Nothing is more important than the health and safety of your family. In Canada, family life insurance is at the top of the list for many parents when it comes to protecting themselves and their children. It helps them stay prepared to handle potential obstacles, like costly medical emergencies or serious illnesses.

Although Canada doesn’t offer a standard life insurance plan for families, Canadians can easily combine different policies based on their family’s needs and health risks. In this article, we’ll walk you through the best options for family life insurance and some considerations to make as you plan for your family’s safety and financial security.

Why the Majority of Canadian Households Are Underinsured

Canada is known for having an exceptional healthcare system, so it isn’t surprising that Canadians are generally health-conscious. Despite this, the country’s rate of underinsured households ranges between 13% and 27.5%. The primary causes of this insurance gap are:

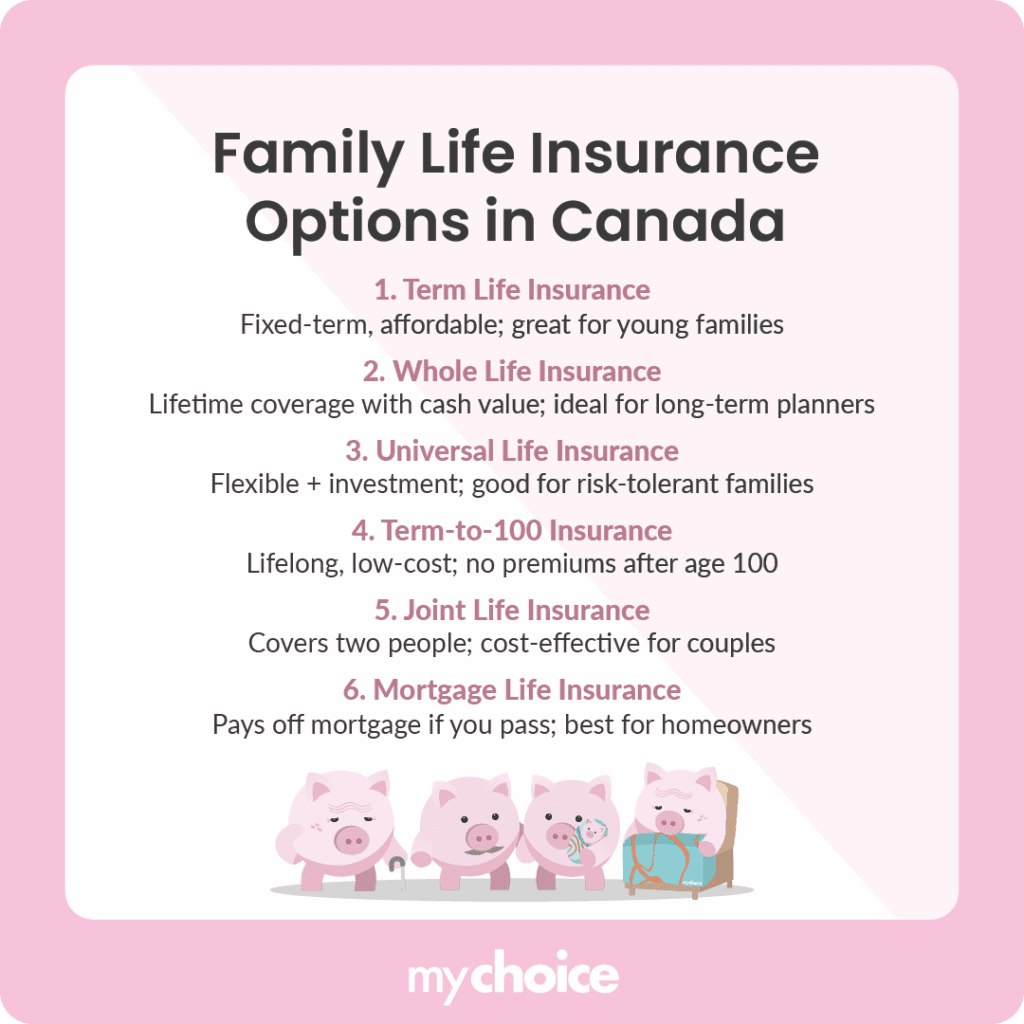

What Are My Family’s Life Insurance Options in Canada?

Planning ahead makes all the difference when it comes to your family’s future. To help you get a better grasp of the available options in Canada, here are the differences between the most popular family life insurance plans:

| Insurance Type | Coverage Overview | Who It’s Ideal For | |

|---|---|---|---|

| Term life insurance | – Offers fixed coverage for a set number of years – Provides beneficiaries with a lump sum payment if you pass away within the term. | – Families on a budget – Single-parent households | |

| Whole life insurance | – Offers guaranteed lifetime coverage. – Provides a lump sum payment to beneficiaries, regardless of when you pass away. – Allows you to cancel the plan and withdraw the cash value payout or stop paying premiums and receive coverage based on your policy’s accumulated value. | – High-income earners looking to pass down generational wealth or financing. – Families who have children with disabilities. – Families who prioritize guaranteed payouts. | |

| Universal life insurance | – Provides payment flexibility through either fixed or incrementally increasing premiums. – Lets you distribute payments between the insurance premium cost and an investment fund. – Does not guarantee your investment fund will grow quickly enough to help pay for your insurance costs within the planned timeline. | – Families with a financial advisor who can assist in growing their investment fund strategically. – Families who don’t mind higher risk for potentially higher returns. | |

| Term-to-100 insurance | – Offers lifelong coverage free of premiums once you turn 100 years old. – Guarantees that your beneficiary receives the death benefit, even if you pass away before 100 years old. | – Families on a budget who need permanent coverage and aren’t necessarily interested in investing. | |

| Joint life insurance | – Covers two people under one insurance policy – Provides lump sum payment given to the surviving policyholder. – Can be set up as a family term insurance or permanent life insurance. | – Couples who want to avoid paying two individual plans. – Spouses – Common-law partners – Business partners | |

| Mortgage life insurance | – Settles remaining mortgage payments to protect your loved ones from bearing the financial burden after your passing. | – Parents with outstanding mortgage payments. – Single-parent households | |

Tip: Ask your insurer about rider options – these are add-ons you can include in your plan for better overall coverage. For example, parents can add a child rider to their plan to cover funeral expenses if their child unexpectedly passes away.

How is Family Life Insurance Different from Other Plans?

The main difference between a family life insurance plan and individual insurance is how it’s structured. A family life insurance plan is made up of multiple individual policies and add-ons bundled under the same insurer.

How to Choose Your Insurance Based on Your Family Type

Families come in all types and sizes, so their insurance plans can look vastly different. For instance, a single mom raising three young kids makes her the sole breadwinner and primary caretaker of the family. In this case, she can get an affordable term life insurance so that her kids remain financially stable if she passes away.

Similarly, children with disabilities likely need continued financial or medical support into adulthood. In this case, parents can get whole life insurance to keep their finances in order and look into building a special needs trust for their children to help them sustain themselves as adults.

Note that child riders in family insurance plans are only valid until they turn 21 or 25 years old, depending on the insurance provider.

Why Some Family Members Need Insurance and Others Might Not

Most families don’t get insurance for their kids because they’re still minors without financial responsibilities and typically outlive their parents. It’s wiser to prioritize getting insurance for family members susceptible to illness who have a higher risk of death. For instance, a 50-year-old father working as a construction worker has a higher-risk profile than his 22-year-old niece, who has no kids and works from home.

Should You Make a Family Life Insurance Plan?

As mentioned, there is no standard family insurance plan in Canada, but you can still package specific policies to create one. Here are the pros and cons of setting up a family life insurance policy to help you decide if it’s the right choice for you:

Key Advice from MyChoice

- Take a thorough look at what your current financial responsibilities are. List all your monthly living expenses, including remaining debt and loan payments, to create a realistic plan for the policies you need and the total premium costs you can afford long-term.

- Routinely adjust your coverage as your family’s priorities and plans change. It’s always good to inquire about new policy options with your insurer because you can compare these with family insurance quotes from other providers to get the best deal.

- Pets are a part of some families, too, and visits to the vet can be costly in Canada. Although pet insurance won’t fall under your family insurance policies, it can indirectly protect your savings as a separate investment so that you can manage your expenses more wisely.