If your term policy is nearing its end date, you may be wondering what the most sound financial move would be. Do you shop for a new policy, go for permanent coverage, or are there other options that you aren’t aware of yet? Let’s walk through your choices to strike the right balance between protection and your current financial status.

What Happens When Your Term Life Insurance Expires?

When a term policy ends, you may be able to renew, convert to permanent coverage, or let it lapse. However, many people confuse the expiry date with the shorter conversion window.

Expiry marks the end of your guaranteed coverage term, while the conversion window is the shorter period when you can switch to permanent coverage without new underwriting. Miss it, and you’ll need a fresh policy, often at higher rates. For example, a 20-year term might have a conversion deadline hidden in the fine print that ends two years before expiry, leaving you scrambling for costly coverage if your health has changed.

Main Options You Have When Your Term Life Insurance Expires

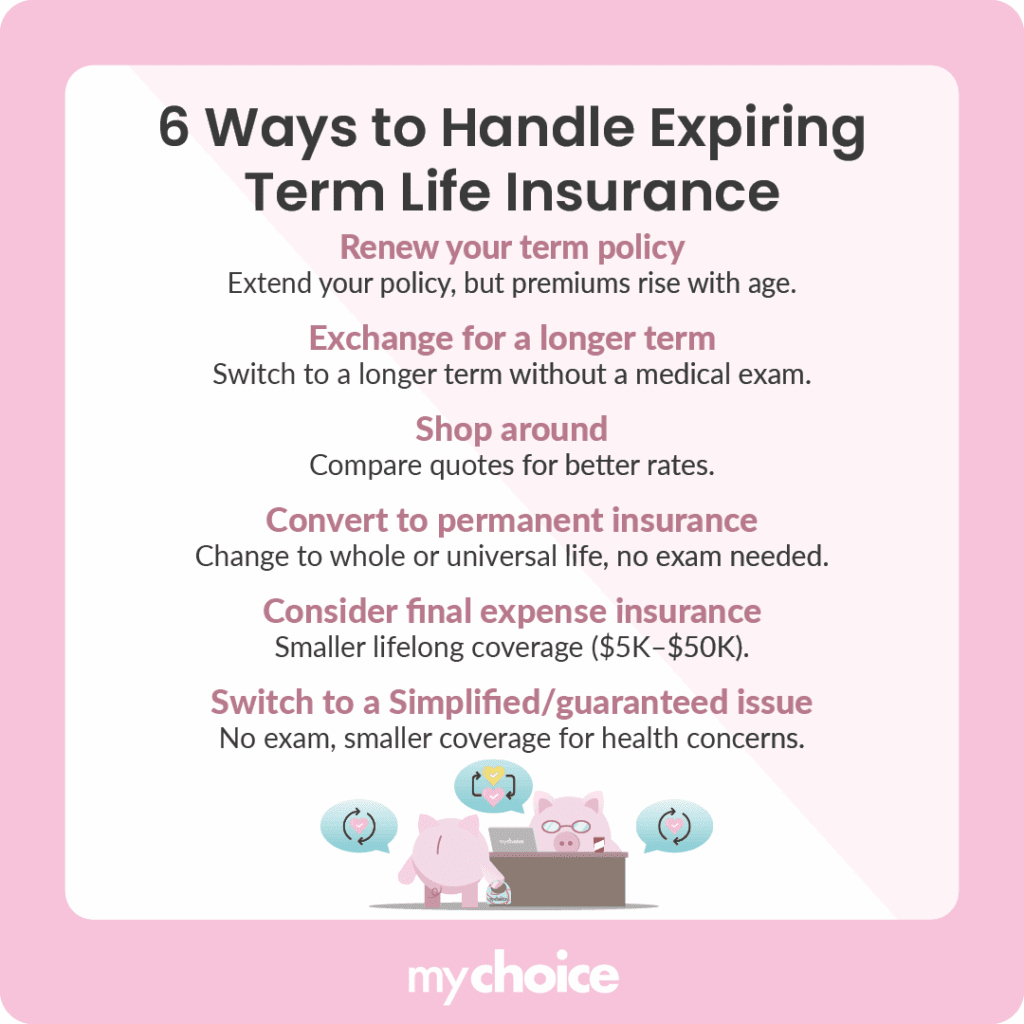

When your term life insurance is nearing its end, you’re not locked into just one path. Here are six routes you can take before the expiry date hits:

A Hidden Strategy You Can Try: Partial Conversions & Term Riders

If you want more protection than what your current term policy offers, but aren’t ready for permanent life insurance, you can try a partial conversion or a term rider. In a partial conversion, you take only a portion of your current term coverage and convert it to a permanent policy.

For example, if you have a $500,000, 20-year term policy, you might convert $200,000 to permanent coverage and keep the remaining $300,000 as term coverage until it ends. This locks in lifelong protection for part of your coverage without paying for a full permanent policy.

You can combine your partial conversion with a term rider. This is essentially temporary term coverage that’s added onto a permanent policy. Instead of keeping two separate policies, you could convert part of your term policy into permanent coverage and attach a term rider for the rest.

The rider can match the amount and duration you still need for expenses like university tuition or mortgage coverage, then it will automatically drop off when it’s no longer needed, leaving you with just the permanent base.

What Happens If You Do Nothing?

If you ignore your expiry date, two things might happen: either the policy ends completely and your coverage disappears, or it auto-renews at your insurer’s guaranteed renewal rate, which can be shockingly high.

For example, a $500,000 term policy that costs $45/month in your 40s might jump to over $400/month in your 60s at renewal. It’s enough to make most people cancel, but by then, your health might make new coverage tough to get.

Key Advice from MyChoice

- Check your policy’s expiry and conversion dates. They might be different, and missing the conversion window can cost you.

- Start your replacement or conversion process 6–12 months before expiry to have enough time to compare and choose without pressure.

- Don’t assume renewing is your best option. In many cases, shopping around or partially converting is cheaper long-term.