Get approved for up to $50,000 and choose your loan term from anywhere between 6-60 months. We offer rates as low as 4.6% APR from Canada’s top lenders.

Banks and Lenders should be competing for your business, not the other way around. Use the power of MyChoice and compare the best offers from Canada’s top lenders today!

*Searching for a Personal Loan WILL NOT Affect Your Credit Score

Debt Consolidation Loans in Canada

If you could lower your interest rate and simplify your budget in the process, would you do it? Chances are the answer is yes, and that’s why debt consolidation loans are so popular in Canada. However, taking full advantage of the benefit of a debt consolidation loan hinges on finding the best interest rate, loan length, and terms.

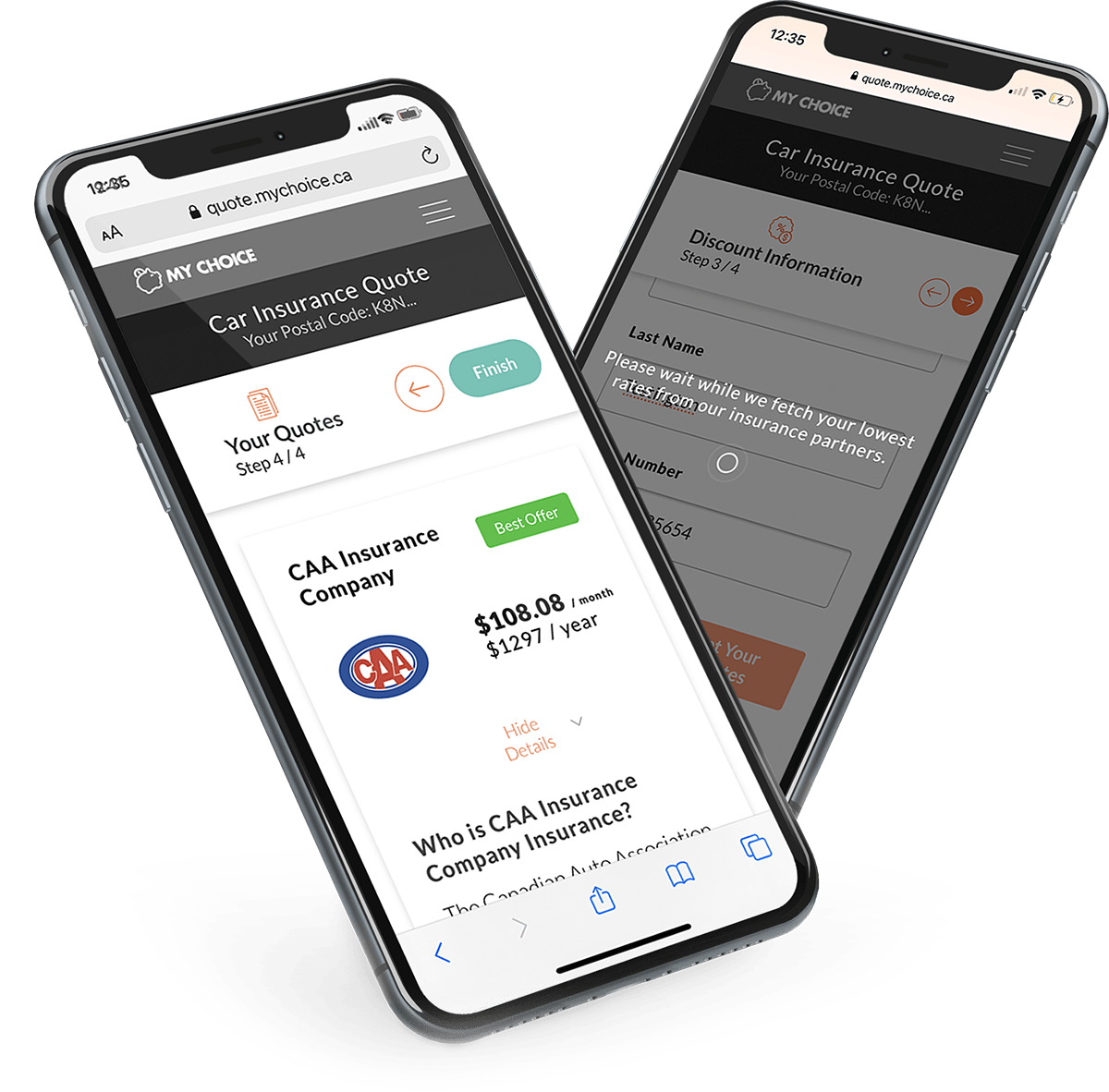

At MyChoice, we make it easy to find the best rates from local lenders for debt consolidation loans. Just answer a few quick questions, and in five minutes or less, you’ll have a lengthy list of loans to consider. You can filter your offers by loan amount, term, and more to quickly find an option that fits your needs. Whatever your financial situation, there is always an option to relieve debt. Let us help you find it.

Get started on your journey to financial rehabilitation by checking your loan rates on MyChoice today—it will have no effect on your credit score.

What Does it Mean to Consolidate Debt?

Debt consolidation is the process of taking out a loan to pay off other debts. You may ask why someone would do this. Isn’t it counterintuitive? The short answer is absolutely not. While consolidation loans are a form of debt, they also offer many benefits.

How Does a Debt Consolidation Loan Work?

First, in most cases, debt consolidation loans have lower interest rates than other forms of debt, such as credit cards. In effect, you will be able to get rid of the high interest you are paying on your credit card while being able to make lower monthly payments to resolve your debt. Of course, the earlier you can pay off your debt, the better off you’ll be. But consolidation loans give you more time to find a better stream of income.

You are also able to combine other forms of debt, such as medical bills and student loans, into your debt consolidation plan. It’s a pain to keep tabs on all your bills and expenses—especially if you have a lot of accounts to keep track of. Consolidation loans result in one fixed payment per month, making budgeting a far easier task.

We offer loan amounts up to $50,000 with term lengths up to 60 months and rates as low as 4.6% APR! For most, that’s plenty of capital to consolidate everything into one convenient loan.

When Should You Consider a Debt Consolidation Loan?

Considering a debt consolidation loan can make sense anytime you’re paying on multiple accounts or struggling with high interest rates, but it can be particularly helpful if your outstanding debt has gotten to the point where you’re unable to keep up with the payments.

The only time a debt consolidation loan may not be practical is when you have multiple accounts but with low interest rates. For instance, if you have credit cards in a zero-interest introductory period, it may be best to wait until those offers expire.

Otherwise, debt consolidation is a great way to get your financial status back on track. While this kind of loan does offer lengthier terms as far as paying off the totality of your outstanding debt, it does allow you to keep up with debt in a much easier manner, allowing you more time to improve your financial standing before the end of the repayment period.

With a debt consolidation loan, you have a simple, constant repayment plan. If you’re only making minimum payments on your credit card debt, realistically, you’ll stay in debt forever and end up paying far more than you borrowed. With debt consolidation, you can ensure that every payment you make is actually lowering your outstanding debt.

What Kind of Debts Can Be Consolidated?

We’ve spoken about how a debt consolidation loan combines different forms of debt to make repayment easier. However, consolidation loans can apply to more than just student loans and credit card debt. Let’s dig into other kinds of debt that can be consolidated.

Credit cards are the most common reason people apply for debt consolidation, but they aren’t the only card that a consolidation loan can cover. You may also consolidate department store cards. If you opened a charge account with your favourite retail store, you might be eligible to include that debt in your consolidation plan.

Several bills may also be included in your loan. These include medical bills that often aren’t covered by health insurance, such as dental and long-term care related expenses. You can consolidate utility bills, as well.

This point can prove very important, as if you are behind on your utility bills, your provider may shut off your service. A debt consolidation plan could come to the rescue in this situation.

Other than student loans, there are other types of loans that can be consolidated. That may include car loans. While car loans typically have lower interest rates, that’s not always the case, especially if it’s an older vehicle or you took out the loan when you had no or poor credit.

Unsecured personal loans, payday loans, and finance company loans can also be consolidated. In short, virtually any debt held by an actual creditor can be paid with a debt consolidation loan. Some debts that must be paid in cash, such as those to a private party like a friend or family member, may even be eligible, depending on the lender.

Some Pros and Cons of Getting a Loan to Consolidate Debt

As with any refinancing loan, there are benefits and downsides to getting a debt consolidation loan in Canada. While consolidating debt is a viable solution for a lot of Canadians, it may not be for everyone.

Debt consolidation loans are great as a short-term solution and can put you on the right path by allowing you to make more structured payments on your outstanding debt. They also often carry lower interest rates than other forms of debt.

Even better, they have fixed repayment schedules with one set payment per month and a specific final payment date. You’ll improve your credit score by making more timely payments and reducing the percentage of your debt that’s in use. All of that is on top of the convenience of just one payment.

On the downside, debt consolidation loans can take longer to pay off. This disadvantage can be avoided by paying extra each month after your financial situation improves. There are also potential fees to consider. Some lenders charge upfront costs such as balance transfer and annual fees or an origination fee.

Finally, a debt consolidation loan can be detrimental if it isn’t coupled with other financial changes. For example, if you pay off your credit cards with a debt consolidation loan and then continue to spend money on the credit cards that you can’t pay back every month, you’ll simply be enabling yourself to go deeper in debt.

How to Get a Debt Consolidation Loan

At MyChoice, we help you to find the best rates for debt consolidation loans in Canada. To get started, you’ll be asked to select how much money you’d like to borrow as well as your credit score.

After answering those prompts, you’ll be instructed to enter your personal information along with your income status. You will then see offers for loans—it’s that easy. Please note that these offers aren’t pre-approvals for loans. You will still have to apply through the lender’s website to actually obtain the loan.

Traditionally, debt consolidation loans require at least average credit, with a score above 650. You may be able to score a personal loan with poor credit, but usually, these will be for a lower sum of money with a shorter term.

Another determinant is your current annual or monthly income. Even if your credit is in good shape, if you’re not making an adequate amount of money, lenders will hesitate to loan you money. It is still worth it to check your offers here at MyChoice as everyone’s situation is different, and it won’t hurt your credit score.

Credit Card Consolidation to Get Out of Debt

Consolidating your credit cards is a useful way to get yourself out of credit card debt, combating the high interest rates credit unions place on your accounts. What is most important when dealing with credit card debt is to pay off the principal amount. The principal amount is the total expenses you charge to your credit account, excluding interest.

“Excluding interest“ is the key phrase there. Minimum credit card payments simply keep your account from becoming delinquent. They don’t cut into the principal amount, which is what you need to do to climb out of debt. That’s the beauty of consolidating your credit card debt.

When you consolidate, you are refinancing your existing debt. What this does is simplify your repayment plan by combing all your payments into one that cuts into the principal amount that you owe creditors. It is a great way to get out from under high interest rates and exorbitant late fees. For those unable to pay off their debt in the near future, credit card consolidation is the best way to get out of debt faster.

5 Ways to Consolidate Credit Card Debt

We’ve told you about all the benefits that a debt consolidation loan has to offer. But did you know there are a variety of methods in which you can consolidate your credit card debt? Determining which method is best for you depends on factors such as home equity, the amount of debt you have, and your credit score.

The first option is to get a balance transfer credit card. You can transfer the amount you owe other creditors to a new credit card with a better interest rate. You may even be able to find a zero-interest balance transfer offer. However, this option requires excellent credit, and you may not be able to find a new card with a sufficient limit to cover all of your debts. You’ll also need to pay a balance transfer fee between 3-5%.

The second option is a home equity loan. If you own a home, this is an excellent option as it comes with a long loan term and low payments. Take out a loan on the equity in your home to settle your credit card debt. The biggest downside to a home equity loan is that it can be difficult to qualify for and uses your home as collateral.

A 401(k) loan is another option. Consider this an emergency option as taking out of your 401(k) has a deep impact on your retirement. This kind of loan does not show up on your credit report.

You also could consider bankruptcy. This option will often result in a repayment plan, but obviously, will also have a very negative impact on your credit and is an involved process.

Out of all the above, a credit card consolidation loan is likely going to be the easiest to obtain and the most likely to cover all your debt without negatively impacting your credit. In fact, it will likely improve your score.

Apply for a Debt Consolidation Loan Today

Ready to take back control of your finances? At MyChoice, we’re here for you. We’ve helped countless Canadians better structure their debt and make progress towards a debt-free life. You can find out how big of a debt consolidation loan you qualify for, as well as what it will cost within minutes.

We work with the top lending institutions in Canada to offer the lowest rate and best loan terms possible. You’ll find offers here at MyChoice you can’t access anywhere else. The process won’t have any impact on your credit and is 100% secure.

We also offer a range of other loan and insurance comparison tools. We strive to provide everything you need to lower your monthly obligations, save money, and say goodbye to the stress of burdensome debt for good. Get started now to see what kind of rates Canada’s best lenders can offer you.