There are many types of insurance protection when it comes to protecting your loved ones’ financial future. Two options you often see are life insurance and accident insurance. While these two types of insurance coverage provide benefits if you pass away, there are some key differences. Let’s take a closer look at these two policy types.

Accident Insurance vs Life Insurance: Key Differences

The best way to understand the differences between accident insurance and life insurance is to learn how they work. Here’s a table that lists incidents like death and injuries, explaining which type of insurance can cover you for each incident and what the benefit can be used for.

| Payout Trigger | Which Insurance Kicks In | What the Benefit Can Be Used For |

|---|---|---|

| Death from illness | Life insurance | Covering funeral expenses and paying medical bills |

| Death from accident | Life insurance (can be enhanced with accidental death & dismemberment coverage) | Covering funeral expenses and paying medical bills |

| Broken leg from ski trip | Accident insurance | Paying for treatments and replacing income while you recover |

| Hospital stay after car accident | Accident insurance | Paying for treatments and replacing income while you recover |

| Long-term disability from accident | Accident insurance | Paying for treatments, replacing income, and covering long-term care |

Note that the terms may vary depending on the insurer, so check with your insurance company to know what risks you’re covered for. You can also enhance your coverage with policies like disability insurance, which can replace up to 85% of your income in case you experience a permanent disability.

Which Insurance Option Is Cheaper?

Accident insurance may be cheaper than life insurance because the coverage scope is generally smaller, since it only provides benefits if you get hurt or die in an accident. Meanwhile, life insurance offers a broader coverage scope and can be more expensive, as it also provides benefits in the event of death due to illness or other causes.

However, your insurance rates will still be determined by various factors, such as your age, lifestyle, and occupation. If you have high-risk hobbies like extreme sports or work in dangerous fields like logging or roofing, your accident and life insurance rates are likely to be higher.

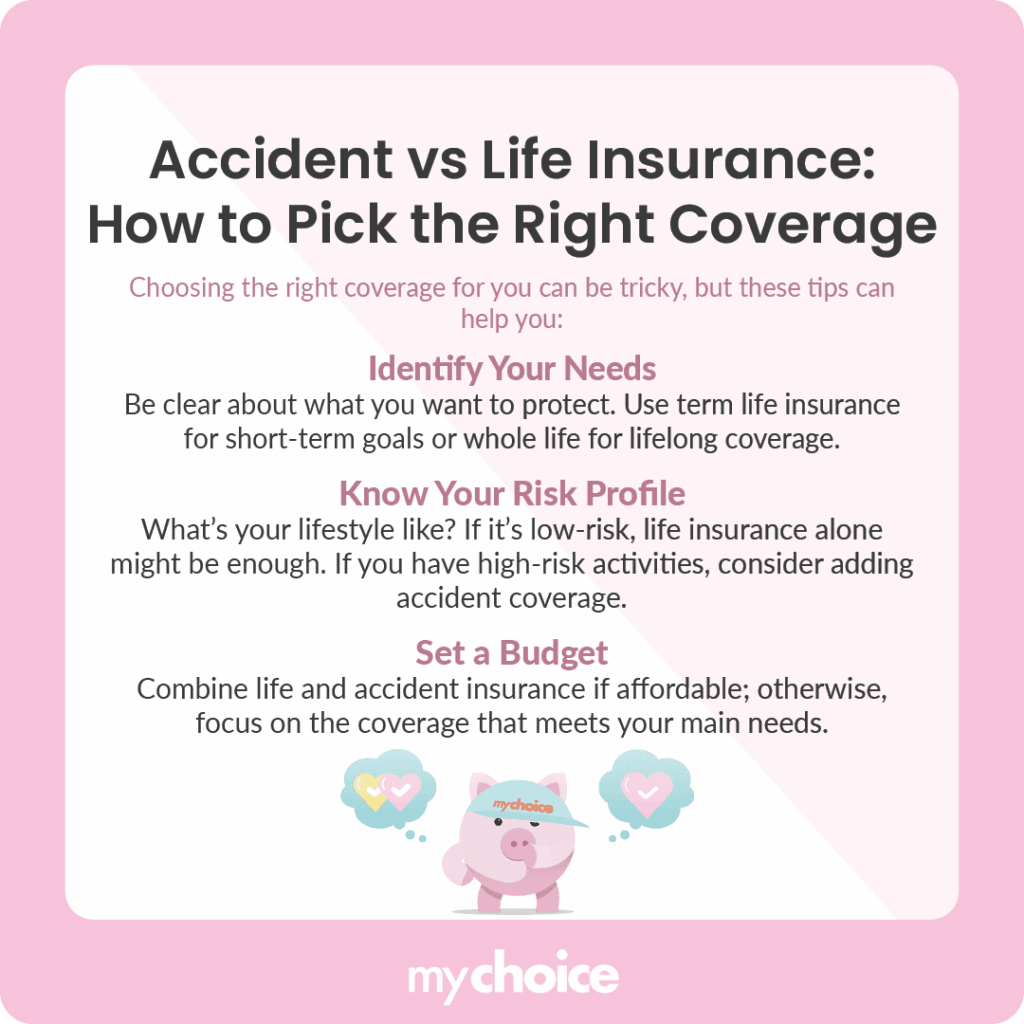

How to Choose the Right Coverage

Choosing the right insurance coverage can be challenging due to the numerous available options. To help you pick the right policy for your needs, consider the following tips:

When Might You Want Both?

You may want to consider both life and accident insurance to round out your insurance protection. Accident insurance allows you to still receive benefits if you get into a non-fatal accident, while life insurance can pay out if you pass away due to the accident.

Accident Insurance vs AD&D Insurance

While the names are similar, accident insurance and accidental death & dismemberment (AD&D) insurance are two distinct policy types. The key difference between these two policies is the payout condition, which we’ll outline here:

| Insurance Type | Payout Condition | What’s Covered |

|---|---|---|

| Accident Insurance | Pays out if you get injured or die due to a covered accident | Accident or death coverage, income replacement |

| Accidental Death & Dismemberment Insurance | Pays out if you experience a permanent impairment, like paralysis or limb loss, or die due to an accident | Death or dismemberment coverage, rehabilitation treatments, family benefits |

Note that the details of what’s covered by each policy can vary depending on the insurance company, so ask your insurer about the benefits offered by your accidental or AD&D policy. Some companies also bundle accident and accidental death and dismemberment (AD&D) protection into one package.

Key Advice from MyChoice

- Accident insurance is distinct from accidental death & dismemberment (AD&D) insurance, though they share similarities and are sometimes packaged together.

- Life insurance and accident insurance serve distinct purposes, helping you protect your loved ones.

- Life insurance and accident insurance can support each other to protect you from fatal and non-fatal accidents.