Most people get life insurance to protect their loved ones’ financial future if they pass away. However, what happens if their loved one passes before them? That’s where dependent life insurance comes in. Keep reading to learn more about dependent life insurance and how it works.

What Is Dependent Life Insurance?

Dependent life insurance is coverage that provides an insurance payout in the case of one of your dependent’s death. Dependent life insurance is primarily meant for your child or spouse, though sometimes elderly or disabled relatives can also qualify for coverage.

How Dependent Life Insurance Works

Dependent life insurance works much like any other life insurance policy. If your dependent passes away, you’ll be provided with a death benefit payment according to what’s listed on the coverage terms. Dependent life insurance can be provided through group life insurance policies, like when you get life insurance from work.

Who Can Be Added to Life Insurance Policies as a Dependent?

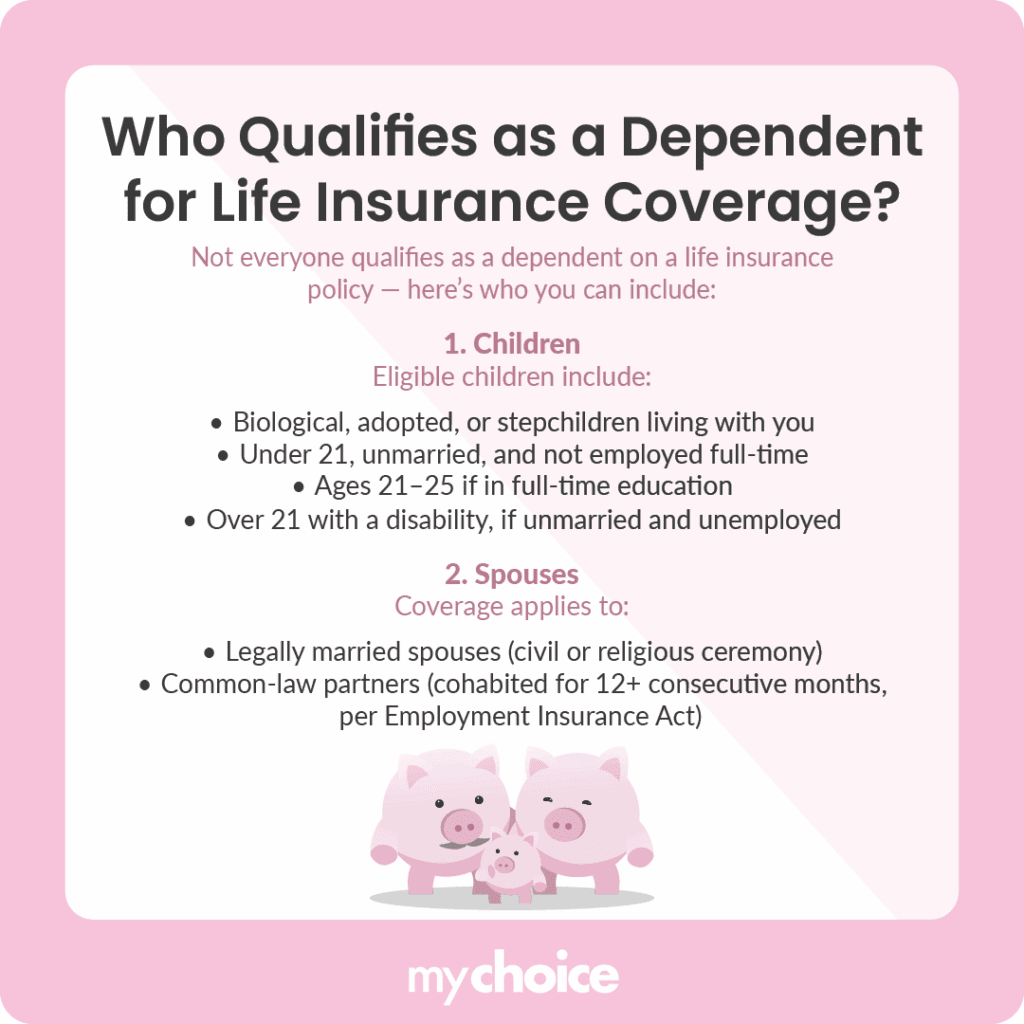

Generally, dependent insurance policies only allow you to add certain people to your policy. Here are the two most common categories of dependents you’re allowed to add to your dependent life insurance protection:

When Dependent Life Insurance Makes Sense

Dependent life insurance is generally provided through your work insurance. In most cases, you need to pay extra to get dependent protection on top of your own group life insurance coverage. So, dependent life insurance might make better sense if you don’t have any other life insurance protection to protect your loved ones.

Extra Protection for Dependent Life Insurance Holders

In addition to death benefit coverage for your dependents, there are other protection options you can consider when getting dependent life insurance. Here are some examples:

- Premium waiver: A premium waiver kicks in if you’ve been approved for a waiver of premium on your main work life insurance coverage. The premium waiver can extend to your dependent life insurance premiums, meaning you get free coverage for yourself and your dependent.

- Prenatal benefit: Your insurance plan may also offer extra protection if your spouse is pregnant. Should your spouse experience a stillbirth, the coverage will pay out a certain amount of money. While the coverage amount is generally lower than if your living child passes away, the money can still help lighten your financial load.

What to Ask Before Opting Into Dependent Life Insurance

Since dependent life insurance is an extra expense on top of your personal group life insurance protection premiums, it’s a good idea to know more about the protection before opting into it. Some important questions to ask your workplace about dependent life insurance protection include:

- How much do I need to pay for dependent life insurance protection?

- How much is the dependent coverage amount?

- Can I insure my spouse and my children, or do I need to choose between them?

- Is my spouse/child eligible for dependent life insurance protection?

- When will the dependent life insurance protection terminate?

Alternatives to Dependent Life Insurance

Dependent life insurance isn’t the only way you can provide insurance protection for your loved ones, because sometimes your group life insurance may not be enough. Let’s take a look at a few alternatives to consider:

Key Advice from MyChoice

- Dependent life insurance is rarely found as a standalone policy. Ask your workplace if you can add dependent life insurance to your existing group life insurance policy.

- Before opting into dependent life insurance, ask questions and ensure you know for sure that dependent life insurance will give you the most bang for your buck.

- You can consider joint policies, spousal riders, and individual life insurance policies if dependent life insurance doesn’t suit your needs.