Buying life insurance is one way to protect your family’s financial future, but before your policy gets approved, there’s an important step called underwriting. While it may seem technical, this simply determines how much of a “risk” you are to insure and what premium makes sense based on that risk.

Read on to learn what life insurance underwriting is, how underwriters weigh different factors, and how you can lower your premiums.

How Life Insurance Underwriters Evaluate You

Underwriters look at several areas of your life to assess risk. Below is a quick overview of what they focus on and how you can strengthen your application.

| Risk Factor | What Insurers Look For | How to Strengthen Your Profile |

|---|---|---|

| Health Metrics | Your overall health, including height-to weight ratio, blood sugar, cholesterol, and blood pressure readings. | Maintain a healthy diet, exercise regularly, and schedule checkups to monitor key health stats. |

| Family Medical History | Whether close relatives have had serious conditions (heart disease, cancer, diabetes) at an early age. | Share full details honestly; you can’t change your genes, but you can demonstrate proactive healthcare habits. |

| Lifestyle | Smoking, alcohol use, and other habits that can affect longevity. | Quit smoking, limit alcohol, and document healthy routines (like exercise or stress management activities). |

| Occupation and Hobbies | Jobs or pastimes that could increase risk (e.g., construction, aviation, scuba diving). | If possible, show safety training or certifications that reduce your risk level. |

| Financial Health | Your income, debt levels, and ability to maintain policy payments. | Keep finances in order as assurance that you can maintain premiums long-term. |

| Driving Record | Tickets, DUIs, or accidents can signal risky behaviour. | Drive safely and maintain a clean record for several years before applying, if possible. |

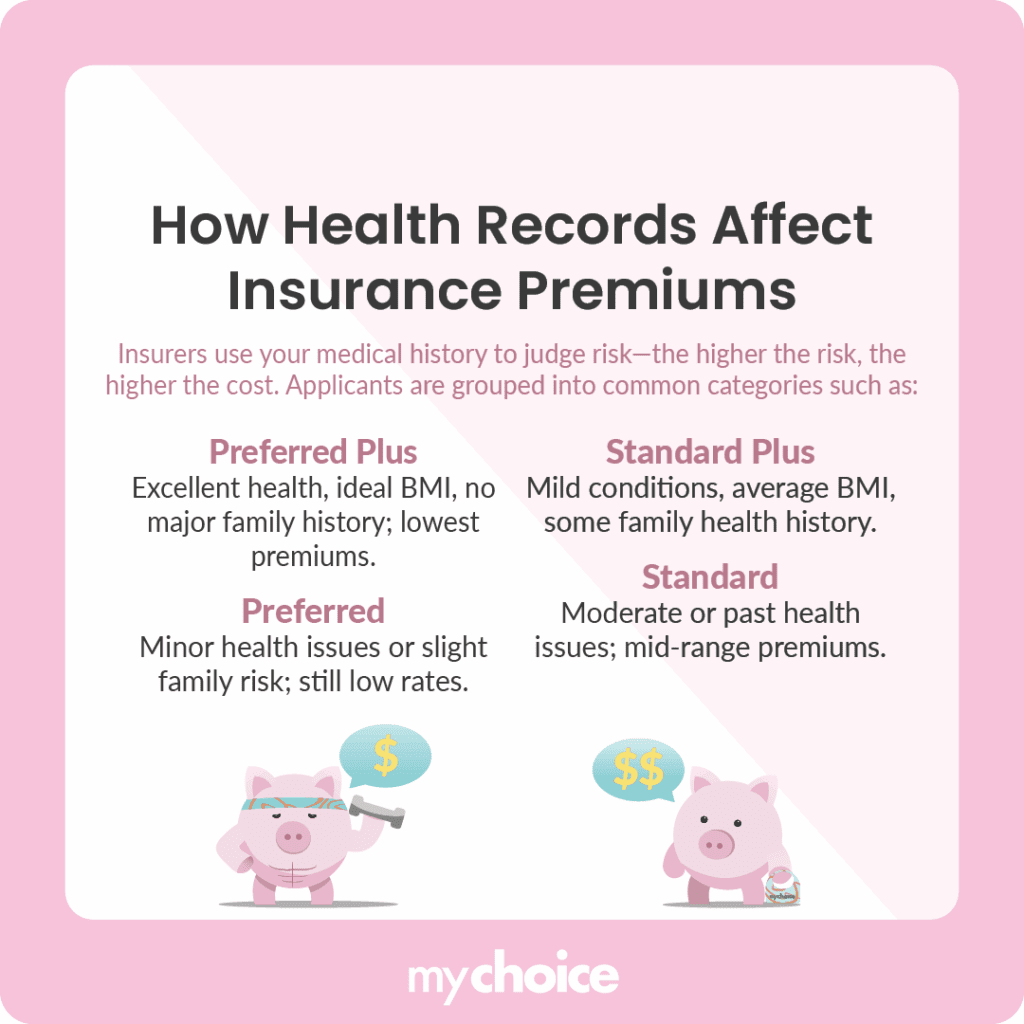

What Are the Main Life Insurance Health Classes?

When underwriters assess your health profile, they assign you to a health class based on your medical records, lifestyle habits, and overall risk factors.

If your health is below average, you can still qualify for coverage — just under a Table Rating (sometimes referred to as “Substandard”). This means the insurer considers you a higher risk because of ongoing or multiple health issues.

The 3 Types of Life Insurance Underwriting in Canada

In Canada, you’ll generally encounter three types of life insurance underwriting depending on how much coverage you want and how detailed your application is.

What Actually Happens During the Underwriting Process

Once you’ve submitted your life insurance application, the underwriting process begins. First, you’ll complete an online or paper form with details about your health, lifestyle, and finances. Depending on the type of policy, you may also need to answer additional health questions or undergo a medical exam, which could include blood and urine tests or a doctor’s statement.

When all the information is collected, the underwriter reviews it alongside lab results, medical reports, and sometimes your prescription or driving history to get a full picture of your risk profile. After this evaluation, the insurer makes a decision: you might be approved, declined, or approved with certain conditions, such as a higher premium or modified coverage amount.

In some cases, the insurer may issue a postponement, meaning they can’t provide coverage at the time of your application. This is often due to health concerns that could improve over time, allowing you to reapply later. If you’re approved, you’ll receive a policy contract outlining your coverage, premium, and all the terms of your agreement.

It’s important to be completely honest throughout this process. Lying or leaving out details like a smoking habit or past medical condition might seem tempting, but it can lead to serious issues later. If the insurer finds false or incomplete information, your policy could be voided, and your beneficiaries might lose their payout. Transparency protects you and ensures the underwriter can fairly assess your application.

The Rise of AI and Predictive Underwriting in Canada

In Canada, several insurers are adopting AI-driven and predictive underwriting to speed up approvals and improve accuracy. Instead of relying entirely on manual review, these systems analyze large datasets to predict risk with greater precision.

For example, AI can:

- Cross-reference public health data to estimate life expectancy trends

- Assess applications in minutes, reducing waiting times from weeks to days

- Identify inconsistencies or red flags automatically

For customers, that means faster decisions and, in many cases, more personalized pricing. Of course, data privacy remains a top concern, and Canadian insurers must comply with strict privacy and consent rules like the PHIPA (Personal Health Information Protection Act) in Ontario.

In the coming years, it’s likely that many simplified or smaller-coverage policies will have more assessments driven by AI, with traditional medical exams reserved for high-value policies.

Key Advice from MyChoice

- Make small, positive lifestyle changes before applying for life insurance. Even little changes show you’re taking care of yourself and reduce the perceived risk of insuring you.

- Compare multiple insurers. Not all insurance companies weigh risk factors the same way, so shopping around can save you money.

- Before applying, gather key details like your doctor’s contact info, medical history, and current medications. Being prepared helps speed up the process and prevent delays.