If you’re single, life insurance might be one of the last things on your mind. The popular belief is that you get life insurance to offer financial protection to your family in the event of your passing. However, life insurance can still provide unique benefits to single people in Canada.

Why Should Singles Get Life Insurance?

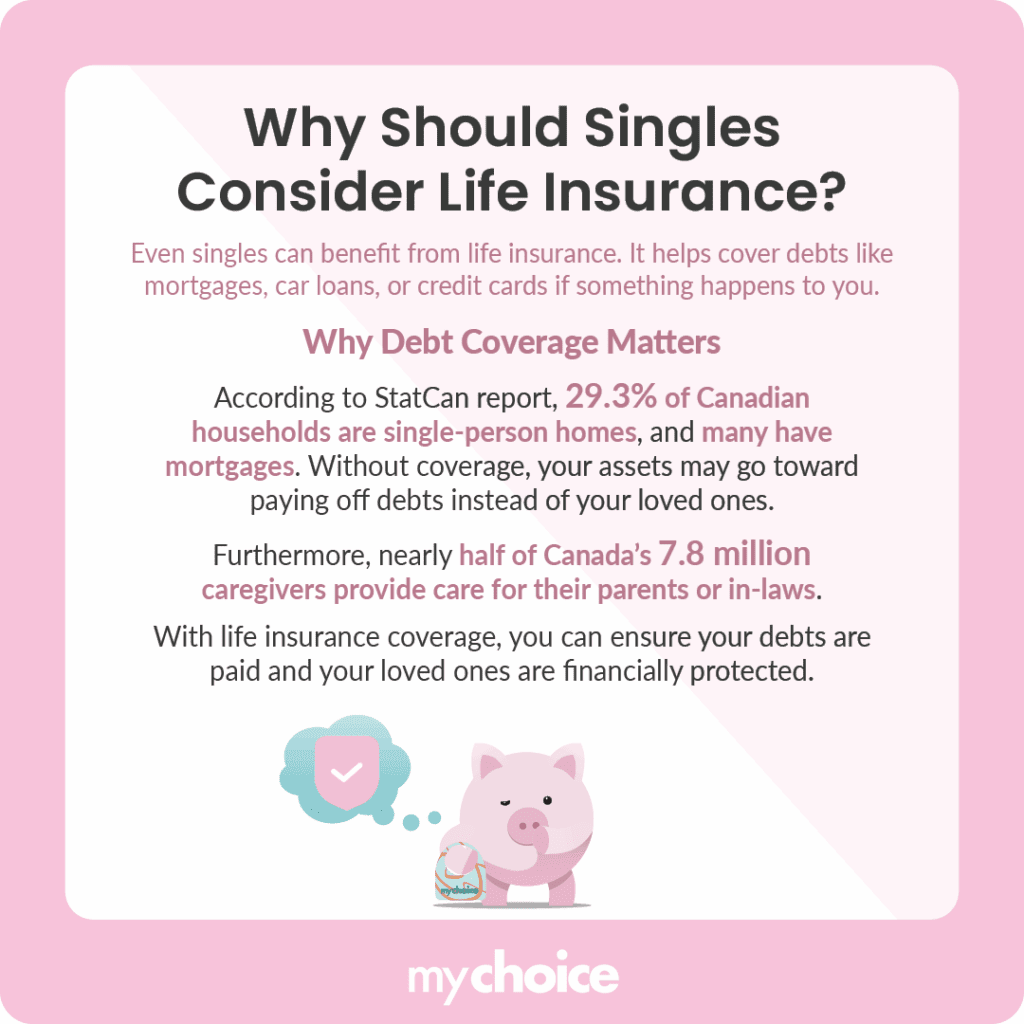

Singles should still consider getting life insurance if they have significant financial responsibilities, such as mortgages, car loans, or other debts, that the insurance payout can cover.

One good reason to get insurance is to cover your mortgage. Around 29.3% of Canadian households are one-person households, making singles the most common household type in the country. If you pass away before repaying the mortgage, your remaining assets will be used to repay the mortgage and any outstanding debts before they can be distributed among your family.

Another reason to consider life insurance is to provide financial support for dependents. About 7.8 million Canadians are caregivers to a family member or friend with long-term physical or mental issues. Of that 7.8 million, 47% provide care for their parents or parents-in-law.

Life Insurance Isn’t Just About Who You Leave Behind

Life insurance isn’t just used to leave money to your loved ones after you pass away. As a policyholder, you can also benefit from life insurance during your lifetime. Here are some ways you can benefit from your life insurance policy during your life:

- Borrow against your cash value through low-interest policy loans.

- Withdraw money from your cash value for extra cash when needed.

- Get coverage for chronic or critical illnesses if you have the relevant riders.

- Use your policy as collateral for a business loan.

Learn more ways to use life insurance while alive in our guide.

Using Life Insurance as a Long-Term Asset

The primary way to use life insurance as an investment and long-term asset is to leverage its cash value, typically found in whole life insurance policies. This cash value builds slowly through portions of your premium payments.

Whole life insurance cash value grows quite slowly, but it is tax-deferred and stable. Once you’ve built up enough, you can cash it out and earn the money you’ve put into your policy.

How Single Canadians Are Actually Using Life Insurance

In addition to covering outstanding debts, Canadian singles are using life insurance in other ways to support themselves and those they love. Here are a few examples of how they use life insurance:

- Protecting dependent family members, like your aging parents or siblings, in your absence.

- Leaving money to take care of your pets after you pass away.

- Covering funeral and end-of-life expenses.

- Giving money to charity.

What Type of Policy Makes Sense If You’re Single?

As a single person, your insurance needs may differ from those of individuals with a spouse or children. The table below offers a comparison between the three most common types of life insurance and their unique values:

| Policy type | Strengths | Best for |

|---|---|---|

| Term life insurance | Affordable, adjustable coverage period | Covering specific debts like a mortgage or student loans that will eventually be repaid |

| Whole life insurance | Cash value component, stable growth, lifelong coverage | Low-risk investing and building cash value that you can borrow from |

| Universal life insurance | Lifelong coverage, choice in investment methods, flexible premiums | Higher-risk investing with potentially higher returns |

Key Advice from MyChoice

- As a single, consider taking life insurance if you still have loved ones to protect, even if that’s not your spouse or child.

- Examine your investment and insurance protection needs to ensure you pick the right life insurance policy type.

- Even if you don’t have parents or siblings to care for, consider getting life insurance to make one last charitable donation to your favourite charity.