Getting life insurance as a freelancer can be challenging because you’re essentially on your own from application to getting the policy. There’s no employer to guide you or provide group coverage. But skipping life insurance may leave you and your loved ones more vulnerable than traditional employees.

Because freelancers don’t have steady paychecks or job security, your income is gone the moment you pass away. But how do you even begin to apply for life insurance and choose the right policy type? Let’s take a closer look at why freelancers should get life insurance, what type they should get, and tips to get adequate coverage.

Main Reasons to Get Life Insurance as a Freelancer

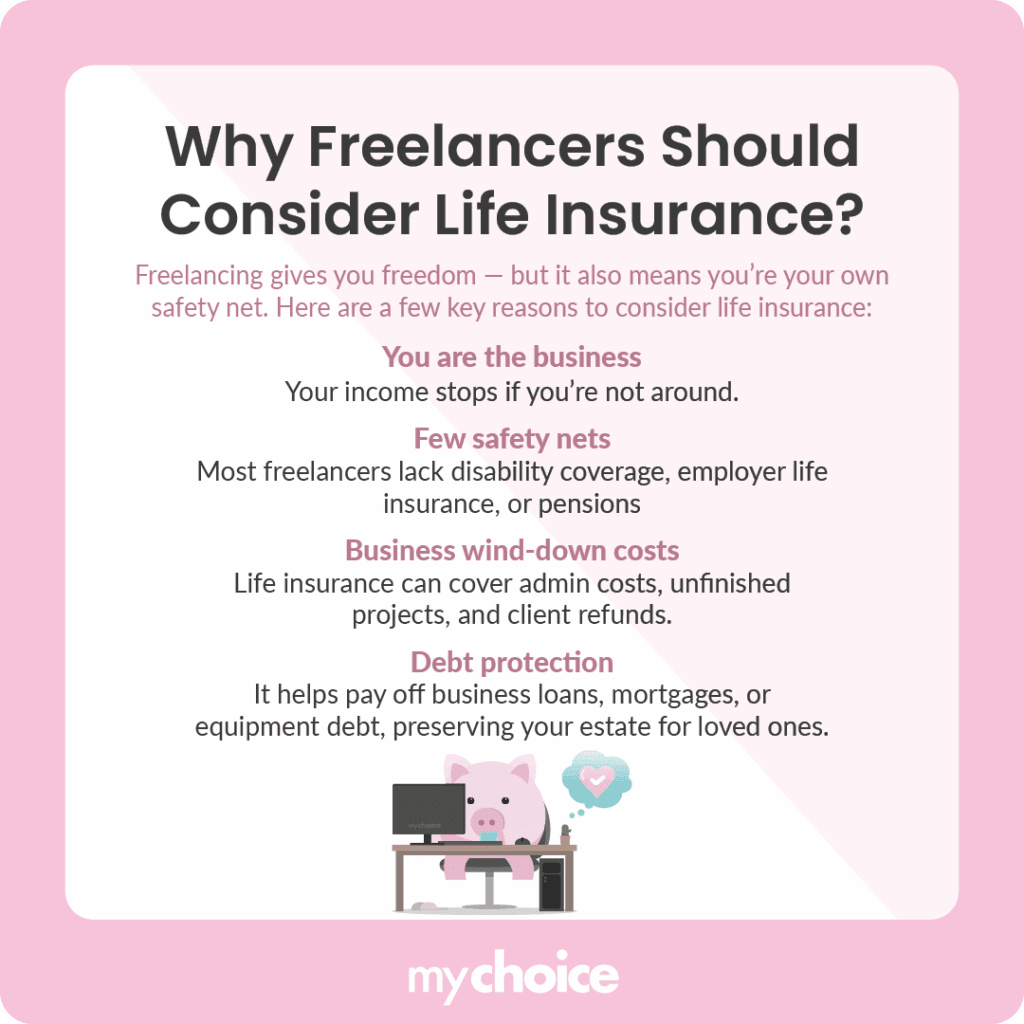

As a freelancer, your livelihood and your family’s financial security rest squarely on your shoulders. Without employer benefits or built-in safety nets, it’s crucial to think ahead about what would happen if you weren’t around.

Here are the main reasons why life insurance should be a key part of your financial planning as a self-employed professional:

What Type of Life Insurance Works Best for Freelancers?

For most freelancers, term life insurance may be the best option. It’s more affordable than permanent life insurance and provides a large payout if you pass away during its specified term, which can be anywhere from 10 to 30 years.

Term policies make sense because your highest insurance needs typically align with your peak earning and debt-heavy years. When you’re 35 with a mortgage and school-age children, you’ll need substantial coverage. By the time you’re in your 60s, hopefully, you’ve paid off your mortgage, built up savings, and your kids are independent.

While some forms of permanent life insurance, like universal, combine coverage with investment components, it can be more expensive and complex. Unless you have very specific estate planning needs for passing on wealth to the next generation, it may be best to stick with a term policy.

How Much Coverage Should You Get?

When your income varies from year to year (or even month to month), it can be tricky to use it as a baseline for determining how much coverage you should get. Think about it this way instead: start with your annual expenses instead of your income.

Ask yourself the following questions:

What Makes Getting Life Insurance Tricky for Freelancers

Getting life insurance is a tricky process from the very beginning for freelancers because of income documentation. Life insurance companies always want proof of income, but your bank statements and T4A slips may not always tell a clear picture of your financial situation. This is especially true if you’re new to freelancing or if you’ve had an unusually good or bad year lately.

This is why some insurance companies don’t fully understand freelancing. They may even classify freelancers as higher risk, even though many freelancers earn more and have more diverse income streams than traditional employees.

Another major complication for freelancers is that changing income affects coverage needs. Simply put, your insurance needs will likely fluctuate more than those of someone with a steady salary. For example, losing a big client might make your current premiums feel tight, while signing a major, long-term contract might mean you need more coverage.

Tips for Getting the Best Policy as a Freelancer

Navigating insurance and application requirements can seem overwhelming, but it’s worth it to secure the right policy and protect your income. Here are practical tips to help you present your best self and get enough coverage for your needs:

Key Advice from MyChoice

- Some insurers offer provisions with “income averaging”, smoothing out income fluctuations for freelancers. Ask your life insurance provider if these clauses are available so you can protect your coverage even during lean years or if you decide to take a break.

- Treat your premiums as a non-negotiable business cost like internet or phone services. By building your life insurance into your business expenses, you’re essentially using your income to fund your family’s financial protection.

- Consider applying for insurance right after filing taxes, while your income documentation is organized and fresh. A freshly obtained life insurance policy can provide a premium refund if it’s cancelled within the free-look grace period. Your free-look period usually lasts 10 days.