Health insurance and life insurance fulfill entirely different needs, and most people think they can get one or the other. However, there’s a good case to be made for getting both of these policies to maximize your protection. Learn how these insurance types differ and how they combine to provide well-rounded coverage.

Life Insurance vs Health Insurance: Key Differences

The number one difference between life insurance and health insurance is when it pays out. Life insurance generally pays out when the policyholder passes away, leaving money for their beneficiaries. Meanwhile, health insurance pays out to medical care providers to reduce the costs of your treatment.

For a better look at the differences between these two insurance types, look at the table below:

| Type | Protects You From | When it Helps | Example |

|---|---|---|---|

| Life insurance | Death | When you want to leave money behind for your loved ones. | If you pass away unexpectedly, you can still provide for your family with a death benefit. |

| Health insurance | Sickness | When you need money to pay for a medical treatment. | If you get injured or contract a serious illness, you can get treatment without paying out of pocket. |

How Life and Health Insurance Work Together in Real Life

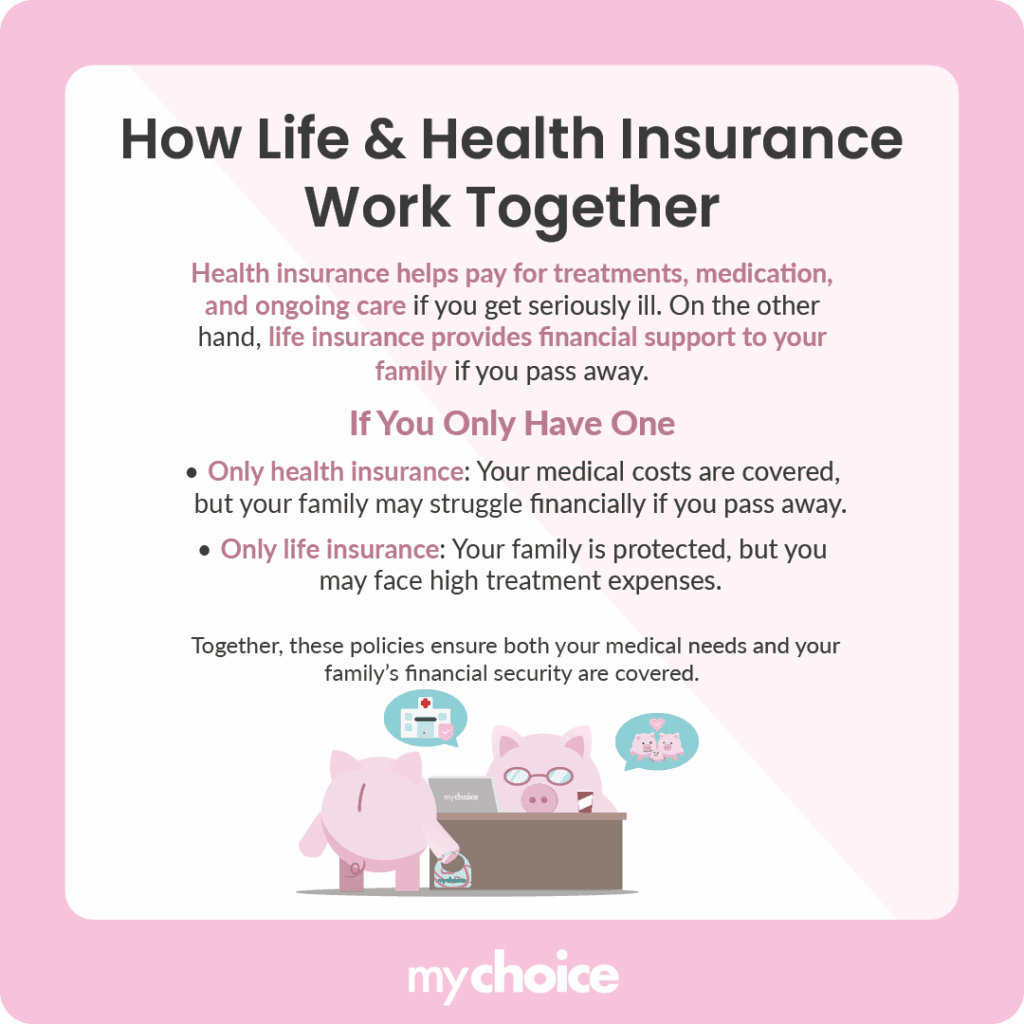

While the two policy types cover different risks, life and health insurance can combine to create well-rounded insurance protection that helps address the unpredictability of life. Here’s a sample scenario that illustrates how life and health insurance can join forces:

Let’s say you have a mortgage and a family to support. However, you’re diagnosed with an illness that requires long-term treatment and medication. Health insurance can kick in to cover the treatment costs throughout your illness. For instance, according to CHLIA, health insurance plans provided 27 million Canadians with prescription drugs for chronic and complex health conditions. If things turn for the worse and you pass away due to this illness, your life insurance policy can potentially repay the mortgage and leave some money behind to support your family, helping them get back on their feet even in your absence.

Now, imagine if in this scenario, you only have either health or life insurance. Having only health insurance means your family may need to work hard to repay your mortgage and support themselves in your absence, while having only life insurance might mean you may have to scramble to find the money needed to pay for your treatments.

How Each Product Evolves Through Your Life Stages

Your insurance needs aren’t static. As you age and go through life, your protection needs may change due to changes in your health, career, and family situation. As a fresh graduate, you’re likely still young and healthy, so basic healthcare coverage would suffice. But as you grow older and potentially develop health issues, you may need more comprehensive coverage.

Check this table for health and life insurance coverage recommendations for each life stage:

| Life Stage | Primary Risk | Best Health Coverage | Best Life Coverage |

|---|---|---|---|

| Student/ Early Career | Accidents and sudden illnesses | Workplace healthcare benefits and universal tax-funded healthcare | Term life insurance |

| Young Family | Accidents and sudden illnesses | Workplace healthcare benefits, universal tax funded healthcare, and supplemental health insurance | Term/whole life insurance |

| Mid-Career | Middle-age health concerns like heart issues, diabetes, and cancer | Workplace healthcare benefits, universal tax funded healthcare, critical illness insurance | Whole life insurance |

| Pre-Retirement | Heart issues, diabetes, other chronic conditions | Personal health and dental insurance, critical illness insurance | Whole life insurance |

| Retired | Age-related illnesses | Personal health and dental insurance,critical illness insurance, long term care insurance | Whole life insurance |

Everyone’s life and health insurance needs are different, so don’t take the table above as an absolute recommendation. Instead, review the options available to you and choose a health and life insurance combination that works for you. If you need advice, we recommend speaking to a trusted insurance broker.

The Overlap Products Worth Considering

There’s a fair bit of overlap between health insurance and life insurance, and getting coverage that fills the rest of the gaps can be beneficial. Here are some complementary products that can enhance your insurance protection for maximum coverage.

Key Advice from MyChoice

- Canada offers a tax-funded universal health care system, but you can supplement that protection with personal health insurance.

- Consider adding products such as critical illness or disability coverage to ensure you’re well-protected.

- Review your insurance coverage as you enter new life stages to ensure it remains appropriate to your situation.