People usually buy life insurance based on their current financial circumstances and protection priorities. Over the years, these circumstances can change, and your policy won’t fit your needs anymore. When that happens, you can either change your life insurance policy or cancel it outright in favour of a new one.

Reasons to Cancel Your Life Insurance Policy

People often cancel their life insurance policies for various reasons. Here are some of the more common ones:

Do You Get Penalties for Cancelling Life Insurance?

Whether you get penalties for cancelling life insurance depends on your policy type. Generally, there are no penalties for cancelling term life insurance. Your protection simply ends, and all the money you paid for premiums becomes a sunk cost. However, some term policies may impose cancellation fees, so check your policy document before cancelling your policy.

Whole-life policies work similarly. They generally don’t impose penalties, but you may need to pay a cancellation fee. However, you likely won’t get the entire cash value you built up in your whole life insurance policy, because instead of the whole cash value, you receive the amount listed as your cash surrender value.

Alternative to Cancelling: Pausing Your Policy

If you can’t pay your premiums, you can consider pausing your policy. Note that this doesn’t mean you stop paying premiums and freeze your life insurance policy. Instead, this is an option available for whole life insurance policyholders, where you can use your accumulated cash value to pay for your insurance protection.

Since you’re using your cash value to pay premiums, this might not be a viable option if your policy is new and hasn’t accrued enough cash value.

When Cancelling Your Policy Costs More

Cancelling your life insurance policy means you won’t have to pay premiums anymore. However, cancelling your policy isn’t always the best move because it can cost you even more than keeping your policy. It might sound counterintuitive, but there are scenarios when cancelling your policy will cost you more money down the line.

One of the most common examples when cancelling your policy costs more is if you plan to reapply for life insurance after holding your previous policy for some time. Insurers generally set affordable rates for younger and healthier applicants because they have a lower risk of developing medical conditions and diseases that come with age.

If you cancel your current policy and reapply a few years later, you’re not as young as you used to be, and you may have developed conditions that make you a riskier person to insure, saddling you with higher rates.

Cancelling your life insurance may also cost more if you haven’t achieved the objective you want to achieve with life insurance, like protecting your children’s financial future or making sure your mortgage gets paid. If you cancel your life insurance before your children become financially independent or before your mortgage gets paid off, there’s a chance that you might pass away or otherwise be unable to provide for your family.

Even if you have achieved your objectives, cancelling your policy isn’t always the best idea. Four out of ten Canadians say that they’ll face financial hardship within six months if their primary wage earner dies unexpectedly. So, if you’re the family’s breadwinner and you’re not sure if your family can stay financially stable if you pass away, it’s a good idea to hold onto your policy.

When Cancelling Your Policy Makes Sense

Cancelling your policy makes sense if you don’t need your life insurance policy anymore. If you bought life insurance for a certain purpose, like ensuring your child is financially secure until they become independent, and they have become independent, it might be a good idea to cancel your policy if premiums are burning a hole in your finances.

However, it’s a good idea to think before you decide to cancel your policy. Would cancelling your policy be better for your finances than keeping it?

For term life insurance policies, you don’t get anything back once you cancel the policy, so it might be a better idea to wait out the term and not renew. For whole life insurance policies, you get part of your cash value back, so you may want to wait a bit until your cash value accumulates more money before cancelling to increase the money you receive.

Cancelling a Policy Cost-Effectively Without Breaking the Rules

Before you pull the trigger on cancelling your life insurance policy, read the rules and policy details carefully. Use this guide from the Insurance Bureau of Canada to help you understand your policy better.

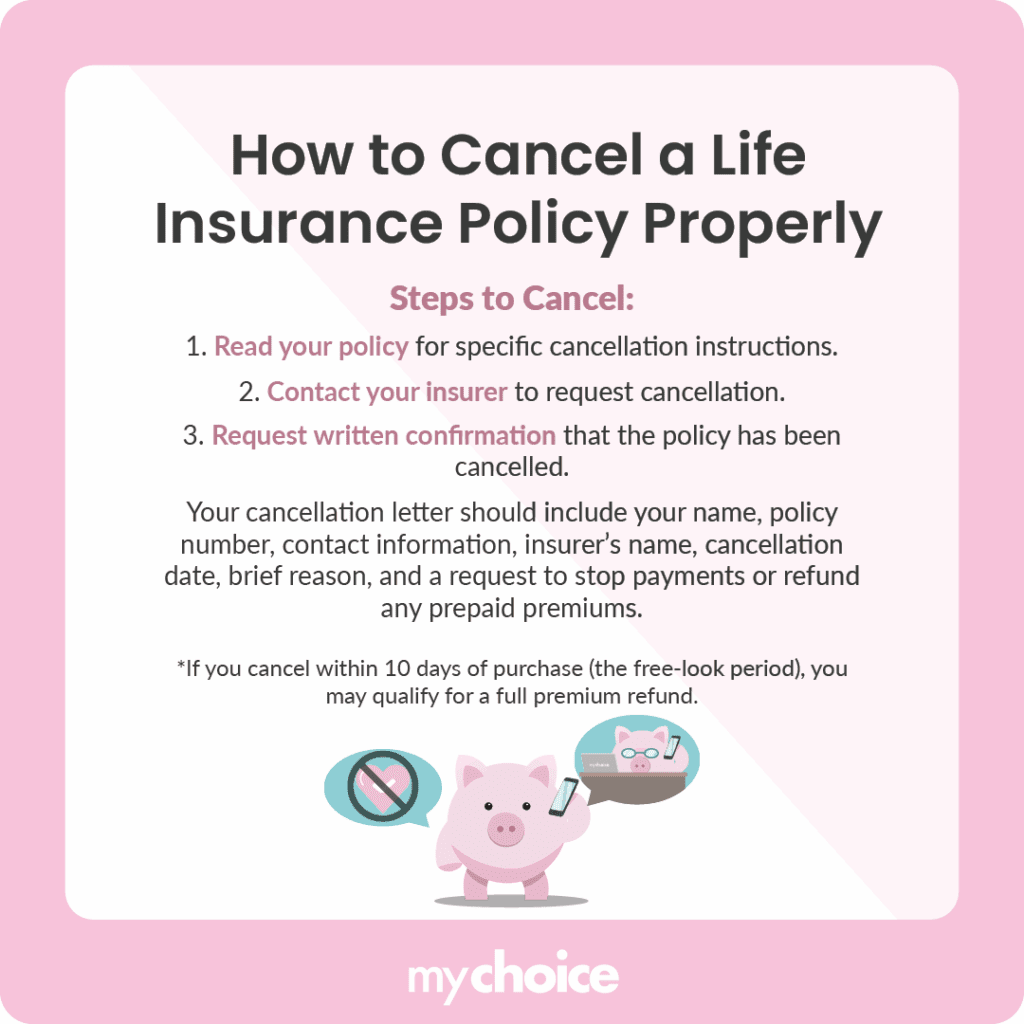

Here’s how you can cancel life insurance:

- Read your policy and identify specific steps you need to follow to cancel your policy.

- Contact your insurance provider about cancelling your policy.

- Request a written confirmation from the insurer that the company cancelled your policy.

If you’re thinking about cancelling a freshly-obtained life insurance policy, you can get a premium refund if it’s cancelled within the free-look grace period. Your free-look period usually lasts 10 days.

Writing a Life Insurance Cancellation Letter

Your insurer may ask for a life insurance cancellation letter as written documentation of your request. Even if you’re not required to send one, it’s still a good idea to do so, as it provides written documentation that you requested to cancel the policy.

Here’s what you need to include in the letter:

- Your name and policy number

- Your address and contact details

- The insurance company that provided your policy

- The current date and the requested cancellation date

- Reasons why you requested a cancellation

- Request to stop automatic payments or provide a refund if you paid in advance

You don’t need to write a long-winded story about why you need to cancel the policy. Keep the letter simple and firm, outlining your desire to cancel.

Do I Get Money Back If I Cancel My Life Insurance?

You may or may not get money back if you cancel your life insurance, depending on the nature of your policy. Term life insurance won’t give you any money back after you cancel the policy since it only provides insurance coverage and doesn’t accumulate cash value as an investment component.

You’ll likely get money back if you cancel a whole life insurance policy since you have cash value stored in the policy. Generally, you won’t get your entire cash value back because you’ll only get the cash surrender value. Your cash surrender value is generally calculated as your cash value minus your surrender charge.

Surrender charges usually start out relatively high and then go down as time goes on. Eventually, your policy may do away with the surrender charge altogether, letting you get the entire cash value back when you cancel the policy.

Check our term vs whole life insurance comparison to learn more about the differences between these types of insurance.

Key Advice from MyChoice

- Instead of cancelling your life insurance policy, you have the option to pause premium payments by using your cash value to pay for your insurance. Note that this only works if your insurance policy has a cash value component.

- There are times when cancelling your life insurance policy will cost you more money, like if you’re planning to get another policy in the future. Weigh the risks and benefits before cancelling your policy.

- Before cancelling your policy, read the rules and policy document carefully to ensure you won’t incur any penalties.