While it isn’t expressly required, landlord insurance is still a good idea if you have a rental property. Keep reading to learn more about landlord insurance and how it can protect your investments.

How Much Is Landlord Insurance in Canada?

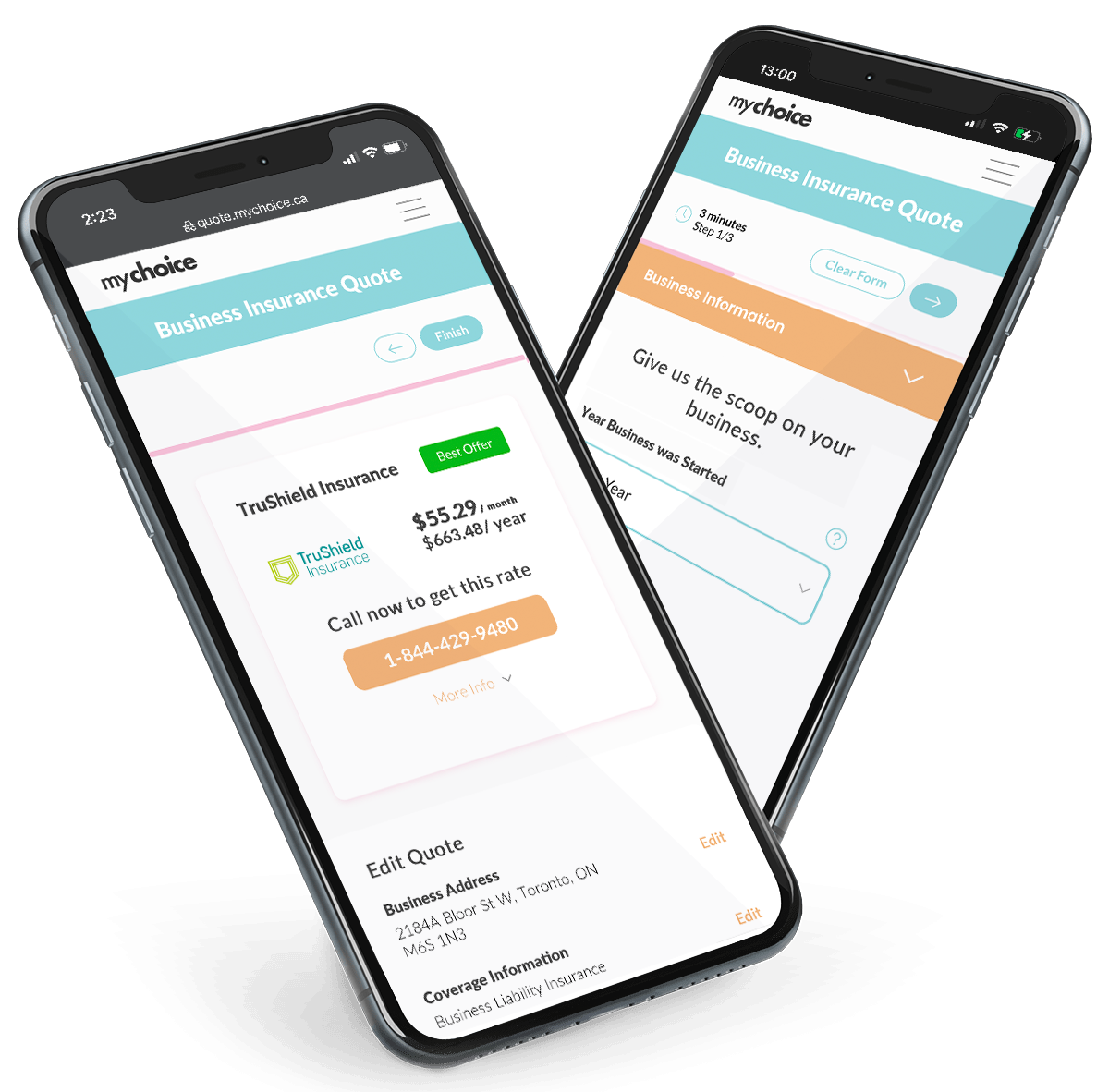

On average, basic landlord insurance costs around $40 to $80 per month. Your monthly landlord insurance costs heavily depend on your property’s characteristics, like its size, type, age, and safety features installed. The safety of your surrounding area also affects your insurance rates because landlord insurance can cost more in regions more prone to crime or natural disasters.

Landlord insurance costs can also increase as you add more coverage to the policy, like rent non-payment coverage and flood insurance.

Landlord Insurance Coverage: What’s Protected and What’s Not

Similar to other types of home insurance, landlord insurance covers your rental property from financial loss, but doesn’t cover everything that goes in or around your property. To understand what you’re about to purchase, let’s look at the standard and extra purchasable coverage available on this policy type:

Provincial Differences: What You Need to Know

Depending on which province your rental property is located in, you may run into differences in the details of landlord insurance. Let’s take a look at what landlord insurance looks like in some Canadian provinces:

| Province | Average Monthly Cost | Basic Coverage Provided |

|---|---|---|

| Ontario | $120 | Property protection, landlord’s belongings, liability coverage, rental income loss |

| Alberta | $40 | Property protection, landlord’s belongings, liability coverage, rental income loss |

| British Columbia | $40 | Property protection, landlord’s belongings, liability coverage, rental income loss |

Picking The Best Landlord Insurance Coverage Based on Your Scenario

Every landlord’s property coverage needs differ, so what works for someone else may not work for you. So, it’s important to pick the best coverage for you. Here are some tips to do just that:

Frequently Asked Questions

Is landlord insurance mandatory in Ontario?

Landlord insurance isn’t mandatory in Ontario. However, mortgage lenders usually require you to have a policy and having one is a good idea to ensure your property, which is a source of income, is secured.

How much landlord insurance do I need?

How much landlord insurance you need will depend on your financial circumstances and property protection needs. A good way to calculate how much landlord insurance you need is to figure out how much repairs would cost for your property.

What is the difference between landlord insurance and tenant insurance?

The difference between landlord and tenant insurance is the subject of protection. Landlord insurance protects the rental property owners, while tenant insurance protects the renters.

What will you most likely need to insure as a landlord?

As a landlord, you’ll most likely need to insure the property itself, alongside any valuables you may have inside. You should also get liability coverage in case somebody gets hurt on your property.

Does landlord insurance cover loss of rent?

Yes, standard landlord insurance covers loss of rental income if tenants can’t pay rent due to damage to your rental property. Additionally, you can buy rent non-payment coverage to ensure you still get money after evicting a non-paying tenant.

When is the best time to buy landlord insurance?

The best time to buy landlord insurance is when you get a rental property and before tenants move in.