Life insurance companies calculate your premiums based on how risky you are to insure, and your health history is one of the key factors they use to determine this risk. To do this, insurers may occasionally request access to your health records. Keep reading to learn how your health record can influence your life insurance premiums.

Why Health Records Matter in Life Insurance

Your health records matter in life insurance because the insurance company wants to know how much of a risk it’s taking on by providing insurance protection to you. In addition to health records, the insurer may ask you to answer a health questionnaire and go through a medical examination.

What Insurers Actually Look At

When insurers want to examine your health records, they usually ask you to sign a medical release form to authorize them to access your medical information. Once the insurer gains access to your medical information, it may review documents such as doctors’ reports, test results, and prescription histories.

Note that the insurer usually doesn’t have full access to your health records. Instead, your insurer can only see the documents that you allow them to see.

The Role of Canadian Privacy Laws

Insurance companies don’t automatically have access to your health data stored in OHIP (Ontario Health Insurance Plan), which covers doctor visits, hospital stays, lab tests, and other medical information, or other provincial databases, due to the strict privacy laws, like the PHIPA (Personal Health Information Protection Act) in Ontario. By signing a release or consent form, you’re providing access to the insurer that lets it look into a targeted list of your health data.

How Health Classes Translate Into Premiums

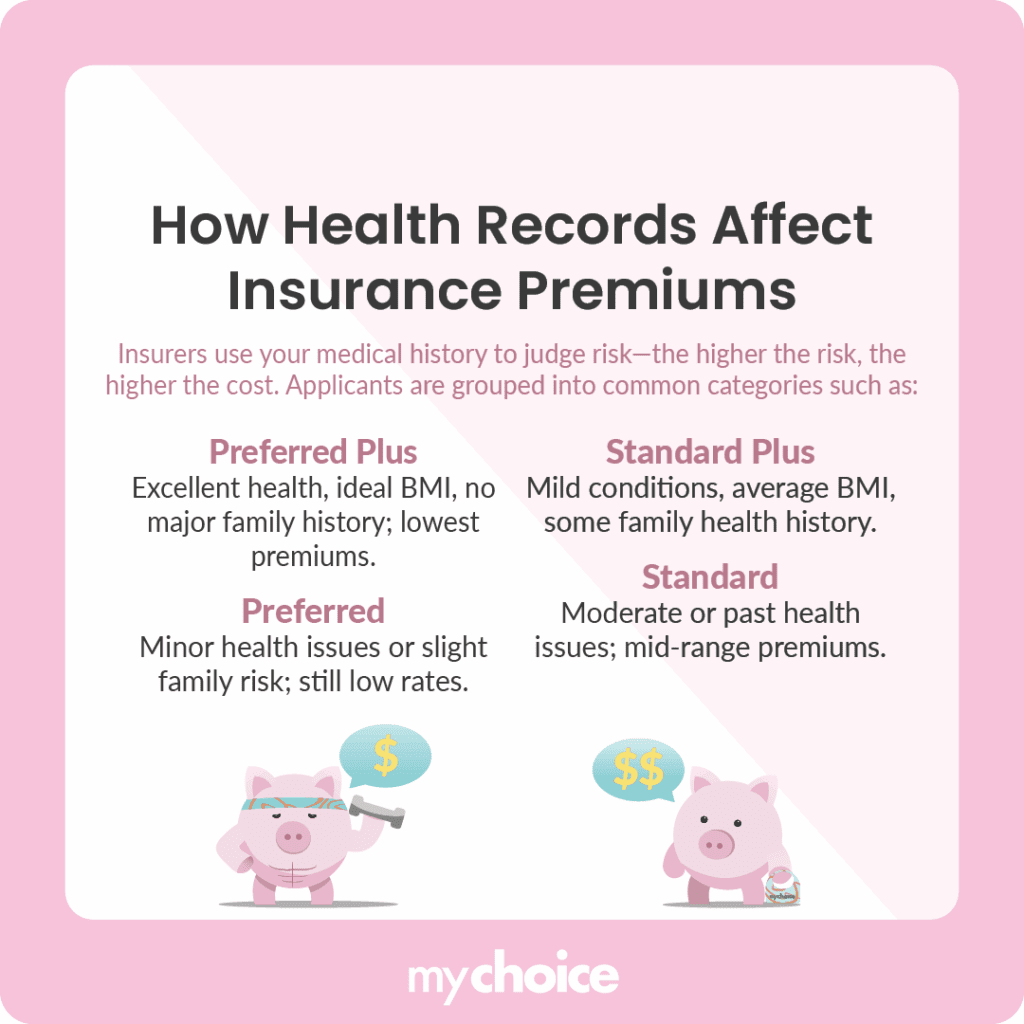

Insurance is a business based upon risk. The riskier you are to insure, the higher your insurance premiums. But you may be curious about what role health records play in determining your insurance rates. Visit our main life insurance page to see how your premiums will change depending on your health status.

Insurance companies categorize customers into one of several categories that determine their premiums. Each company likely has different categorization methods, but let’s take a look at the six common categories an insurance customer may fall into:

How Does Smoking Affect Your Life Insurance Rates?

Life insurance applicants who have consumed tobacco or nicotine products in the past 12 months receive the Tobacco or Smoker classification. Within this classification, we can break it down to three sub-categories: Preferred, Standard, and Table.

If you quit smoking after getting your life insurance policy, you can typically ask to have your premiums reassessed if you’ve been nicotine-free for at least 12 months.

What Are Table Ratings in Life Insurance Health Classification?

Some insurance companies use table ratings for applicants with more serious health conditions or those whose height-to-weight ratio falls within the company’s table-weighted range. Table ratings are a group of insurance classification categories, each with a corresponding table. Table 1 has the lowest premiums, while Table 10 has the highest premiums. The more health risks you have, the higher your table ratings are, with each successive table adding another fixed percentage above standard rates.

For instance, Table 1 customers need to pay premiums valued at 25% above Standard rates, with each successive table adding 25% until Table 10, where their premiums are 250% above Standard rates.

How Many Years Back Do Insurers Go to Check Your Records?

While it may differ from insurer to insurer, insurance companies generally check your medical records as far back as three to ten years. However, if you’ve experienced chronic health conditions for a long time, have a history of substance abuse, or have had a recent major surgery, they may request data from further back.

Can You Say No to Insurers Checking Your Health Records?

Yes, you can refuse a health record check by insurance companies, as they require you to sign a release form before they can proceed. However, refusing a health record check may result in higher insurance rates or even a denial of coverage.

Alternatives if Health Records Hurt Your Chances

If your health history isn’t the best and you don’t want to take chances with an insurer checking your medical records, you can look into life insurance policies without rigorous medical underwriting, like a no-medical life insurance policy or a guaranteed issue life insurance policy.

These life insurance policies generally let you qualify for life insurance without any testing and medical record checks, instead only requiring you to fill out a medical questionnaire.

However, the guaranteed life insurance protection does come with higher premiums, so you can expect to pay more if you don’t want your insurers to look through your medical records.

Key Advice from MyChoice

- You can choose not to sign the release form if you don’t want your insurer to look through your health records.

- If you’re confident about your health history, you can allow insurers to check your health records to potentially get better rates.

- If your coverage gets denied because you don’t want to show the insurer your records, you can consider no-medical or guaranteed issue life insurance.