Get approved for up to $50,000 and choose your loan term from anywhere between 6-60 months.

Banks and Lenders should be competing for your business, not the other way around. Use the power of MyChoice and compare the best offers from Canada’s top lenders today!

*Searching for a Personal Loan WILL NOT Affect Your Credit Score

Loans for Personal Use in Ontario

We’ve all been in a tight financial situation that adds to the everyday stress of life or not had the funds for a major purchase. Whatever the reason you need extra cash, a personal loan is a great solution. Personal loans are the fastest-growing debt product in Ontario for a reason—they have many benefits.

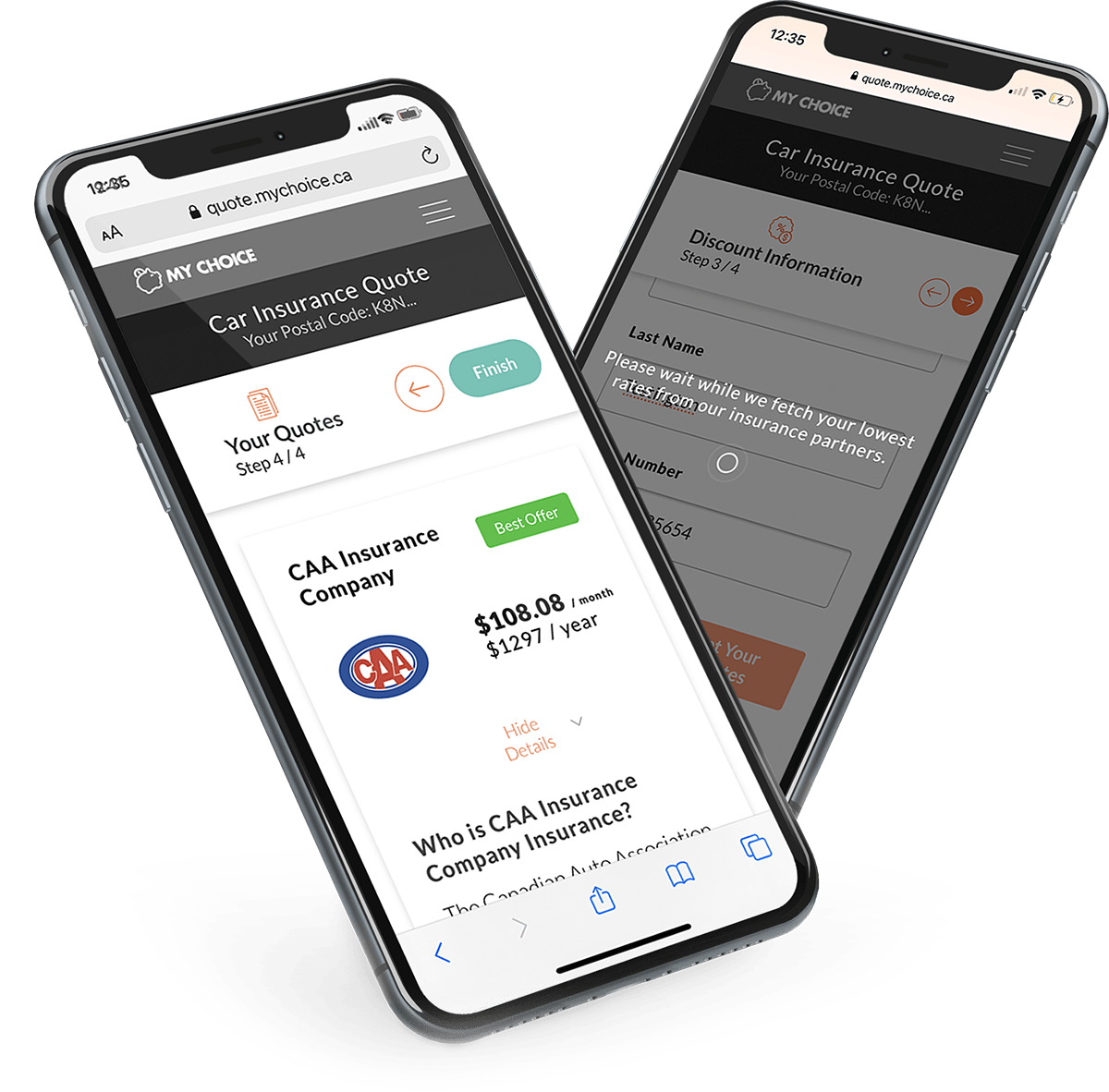

Interest rates are typically lower than a credit card, and they are easier to qualify for than many loan types. At MyChoice, we make finding the best personal loan terms in Ontario a breeze. Just provide a few details, and we’ll scour our vast network of lending partners for the lowest interest rates available.

You can filter your offers by different factors such as your credit score, the amount you’re looking to borrow, loan length, and the purpose of the loan. Try it today!

Why You Might Want to Consider a Personal Loan in Ontario

Another benefit of getting a personal loan is that you can use it for virtually anything. What would you use yours for?

Debt consolidation, or the process of gathering all your debt expenses (student loans, credit cards, etc.) and bringing them under one umbrella, is a popular option. Personal loans often come with lower interest rates than other common debt types, particularly credit cards. Debt consolidation can also lower your monthly costs by offering a longer pay off period—and you only have to worry about keeping up with one payment.

Personal loans aren’t just for climbing your way out of debt, either. They are also useful if you don’t necessarily want to pay the entirety of a big project, such as a home remodel or vacation, out of pocket right away. Using a loan for these situations is a good way to bide time while you recoup the money you will be spending on the project and offers a way to build better credit.

Car repair is another major expense that insurance won’t always cover. Even routine maintenance like tire replacement or a brake job can cost a pretty penny. A personal loan allows you to get cash for whatever you need at a reasonable rate.

Am I Eligible for a Personal Loan in Ontario?

When it comes to applying for loans, most people fear that they won’t be approved for one reason or the other. Issued loans are dependent on a few factors, such as what the loan is for, how much one is looking to borrow, and the applicant’s credit score and income status.

However, there are a few requirements to get a personal loan in Ontario. You’ll need to be at least 18 years of age and be able to show proof of income. There isn’t really a set amount you need to make to qualify for a personal loan, but your debt-to-income ratio needs to stay within reasonable bounds. Unless you are consolidating debt and will simply be trading many payments for one, you’ll also want to run the numbers to ensure you can afford the new payment.

The best way to see if you’re eligible is to fill out the form right here on this page—it won’t hurt your credit score and takes less than five minutes.

Can I Get a Personal Loan with Bad Credit in Ontario?

While a good credit score is a significant component in getting approved for any loan, it is not the end all be all. Other determinants are considered as well, including your current income status. The most important thing for lenders is that you can show proof of income to support the loan.

If you have poor credit and no job, then lenders have no reason to believe you can afford to pay back a loan. However, if you’re employed and in the process of rebuilding your credit, there will be lenders willing to make you an offer.

Keep in mind that bad credit personal loans are likely to come with a higher interest rate, shorter loan term, and may require a larger down payment or collateral. If you can improve your credit score before applying, you’ll find much better terms. A score of 650 or above is ideal.

Can I Get a No-Credit-Check Personal Loan in Ontario?

If you do have bad credit, your next question might be whether it’s possible to apply for a personal loan without a credit check. The answer is yes, but unfortunately, it will probably come with the same downsides as a bad credit personal loan.

The biggest difference is that no-credit-check personal loans often have a lower loan limit and a much shorter term. Even so, they can be an excellent option to get the funds you need and help build your credit if you don’t have much credit history or the history you do isn’t perfect.

Qualify for a Short-Term Bad-Credit Loan Online Today!

Getting a personal loan in Ontario is easy. Start by gathering all your financial information. You’ll need to show proof of income. We also highly recommend checking your credit score if you’re not opting for a no-credit-check loan. Make sure that everything is accurate and dispute anything that isn’t.

After that, all that’s left is to find the right lender—and that’s where we come in. At MyChoice, we offer the best rates from a multitude of Canada’s top lenders. To see how much you could borrow and what it would cost you, just fill in the form above. You’ll instantly be able to browse through available options and pick the loan that best fits your needs.

We offer loans up to $50,000 and loan terms up to 60 months with interest rates as low as 4.6%! Get started today!