Buy-sell agreements, a beacon of security, can help businesses stay afloat when multiple partners are involved and one passes away. They are essential to business continuity, providing a safety net and helping avoid personal conflicts.

Learn how buy-sell arrangements work, who the beneficiaries are, and how to use them to mitigate losses.

What is a Buy-Sell Agreement?

A buy-sell agreement is a legally binding contract between business owners. This arrangement stipulates what will happen to a person’s share if they leave the company or pass away. It ensures smooth handovers, guarantees the company’s financial health, minimizes potential disputes, creates liquidity for illiquid shares, and reinforces business stability.

There are three main types of buy-sell agreements.

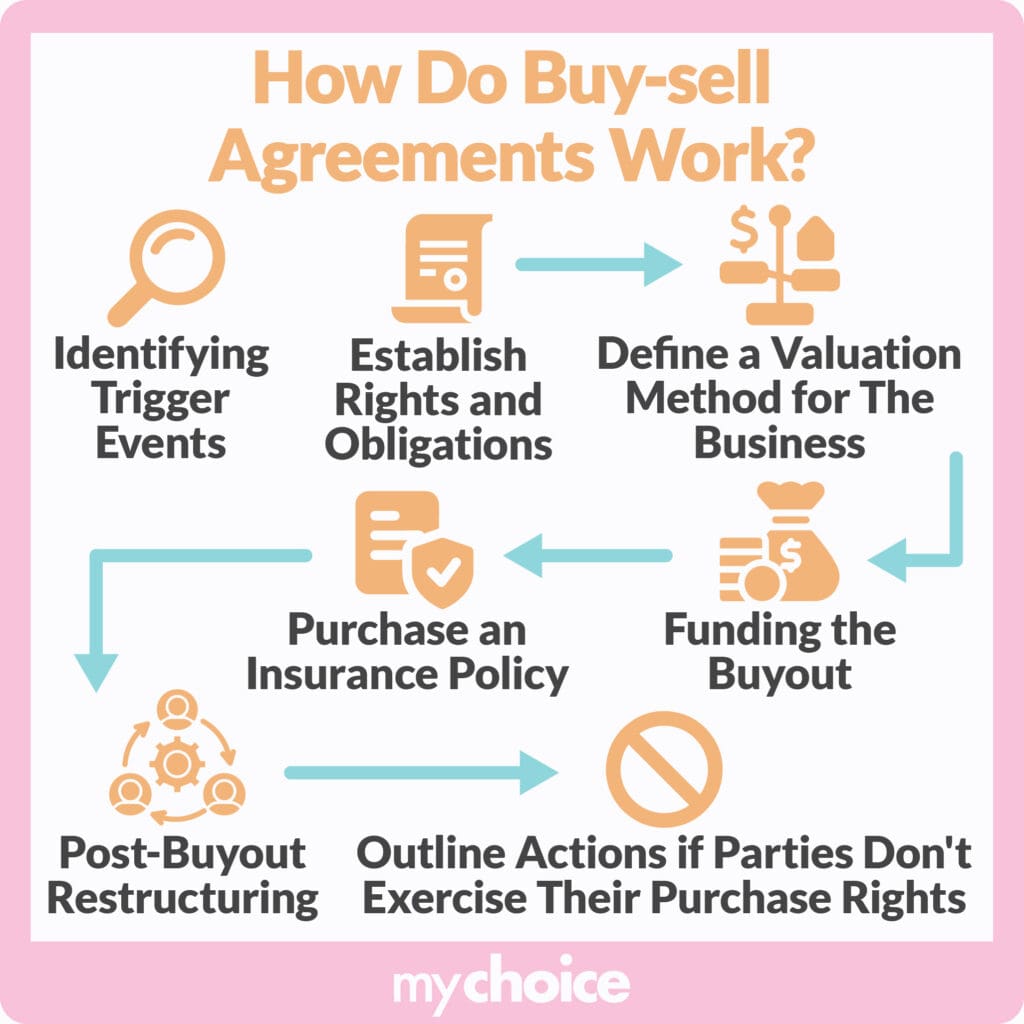

How Buy-Sell Agreements Work in Canada

Buy-sell agreements in Canada function based on three components.

Triggering Events

Triggering events are occurrences that initiate the buy-sell process. Aside from death, these events might include the following:

- Long-term disability

- Critical illness preventing work

- Retirement from business

- Marital breakdown

- Bankruptcy

- Intention to exit

- Deadlock or dispute

Purchase Obligation

Next, businesses must determine who buys the shares. Contenders might include the remaining shareholders, a third party, or the corporation.

Partners may determine the purchase price according to a pre-determined number or valuation formula. The latter provides a more flexible option, as the price may change depending on the company’s financial statements, appraisals, and industry benchmarks.

Companies can get assistance from The Canadian Institute of Chartered Accountants (CICA) to assist in business valuations.

Funding Options

Once the company makes its business valuation, it must determine how to secure the funds to buy the departing owner’s shares. Standard funding options include the following:

- Life insurance policy death benefit

- Disability insurance

- Savings plan

- Corporate buy-back

Facilitating buy-sell agreements typically involve lawyers who ensure the contract is executed accordingly.

When Do You Need a Buy-Sell Agreement?

Buy-sell agreements are imperative for business owners in the following situations.

If There Are Multiple Shareholders or Partners

Co-owning a business can get tricky if one partner plans to leave or can no longer contribute. Buy-sell agreements prevent the company from going into limbo by defining a clear succession plan.

If You Want Business Continuity

A shareholder’s death can suddenly and financially devastatingly end a business. Fortunately, buy-sell contracts ensure business continuity by enforcing smooth transitions and preventing disruptions.

To Minimize Disputes

Even if your business seems stable, you never know when you might encounter a dispute. Buy-sell agreements reduce potential disputes regarding the next steps or business valuations.

Who Are the Beneficiaries of a Buy-Sell Agreement?

Buy-sell agreements might appoint several beneficiaries, including the following:

- Individuals named in the person’s life/critical illness/disability insurance policy

- Estate beneficiaries of the deceased owner

- The corporation itself

If your business has multiple partners, it can be easier to name the corporation as the beneficiary, as it prevents conflict between shareholders.

Funding Buy-Sell Agreements

These are several options for funding buy-sell agreements. Here is a breakdown of the standard funding methods.

Considerations for Drafting Buy-Sell Agreements in Canada

A well-crafted buy-sell agreement should help Canadian businesses navigate tax complexities. Here are a few considerations to remember when drafting your agreement.

Legal and Tax Implications

All buy-sell agreements must comply with corporate law and consider the tax implications imposed by the chosen funding method. For example, life insurance death benefits are typically tax-free, so the business may not receive as large a lump sum from a disability policy.

However, life insurance premiums are not usually deductible, so they may be best for corporations in lower tax brackets instead of individual shareholders, who may be in higher tax brackets.

The Canadian Revenue Agency (CRA) provides more information on the tax implications of buy-sell agreements.

Guidance from Lawyers

Hiring a lawyer to help draft a buy-sell agreement can ensure the contract is legally sound, protects all parties, and minimizes tax burdens.

Choosing the Right Insurance Plan

The nature of your business and its trajectory can dictate what type of life insurance you get in case of a buy-sell agreement. Term life insurance is typically more cost-effective and flexible, but it doesn’t have a cash value component. On the other hand, permanent life insurance provides a guaranteed death benefit with cash value accumulation. However, permanent life insurance has higher premiums and may involve additional fees.

Remember to compare quotes online when choosing the best term life insurance for your agreement.

Updating the Agreement

While buy-sell agreements are usually final and set in stone, they may occasionally change. Corporations must update their contracts in case of:

- Change of ownership

- Adjustments to the valuation formula

- Change of funding mechanism

- Change of legislation

- Unforeseen circumstances like changes in disability definitions within insurance policies

Key Advice from MyChoice

Buy-sell agreements play a critical role in keeping businesses afloat amidst unforeseen circumstances. They act as a roadmap for easy business transitions. Now that you know how they work, here are a few key tips from MyChoice to keep in mind:

- Consult with a lawyer experienced in corporate law to ensure your buy-sell agreement is legal and tax-efficient.

- Explore as many funding options as possible to determine which will offer the smoothest transition and keep your cash flow healthy.

- When drafting your buy-sell agreement, outline triggering events thoroughly, determine purchase obligations, and develop a clear valuation method.

- Maintain clear communication between all shareholders.