What Is a Bad Credit Loan?

There are plenty of reasons a person may need a loan, from unexpected medical expenses to home improvements. When you don’t have a great credit history, getting a loan can be much more challenging. Bad-credit loans help people who either don’t have a credit history or have a low credit score. These loans have higher interest rates than traditional personal loans, but they tend to be more cost-effective than taking out another credit card or getting a payday loan.

A personal loan for bad credit is nothing to be ashamed of–we understand that life happens in unexpected ways sometimes, and it is easy to find yourself in a bind. We try to make the process as easy-to-navigate as it is to understand the terms so that you can get back on your feet and start improving your life and your credit as soon as possible.

How To Get Approved For a Loan with Bad Credit

If you are wondering how you can get a loan when you have bad credit, you’ve come to the right place. While it is true that many personal loans only go to borrowers with a great credit score, at MyChoice, we understand that you are more than your credit score and that your ability to pay back a loan depends on a variety of factors.

Bad credit typically results from either missing or late credit payments, maxing-out credit cards, defaulting on loans, or applying for too many loans in a short amount of time. To improve your credit, you need to make payments on time and take on only the debt that you can afford to pay on your monthly income. Taking out a personal loan for bad credit may help get you back on track, but keep in mind that this only works if you qualify and can pay it off on time.

To qualify for bad-credit personal loans, you’ll need to show your proof of employment and proof of your address and age. You’ll also need to list all your debt, mortgages, and number of dependents. That way, the lender can access your debt-to-income ratio to determine what you can realistically afford.

How Does a Loan for Bad Credit Work & How Might It Help?

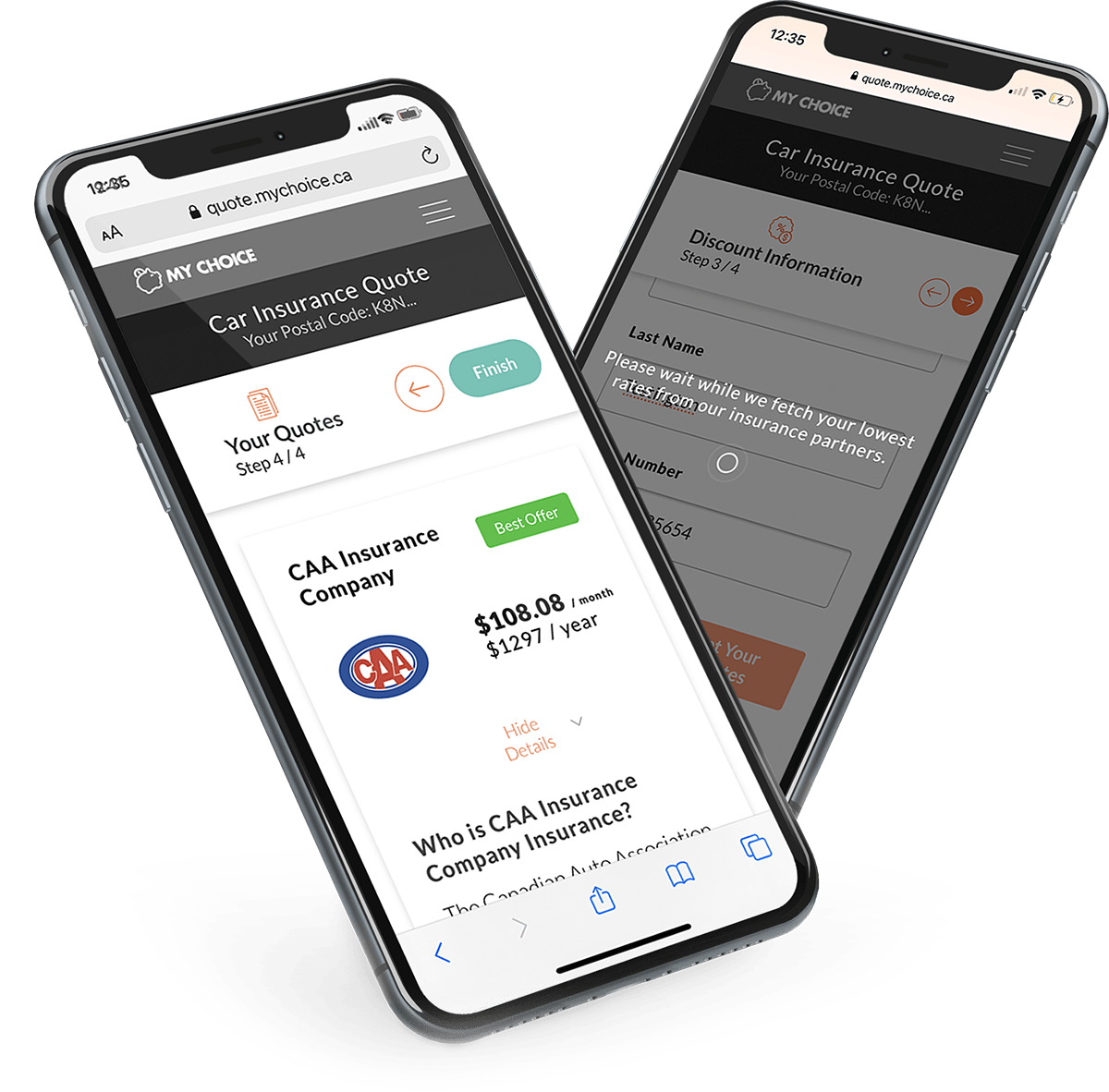

Getting loans for bad credit has never been easier than with MyChoice. You can apply online and get an answer within minutes—and your money within hours. When you have bad credit, it can be hard to find someone to lend to you. We work to make these loans easily accessible and available. You can do the whole process from the comfort and privacy of your own home.

While taking out a bad-credit loan won’t immediately improve your credit score, your rating will gradually improve as you consistently make your repayments on time. In the future, you’ll be able to access other types of loans with lower interest. Another benefit of bad-credit loans is that you can use the loan for any expense and not have to justify it beforehand as you might with some other personal loans.

Things To Consider with a Bad-Credit Loan

While bad-credit loans have many potential benefits, you may also encounter some drawbacks as well. Bad-credit loans come with higher interest rates, which can create a debt cycle that is hard to break. Before taking out a bad-credit loan, make sure that you will be able to pay it off within the agreed-upon time so that you don’t end up worse off than you were before.

Finally, be alert that, while many reputable lenders participate in granting bad-credit loans, you may encounter some predatory lenders who may charge hidden fees and costs. Regulations in this industry have tightened in recent years, but you should still do your due diligence to research the company you decide to borrow from.

Qualify for a Short-Term Bad-Credit Loan Online Today

One significant advantage of a bad-credit loan is that you can get one without a credit check. Bad-credit lenders typically don’t run credit checks. They only look at your employment, monthly income, proof of residence and age, and if you have any bankruptcy of payday loan defaults on your record. They may consider other factors, and they evaluate each application on a case-by-case basis.

Since they are unsecured by collateral, bad-credit loans tend to be for smaller amounts of money and have higher interest since the lender is taking a higher risk by lending to you.

Qualify for a Short-Term Bad-Credit Loan Online Today!

It’s quick, safe, and easy to apply for bad-credit loans in Canada with MyChoice. We work with our affiliate, LoanConnect. Apply online today by answering just a few questions to see if you qualify for a short-term bad-credit loan. You will get an answer within minutes. Once we approve you for a bad-credit loan, you will receive your money within hours.