death, the death benefit pays off the loan, and the excess proceeds are credited to the Capital Dividend Account (CDA), allowing the remaining corporate assets to flow to shareholders tax-free.

2. Philanthropic Leveraging: Donation of Policy Collateral, Not Proceeds

Many HNW individuals want to donate to a charity using their life insurance policy’s death benefit. However, there is a way to do this while the policyholder is still alive. Instead of naming a charity as the primary beneficiary of the policy, it’s possible to take out a loan against the policy’s death benefit and donate the value of that loan to the charity instead.

This advanced philanthropic strategy enables HNW individuals to retain ownership and control of their life insurance policy while benefiting from current-year donation credits, which can significantly reduce their tax liability. This is very useful for people who want to offset large tax events through charity while still growing the policy’s cash value.

3. Using Life Insurance to Equalize Spousal RRSP/TFSA Disparities

In many high-income households, wealth accumulation is not evenly distributed between spouses. One partner may have a generous pension, significant Registered Retirement Savings Plans (RRSPs), or a high-income career, while the other has less accumulated wealth. This imbalance can lead to perceived or actual inequity during retirement and estate transfer.

A life insurance policy on the higher-wealth spouse, with the other spouse as beneficiary, helps rebalance these differences. It ensures that upon death, the lower-asset spouse receives a tax-free benefit to offset any disparity in registered account values. Policies can be structured so that premiums are funded by the higher-income spouse while still directing benefits to the other.

4. Personal Pension Replacement Using Participating Life Insurance

For incorporated professionals like consultants and lawyers, participating whole life insurance provides a valuable retirement planning option, especially if their RRSP contributions have been maxed out. Unlike RRSPs, which are taxable upon withdrawal, cash values within a participating policy grow tax-deferred and can be accessed via policy loans or withdrawals in retirement, often without triggering immediate tax.

Participating life insurance policies pay annual dividends, which can be used to purchase additional coverage, grow the cash value, or reduce premiums. This compounds over time, mimicking the structure of a defined benefit pension plan. Because the policy grows even after the funds are accessed, it can provide both retirement income and a legacy for heirs or charities.

How to Choose the Right Policy

What kind of life insurance policy should you choose for your financial goals and estate plan? Here’s a table with some common use cases and the best life insurance policy option for that scenario:

| Use Case | Best Option | Explanation |

|---|---|---|

| Estate Tax Funding | Whole Life | Provides a guaranteed death benefit and stable long-term growth. Ideal for covering capital gains taxes at death. |

| Investment Leverage | Universal Life | Offers flexible investment options within the policy. Can be customized to align with business goals. |

| Income Replacement | Term Life | Cost-effective for short- to medium- term needs, such as mortgage or education funding. |

| Pension Alternative | Participating Whole Life | Builds cash value steadily and allows tax-efficient borrowing during retirement. |

| Wealth Transfer to Children/Grandchildren | Whole Life | Can be gifted or cascaded tax-free to next generations, supporting long-term legacy planning. |

Policy Structuring Considerations

Using a life insurance policy for financial planning means that you need to structure it correctly to achieve the desired end goal. The ownership structure of a policy can significantly impact tax efficiency, creditor protection, and policy flexibility.

Tax Treatment Summary Table

Here’s how the different components of a life insurance policy are treated tax-wise:

| Component | Tax Treatment in Canada |

|---|---|

| Death Benefit | Tax-free to primary or contingent beneficiary, if structured correctly. |

| Cash Surrender Value (CSV) | Growth inside policy is tax-sheltered. Withdrawals may trigger tax. |

| Policy Loan | Not taxable unless policy is surrendered. Interest may be deductible in corporate-owned policies. |

| Adjusted Cost Basis (ACB) | ACB affects the taxable portion of withdrawals or policy disposition. Lower ACB can trigger higher tax on disposition. |

| Transfers Between Policyholders | Transfers between individuals or entities may trigger tax depending on fair market value and ACB. |

| CDA Credit (Corporation Owned) | Death benefit minus ACB credited to CDA for tax-free dividend distribution. |

| Gifted Policies | May have tax consequences based on fair market value and ACB at the time of gift. |

Key Advice from MyChoice

- Every life insurance policy for HNW Canadians should start with a tax and estate strategy first, before finding an insurance product that aligns with their goals.

- Advanced insurance strategies require advanced planning. Consult a tax specialist and your insurance provider to ensure your plan is executed correctly.

- Not every insurance provider will carry the product that you require. Use MyChoice’s online life insurance comparison tool to compare quotes and policies between insurers.