It’s nearly impossible now to run a Canadian business without relying on technology in some way, whether that’s storing customer data, accepting online orders, or simply sending emails out. While this does make operations more efficient, it also exposes businesses to cyber threats which are rapidly growing in Canada.

This is where cyber liability insurance comes in, and it’s not just for tech companies that deal with a lot of data. Now, even small businesses need protection against cyberattacks. Let’s break down how this coverage type works, why you need it, and what factors affect your cyber liability insurance cost.

How Cyber Liability Insurance Works in Canada

Cyber liability insurance is a type of a liability insurance policy that helps businesses recover from cyber-related incidents such as data breaches, ransomware attacks, and network outages. It covers both direct costs (like data recovery) and indirect costs (like reputational damage).

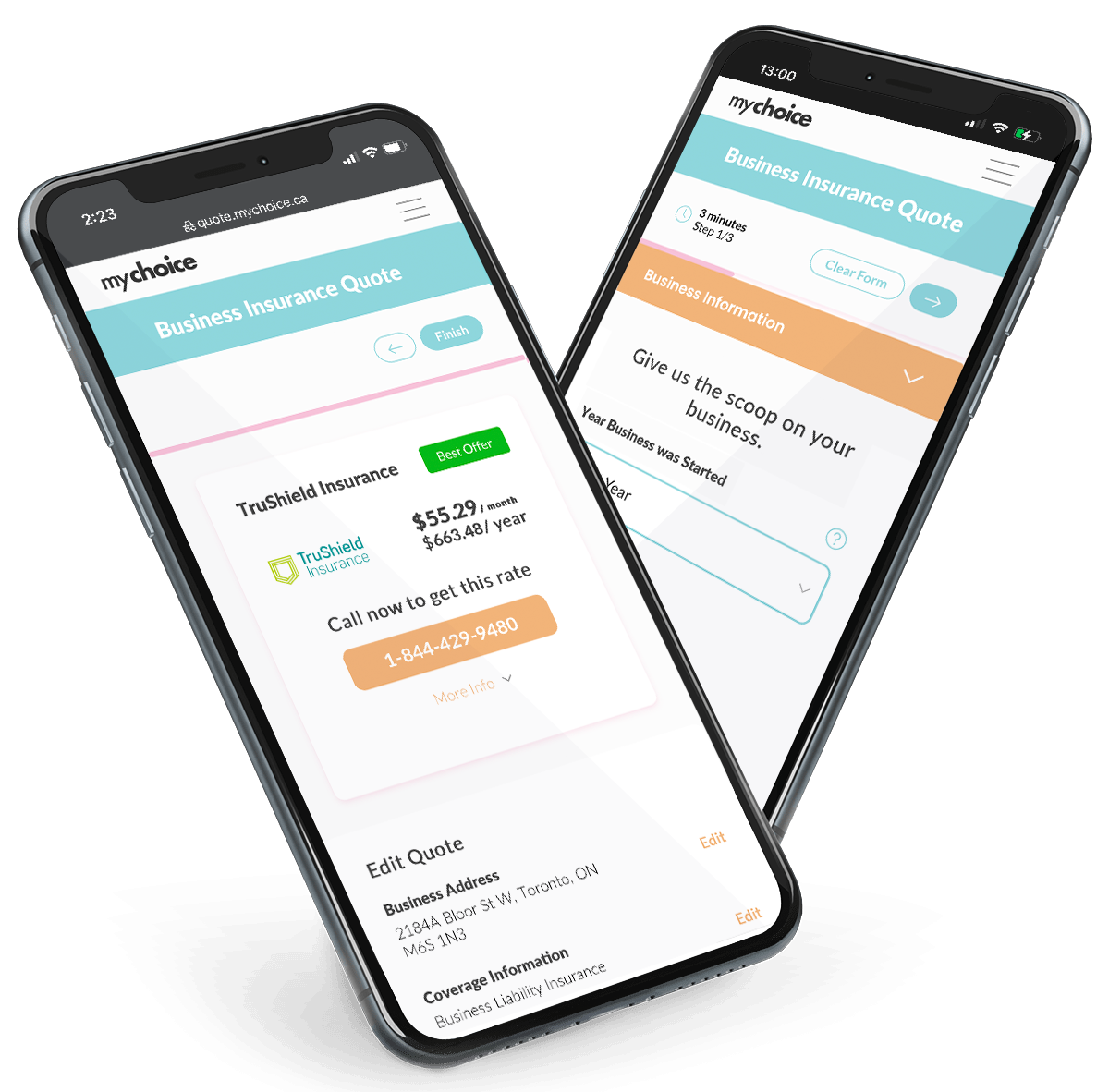

Cyber liability insurance is offered by most major Canadian insurers, often as a standalone policy or as an add-on to an existing business insurance policy. Its protection is critical for business owners as Canada’s privacy laws can impose hefty fines if a data breach isn’t handled properly.

How Much is Cyber Liability Insurance in Canada?

For small and medium-sized businesses in Canada, cyber liability insurance premiums typically range from $100 to $200 a year if they’re purchased as add-ons to existing policies. But if you choose to get a standalone policy, it can cost approximately $500 to $2,000 a year.

Your own cyber liability insurance quote will vary depending on these factors:

- Industry type

- Amount and type of data stored

- Security measures in place

- Annual revenue

What Exactly Does Cyber Liability Cover and Not Cover?

Cyber liability insurance provides coverage against specific risks. Here’s a more detailed breakdown:

| Covered | Not Covered |

|---|---|

| Costs to investigate a data breach | Physical theft of property (covered under property insurance) |

| Customer notification expenses | Future lost profits not directly linked to the breach |

| Legal fees and regulatory fines (where insurable) | Pre-existing vulnerabilities you knew about but ignored |

| Data recovery and restoration | Acts of war or terrorism (may require special coverage) |

| Ransomware/extortion payments (up to policy limits) | Intentional illegal acts by you or your staff |

| Crisis communication and PR expenses | Losses from poor business decisions unrelated to the breach |

| Loss of income from network downtime | Damage to physical IT equipment from fire/flood |

Who Needs Cyber Liability Insurance in Canada?

Whether your business is big or small, if you store sensitive data, you could be a target of a cyber attack, and need to take steps to proactively stay protected. Here are examples of industries that need cyber liability insurance:

Data Types That Trigger Cyber Insurance Needs

Not sure if your business requires cyber insurance? If you store, process, or transmit any of the following, cyber liability insurance should be on your radar:

- Names and addresses

- Email addresses

- Credit card or banking information

- Social Insurance Numbers (SINs)

- Medical or health records

- Intellectual property (designs, formulas, proprietary code)

- Login credentials (usernames and passwords)

- Birthdates

- Employee payroll records

These data types have high black-market value, can cause serious harm if compromised, and often trigger strict legal breach notification obligations under laws like PIPEDA. Cyber liability insurance helps absorb these financial shocks, ensuring that even if sensitive data falls into the wrong hands, your business has the resources to respond quickly and recover.

Canadian Regulations You Need to Know

Canada has strict privacy and breach reporting rules that make cyber insurance more important than ever. The Personal Information Protection and Electronic Documents Act (PIPEDA) applies to most businesses across Canada. It requires:

- Reporting certain data breaches to the Office of the Privacy Commissioner of Canada (OPC)

- Notifying affected individuals

- Keeping records of all breaches for at least 24 months

Without insurance, the cost of breach notification, legal advice, and forensic investigation often delays a proper response, which could put you in violation of PIPEDA timelines and result in fines of up to $100,000 per violation.

Cyber Liability Insurance vs. Data Breach Insurance

Cyber liability insurance and data breach insurance are often used interchangeably, but there’s a subtle difference between these two policy types:

| Cyber Liability Insurance | Data Breach Insurance |

|---|---|

| Broader coverage: includes ransomware, cyber extortion, business interruption, and breach costs | Narrower scope: focuses mainly on breach-related expenses |

| May include third-party liability (lawsuits from clients/partners) | Usually only covers first-party costs (your own expenses) |

| Suitable for companies of all sizes and industries | Often marketed to small businesses as an entry-level option |

Why Small Businesses Are Prime Targets

Small businesses may think they’re not on a hacker’s radar the way a big corporation is, but in reality, small and medium businesses (SMBs) are often seen as easier targets because they may lack full-time IT security staff, rely on basic security measures, and sometimes underestimate the seriousness of cyber threats. In fact, the Canadian Internet Registration Authority (CIRA) reported in 2024 that 43% of all cyberattacks in Canada target SMBs.

Hackers also take advantage of the fact that smaller businesses often work with third-party vendors such as cloud providers, payment processors, or marketing agencies, which can be compromised to gain access to multiple businesses at once. A single breach can disrupt operations, damage customer trust, and lead to costly regulatory consequences, making proactive cyber protection especially important for SMBs in Canada.

How to Choose the Right Cyber Policy

Not all cyber liability insurance policies offer the same coverage. When shopping for a cyber policy in Canada, consider these factors to find the best fit for your business and the risks you face:

FAQs about Cyber Liability Insurance Coverage

Do I need cyber insurance if I use cloud-based platforms?

Yes, you’ll need cyber insurance even if you use cloud-based platforms, as you are often still legally responsible if that data is breached.

Does my policy cover cyber extortion (ransomware)?

Yes, cyber extortion is typically covered by your cyber liability insurance policy. Most Canadian cyber policies cover ransomware demands and related recovery costs, but limits and exclusions apply.

Will my insurance cover loss of income from a breach?

Yes, your insurance will cover loss of income from a breach if you have business interruption coverage within your cyber policy, a.k.a. coverage for income lost during downtime caused by a covered cyber event.

What is the claims process like after a cyber incident?

Typically, the claims process after a cyber incident is as follows:

– Notify your insurer immediately so they can connect you with an incident response team.

– Forensic investigation of the incident begins.

– You and other affected parties are notified.

– Costs are then paid or reimbursed according to your policy.

Can I get insurance if I’ve already had a breach?

Yes, you can get cyber insurance if you’ve already had a breach. However, expect higher premiums and possibly stricter requirements, such as enhanced cybersecurity measures.

Does home-based business insurance cover cyberattacks?

Home-based business insurance usually doesn’t cover cyberattacks. You’ll need either add-on coverage or a standalone cyber policy.

Is my E&O policy enough to cover cyber risks?

No, your Errors & Omissions (E&O) policy isn’t enough to cover cyber risks as it covers professional mistakes, not cyberattacks.