Death can happen unexpectedly. In addition to the emotional cost, you may need to bear the deceased’s financial obligations. If they have life insurance, you can shoulder those costs without scrambling for money, giving you time and space to work through this difficult period.

However, there might be an issue if you don’t know if the deceased has a life insurance policy or if you know they do but don’t know where it is. In that case, you need to find out whether the deceased has a policy and track it down.

Why Do You Need to Find Out If Someone Has Life Insurance?

One of the primary reasons you need to find out if someone has life insurance is because you need to claim their policy after their passing. Often, the deceased may leave debts or other financial obligations that their loved ones have to pay, such as credit card bills or mortgage payments. Life insurance is important because claiming their policy can help you fulfill those obligations, allowing you to grieve without the stress of having to think about money on top of the emotional burden.

What Happens If You Don’t Know If a Person Has Life Insurance?

If you don’t know if the deceased has a life insurance policy, you likely can’t make an insurance claim because you don’t know they have one in the first place. But if it’s reasonable for the deceased to have life insurance, it may be a good idea to seek it out.

Generally, you need the life insurance policy documents to make a claim. Canadian insurers usually give you 90 days to 12 months to submit your claim, so double-check your policy to see your claim deadline. If you don’t know whether your loved one has a life insurance policy, starting your search as soon as possible after they pass away is wise to ensure you can process the claim in time.

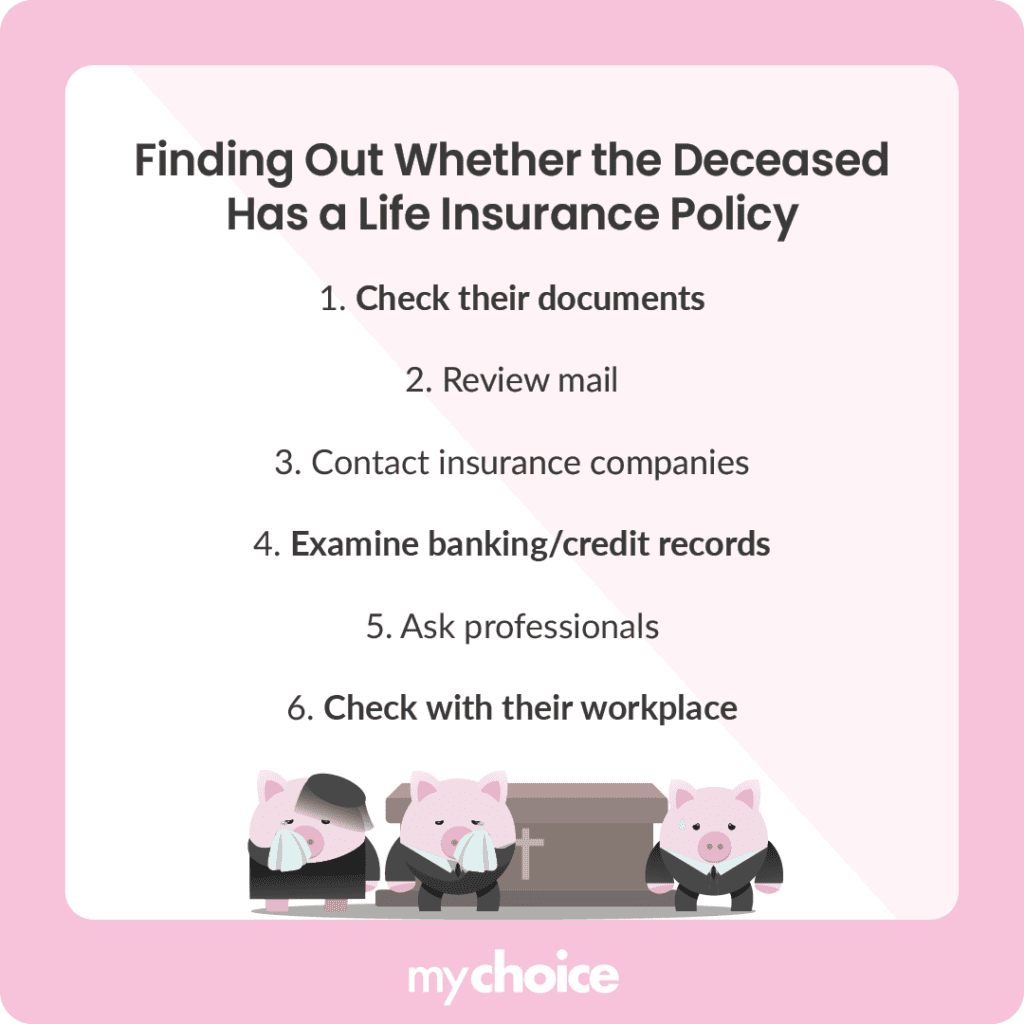

Finding Out Whether the Deceased Has a Life Insurance Policy

Let’s say you don’t know if the deceased has a life insurance policy, but you want to search for it. Here are some steps to check whether the deceased has life insurance and how you can find their policy:

What to Do If You Can’t Find the Person’s Insurance Policy

Maybe you’ve searched everywhere and couldn’t find a conclusive trail leading to the deceased’s policy, but you’re still sure they have one. In that case, the OLHI (OmbudService for Life & Health Insurance) can help you locate the policy.

When requesting a policy search to OLHI, you need to fulfill a few conditions:

- You have evidence of the policy’s existence.

- It’s been over three months and less than two years since the person’s passing.

- The policy must have been issued in Canada.

If you meet those conditions, OLHI will search for the relevant policy on the records of their member companies. While almost all of Canada’s top insurance companies are OLHI members, there may be a chance that your loved one’s policy can’t be found because it’s from a non-OLHI member company.

What to Do After Finding a Person’s Life Insurance Policy

Whether it’s from your legwork or it was found from OLHI, you now have your loved one’s life insurance policy documents. The next thing to do is to file a life insurance claim. The process may differ depending on the insurance company, but it usually goes like this:

- Contact the deceased’s insurance company about the claim, providing the representative with the policy and supporting documents like your loved one’s death certificate.

- Wait while the life insurance company reviews the policy and determines whether your claim is valid.

- If the insurer decides to investigate the claim further, provide additional documents like medical records.

- Receive the death benefit payment if everything checks out on the insurer’s end.

Generally, your life insurance claim will be paid out between 14 and 60 days after you file it. However, the process may take longer if the insurer thinks the claim needs further investigation.

Key Advice from MyChoice

- You need to have the deceased’s life insurance policy to make a life insurance claim. You can request a search from OLHI if you can’t find the policy by yourself.

- If you don’t know where the deceased’s life insurance policy is, you need to look for it. Possible places to look include their essential paperwork, mail, banking history, and credit card statements.

- Apart from checking with top insurance companies, it’s wise to check with the deceased’s employer to see if they have coverage under a group life insurance policy in the workplace.