In recent years, mental health has become one of the most talked-about issues for Canadians. Throughout the country, people are more willing to discuss anxiety, depression, and stress than ever before. For many Canadians, disclosing a mental health diagnosis on an insurance application once felt like a guaranteed denial or a prohibitively expensive premium. Today, however, a combination of improved treatment options, better data, and growing market competition means that you have more choices and options than ever before.

Are you able to get life insurance if you have a mental health diagnosis? What restrictions will an insurance provider have for applicants with mental health issues? Does a mental health diagnosis make a life insurance application harder? Read on to learn how mental health affects a life insurance application.

The Growing Mental Health Crisis in Canada

Over the past five years, Canada has faced a mounting mental health challenge. According to the Canadian Mental Health Association, roughly one in five adults experiences a diagnosable mental health condition in any given year. Meanwhile, prescriptions for antidepressants have risen by 25% since 2019, and waitlists for psychiatric and counselling services can stretch for months in many provinces.

This mental health crisis has had significant effects on the life insurance market. Knowing that mental health treatments can be unpredictable, many Canadians are looking for early coverage as a safety net, locking in a policy while they’re in a stable phase.

Insurance companies have had to refine their risk-assessment models to reflect the reality that people with a past diagnosis can manage their conditions successfully over the long term. What used to be a blanket “high-risk” category is now segmented by severity, treatment history, and overall health profile.

For example, someone who struggled with situational depression during a major life event has been symptom-free for over two years will typically face less resistance than an applicant with ongoing severe bipolar episodes. This attention to nuance enables insurers to strike a balance between competitive pricing and responsible underwriting. It also gives applicants who have worked hard to stabilize their mental health a fair shot at standard rates.

Can I Get Life Insurance If I Have a Mental Health Diagnosis?

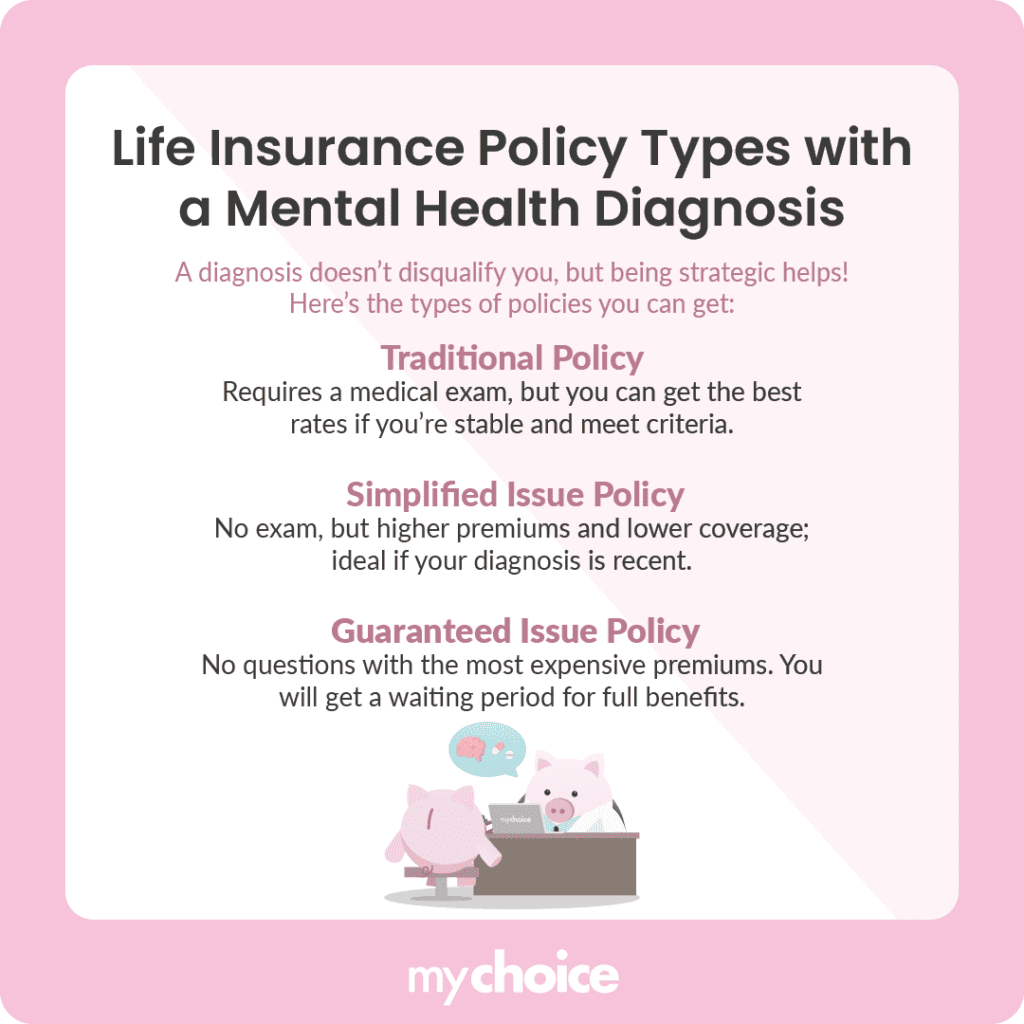

Yes, you can get life insurance even if you have a mental health diagnosis. While a diagnosis won’t automatically lock you out of life insurance, it does mean that you’ll need to be strategic about your application. Here are some things to keep in mind:

How Mental Health History Impacts Life Insurance Applications

When you disclose a mental health condition on your life insurance application, underwriters look into several factors of your medical history:

For instance, if you underwent a six-week course of cognitive behavioural therapy two years ago and have been attending monthly check-ins, you’ll likely face a lower chance of coverage denial than someone with sporadic therapy and multiple medication changes in the last year. If you understand the factors and nuances that insurers consider, you’ll have an easier time anticipating underwriting questions and preparing the exact records that you’ll need for an application.

What Underwriters Look For in Your Application

Underwriters aren’t just scanning for the presence of a mental health diagnosis; they’re evaluating how your condition influences your overall risk profile. Here’s what typically goes on behind the scenes:

Key Advice from MyChoice

- Be honest about mental health issues on a life insurance application. Leaving out details can lead to your application being rejected or a claim being denied down the road.

- Collect all relevant records before filling out a life insurance application. Include recent consult notes, a medication list with dosages, and any self-reported outcome measures.

- Getting life insurance while you’re young can lock in reduced premiums. If you have mental health issues, an early life insurance policy can mitigate higher rates compared to if you get a policy later on in life.